Greetings Agents of Impact!

In today’s Brief:

- Cutting clean cooking costs with carbon credits

- Financing farmers’ transition to regenerative ag

- Costs mount in Texas’ anti-ESG crusade

Featured: Carbon Markets

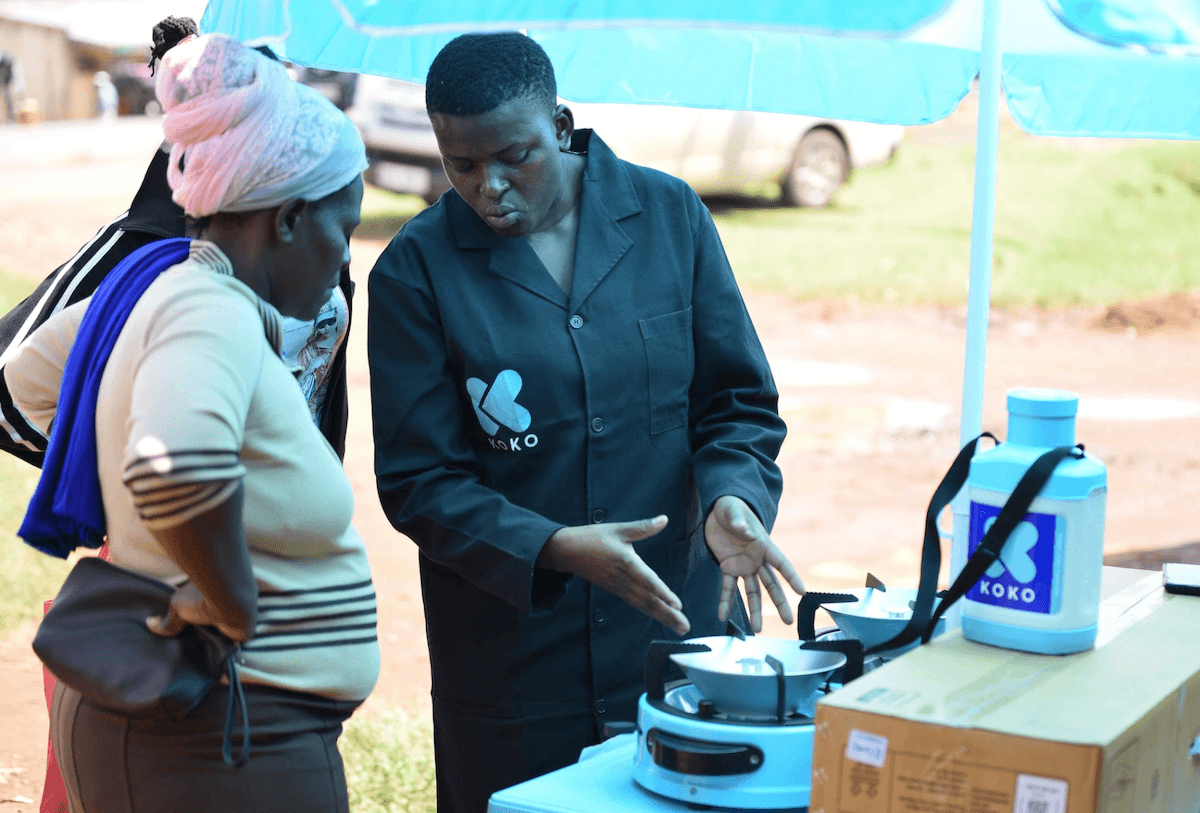

Leveraging the carbon markets for clean cooking, climate justice and social impact. Companies delivering clean cooking products for families in Africa and elsewhere have found a reliable source of capital in the voluntary carbon markets. The additional revenues are accelerating the replacement of crude, dirty and environmentally-destructive cooking fuels like charcoal, firewood and kerosene. Koko Fuel, BURN Manufacturing, Bboxx and other clean cooking providers now account for roughly 15% of credits issued on the voluntary carbon markets. Critics have questioned the quality and quantity of clean cooking carbon credits. But focusing solely on carbon accounting may be missing the point. “We need to relook at this entire climate market,” argues Ashish Kumar, an impact investor and carbon markets strategy expert (see his recent guest post). Corporate payments for carbon credits that lower prices for essential goods like clean cookstoves and fuels can be seen as a form of climate reparations for vulnerable populations suffering the impacts of climate change without having contributed much to causing it.

- Transition subsidies. Koko Fuel in Kenya is tapping the carbon markets to help households adopt ethanol as a cooking source, a healthier, more affordable alternative to charcoal, firewood and even liquified petroleum gas. “Effectively it’s a non-government energy subsidy,” Koko’s Greg Murray tells ImpactAlpha. “In America and in Europe, you get energy subsidies delivered by the government to switch from gas to electric. We’re doing that through the private markets—by taxing foreign corporations for pollution and using that as a subsidy funding source to switch Africans to low-cost, clean energy.”

- Funding fossil fuels. The clean cooking sector initially sought to increase the efficiency of biomass stoves. Such technologies have fallen out of favor, and companies are now pushing electric, biofuel and LPG stoves, which yield better indoor air quality and reduce deforestation. “It’s a redefinition of the problem. The enemy is charcoal,” says Mansoor Hamayun of Bboxx, which is active in the forest-dense countries of central Africa. The carbon impact of switching households from charcoal to LPG cooking fuel is far greater than switching them from kerosene to solar lighting, he says. “It’s quite an unusual choice for a solar company to expand into LPG. But we did the math.”

- Keep reading, “Leveraging the carbon markets for clean cooking, climate justice and social impact,” by Jessica Pothering on ImpactAlpha.

Dealflow: Agrifood Investing

Mad Capital raises $14 million in blended capital for regenerative farmland transitions. Mad Capital raised $10 million in 2021 for its debut Perennial Fund, which helped two dozen farmers in the US transition more than 4,000 acres of farmland to organic production. Such transitions are underway on another 6,000 acres. The Boulder, Colo.-based manager has secured $14 million in commitments from the Rockefeller and Schmidt Family foundations, Builders Vision and others toward a planned $50 million fund. The second Perennial Fund will provide flexible debt financing for 50 family-owned farms to transition 25,000 acres from conventional to organic, along with technical support from Mad Capital’s nonprofit affiliate Mad Agriculture. “Mad Capital is playing an integral role in the transition to regenerative organic agriculture,” said Sara Balawajder of Builders Vision, the impact investing group of Walmart heir Lukas Walton. “They are providing capital to farmers who have been overlooked and underserved by traditional capital markets.”

- Catalytic capital. US supply lags behind consumer demand for organically-grown food. Farmers’ lack of access to capital to finance the multi-year transition to organic production has been a barrier to wider adoption. Mad Capital blends a first-loss pool with market-rate capital to structure deals tailored to farmers’ capital needs. “We have inverted the traditional risk and return profile of a standard capital stack,” by blending program-related foundation investments with family office investors, Mad Capital’s Brandon Welch told ImpactAlpha. The goal: catalyze Wall Street to finance the transition of five million acres of conventional farmland to regenerative and organic production by 2032.

- More.

Beneficial Returns re-ups with Indonesian nut producer Kawanasi. Jakarta-based Kawanasi Sehat Dasacatur buys and processes wild-harvested kenari nuts, a type of tree nut, from the Indigenous Kayoa people in eastern Indonesia. The company’s partnership with mostly female Kayoa harvesters provides a reliable source of income, which helps ensure the community can remain stewards of the lands and forests where they live. Beneficial Returns’ new loan will enable Kawanasi to buy automatic packaging equipment to make nut processing faster and more hygienic.

- Graduation fund. Beneficial Returns first invested in Kawanasi in 2023 through its Reciprocity Fund, which provides impact-linked loans to small social enterprises supporting Indigenous communities in Southeast Asia and Latin America. A goal of the fund is to ready social enterprises to take on larger investments. The San Francisco-based firm has originated $2.4 million from the fund through 30 loans. The second loan to Kawanasi was made from Beneficial Returns’ flagship fund, which makes loans up to $500,000 with stricter credit underwriting standards.

- Share this post.

Dealflow overflow. Investment news crossing our desks:

- KKR took a majority stake in US utility-scale solar and storage developer Avantus, the first investment from KKR’s climate strategy. KKR will help Avantus create an equity ownership program for the company’s employees. (KKR)

- Canada’s Poseidon Ocean Systems raised $20.7 million in Series B funding, led by Ecosystem Integrity Fund, to support sustainable aquaculture. (Poseidon)

- Montauk Climate, a new climate tech accelerator launched by Philip Krim, co-founder of mattress maker Casper, raised $8.5 million. Sheel Tyle, a managing partner at global venture firm Amplo, led the round with $7 million. (TechCrunch)

- Berlin-based Dryad Network, which is developing AI- and solar-powered ultra-early wildfire detection systems, scored €5.6 million ($6.1 million) in a convertible financing round. (Dryad)

Signals: Muni Impact

Texas boots Blackrock, saddling Texans with the costs of its campaign against ESG. House Republicans kicked off “Energy Week” on Monday with a tour of a Texas oil rig and a promise to “protect American jobs.” But the state’s ban on doing business with banks and asset managers that consider risks from environmental, social, and governance issues is having the opposite effect. Texas’ anti-ESG rules are costing the state hundreds of millions in lost economic activity, jobs and revenues. State officials on Tuesday rescinded Blackrock’s financial management of $8.5 billion in Texas’ assets, citing a Texas law that prohibits state investment in companies that “boycott” energy companies and Blackrock’s “dominant and persistent leadership in the ESG movement.”

- Less competition, higher costs. The state’s interventions in the market are costing Texans, according to a new study that evaluated the economic cost of the state’s ban on municipal bond underwriters that use ESG criteria, including Citi and Barclays. The ban lowers competition, which increases borrowing costs for municipalities. The laws banning ESG are “contrary to the state’s historical broad-minded pro-business efforts,” Municipal Market Analytics’ Tom Doe, an Austin resident, told ImpactAlpha. “Restricting competition denies access to financing capital.” Effects to date include $669 million in lost economic activity; $181 million in decreased annual earnings; more than 3,000 fewer full-time jobs; and $37 million in losses to state and local tax revenue, according to the report by Austin-based TXP.

- Ripple effect. At least 20 states have implemented laws banning banks that use ESG considerations from doing some kind of business with public entities. As conservative politicians ramp up these attacks against financial firms, BlackRock, JP Morgan Asset Management, State Street, Pimco and many others, have dropped out of the Climate Action 100+ network. In Texas, “citizens are made increasingly vulnerable when critical infrastructure is not efficiently and effectively modernized,” says Doe. The legislature’s efforts, he said, inhibit local economies “from adapting to the dynamics of a competitive global economy.”

- Share this post.

Agents of Impact: Follow the Talent

Matthew Mulrennan, formerly with XPRIZE, joins the Sustainable Ocean Alliance as investments director for its venture fund Seabird Ventures… Impax Asset Management promotes Charles French as co-chief investment officer of listed investments… The Colorado Health Foundation is recruiting a community investment and impact vice president… The Nature Conservancy is hiring a senior investment analyst in Washington, DC… Also in DC, Eurasia Group has an opening for a biodiversity and sustainability analyst.

Allianz Global Investors seeks a Frankfurt-based intern for its blended-finance impact private equity fund… Also in Frankfurt, Inyova Impact Investing is looking for a compliance analyst… Big Society Capital is on the hunt for a head of communications in London… The Catalytic Climate Finance Facility is seeking proposals from blended climate-finance vehicles for up to $500,000 in grant funding and support services… The Public Finance Initiative will host a webinar on measuring racial equity change in municipal investments, Wednesday, March 27.

👉 View (or post) impact investing jobs on ImpactAlpha’s Career Hub.

Thank you for your impact!

– March 21, 2024