Greetings, Agents of Impact!

Featured: ImpactAlpha Original

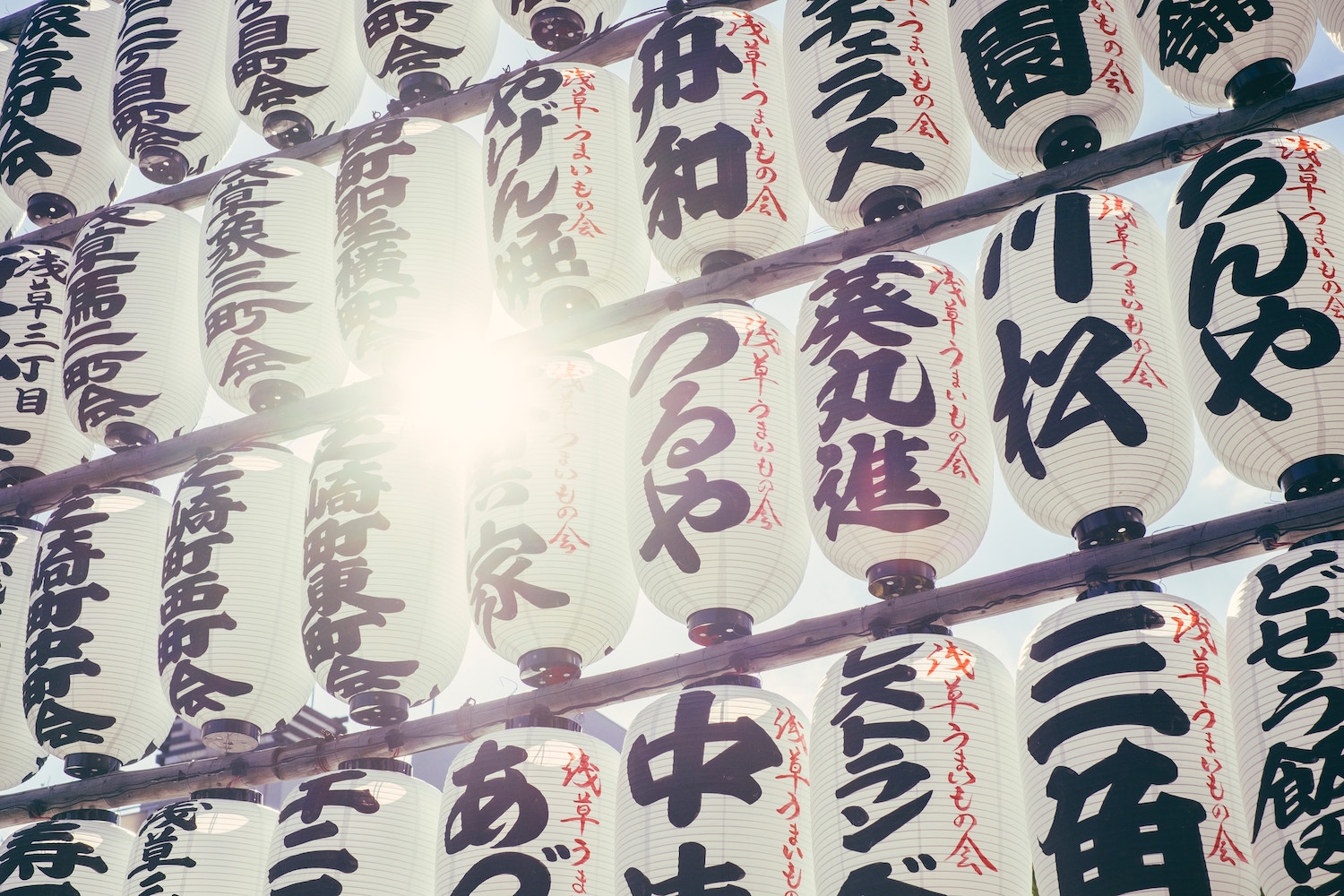

Japanese investors push to take impact investing mainstream. Japan is staking out a leadership position in sustainable investing. Sustainable investing assets under management quadrupled from 2016 to 2018 to 18% of managed assets. Japan is now the third-largest center for sustainable investing, after Europe and the U.S. The $1.6 trillion Government Pension Investment Fund, led by Hiro Mizuno, has become a global catalyst for environmental, social and governance, or ESG, investing. Japanese corporates, including Softbank and Mitsubishi, are leaning in on impact (see dealflow, below). And Japanese Prime Minister Shinzo Abe has embraced impact investing as a mechanism for mobilizing private capital for the U.N. Sustainable Development Goals. At the G20 in Osaka in June, Abe said Japan would lead efforts “to employ innovative financing schemes such as social impact investing” to fund the global goals. Business and sustainable investing leaders gathered in Tokyo last week for an impact investing forum aimed at putting Japan’s post-G20 commitments into action.

And yet, sustainable investing “has not otherwise gained traction with Japan’s mainstream financial community,” says The Investment Integration Project’s William Burckart. TIIP, with the Sasakawa Peace Foundation, released “Sustainable Investing in Japan: An Agenda for Action” at the Tokyo forum with recommendations for needed “breakthroughs.” Among them: Japanese investors need success cases to bust myths about impact investing. Among those cases are Neuberger Berman East Asia, Robeco Japan Co., Sompo Holdings and Sumitomo Mitsui Trust Asset Management Co., which were recognized this year by the first-ever Tokyo Financial Award in ESG Investing from Tokyo’s metropolitan government.

Keep reading, “Japanese investors push to take impact investing mainstream,” by Dennis Price on ImpactAlpha.

Dealflow: Follow the Money

Cooks Venture secures $12 million to scale up regenerative animal farming. The former COO of Blue Apron launched Cooks Venture in April to provide consumers with better quality meat through climate-friendly “regenerative agriculture.” Unlike industrial livestock, poultry and crop farming, regenerative farming can improve environmental impact through a balanced ecosystem of animals and crops that restores soil health and sequesters carbon. “Our soil is our greatest natural resource,” the company says, and the U.S. has more top soil than any other nation. “That will not be the case for long unless we protect it through regenerative agriculture.” Cooks Venture’s model is centered around an 800-acre farm in Arkansas, where it raises heirloom chickens to sell online. It sources feed from other farms and works with a team of scientists that measure and track the farms’ soil health and carbon content over time. The $12 million funding round was led by agri-investor AMERRA Capital Management and will finance a processing facility able to produce 700,000 chickens per week. Cooks Venture also plans to sell beef, pork and fresh produce that it raises, according to its website. Dig in.

“Solar” cell maker Exeger raises $10 million from SoftBank. The Stockholm-based company is trying to level-up the way light is captured and converted to energy. It is making a “solar” cell that can convert any type of light, including ambient light, into energy. Exeger’s technology uses light-sensitive dye to “collect energy much like photosynthesis in a leaf.” The material is designed to be built into everyday consumer devices, which cost U.S. consumers $18 billion, by one estimate. SoftBank invested $10 million to help the company ramp up for commercial launch in 2020. Check it out.

Ginger raises $35 million to improve access to virtual mental health services. The company believes that online chat and video-based mental health support can fill a gap in services for the U.S. workforce. The Series C funding was led by WP Global Partners with backing from impact investor City Light Capital, Kapor Capital, Kaiser Permanente Ventures and others.

AlphaCode backs three South African startups filling financial services gaps. The business accelerator committed $1.5 million to Zande Africa, which connects informal shops to credit, inventory, and transport services; small business finance marketplace Bright On Capital; and Livestock Wealth, a unique farmer financing platform that allows anyone to invest in “shares of a cow.”

Agents of Impact: Follow the Talent

Follow the talent. Rockefeller Foundation awards $3.7 million in grants to Washington DC, Oakland, Dallas and St. Louis to drive responsible private investment in Opportunity Zones. The four cities, which join Newark and Atlanta, will each receive $920,000, including a $400,000 grant to fund a Chief Opportunity Zone Officer… Albright Capital develops emerging-market focused impact measurement methodology to implement the International Finance Corp.’s Operating Principles for Impact Management (see, “Global investment firms adopt IFC principles seeking a market standard for impact investing”).

Seize the opportunity. The Clean Cooking Alliance has vacancies on its private sector and investment team in Washington D.C…. Access Ventures has two associate roles open in Louisville (see, “Access Ventures seeks new ways to lower costs for the housing insecure”)… AccoutAbility is hiring an associate and a managing associate in New York… EcoAgriculture Partners is looking for a communications manager in Washington D.C…. Also in D.C., Opportunity Finance Network seeks a communications associate.

Where to be. Urban Institute is hosting “From Concept to Action: Aligning Opportunity Zones and Mission Capital” on Oct. 10 in Cleveland… Mission Investors Exchange is opening its members-only virtual brown bag, “Impact investing and social impact media,” tomorrow, Tuesday Sept.10 at 3pm ET, to guests of Upstart Co-Lab… Convergence is convening a blended finance training in Amsterdam on Oct. 1. The blended finance platform is also hosting an Oct. 9 webinar on its ‘state of blended finance’ report… IMPAQTO and NEXUS Global convene the Latin American Impact Investment Summit on Oct. 3 and 4 in Quito.

Thank you for reading.

– Sept. 9, 2019