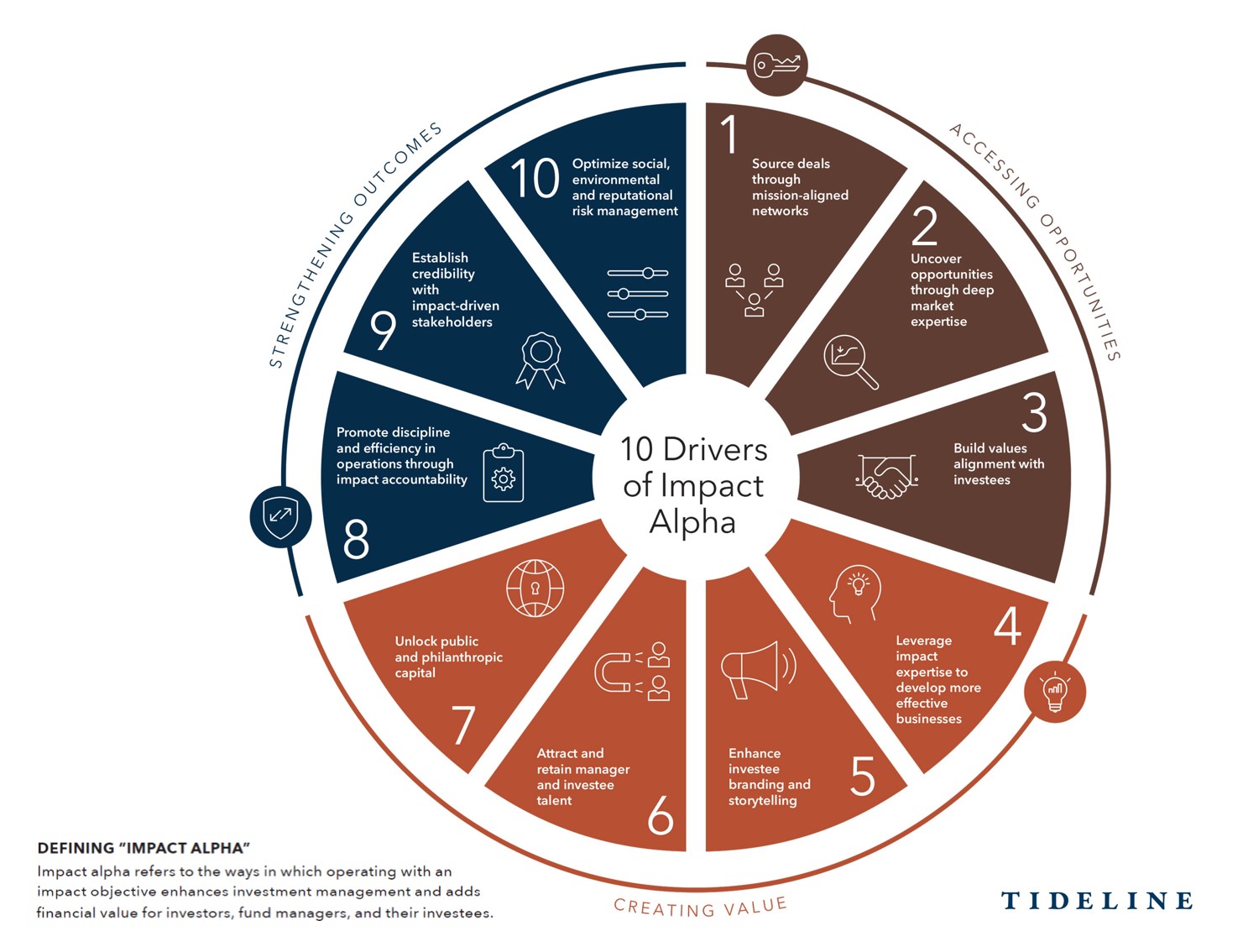

“Impact is not a tradeoff, but an advantage,” says Dave Kirkpatrick of SJF Ventures. The drivers of impact alpha identified in Tideline’s “The Alpha in Impact” report can help investors access opportunities, create value and strengthen outcomes, providing the “roadmap for how we do this better,” Kirkpatrick told ImpactAlpha.

Fighting poverty and remaining rich: Ceniarth shifts portfolio to impact-first capital preservation

1. New networks. Impact alpha investors go beyond the Silicon Valley herd to source investments through other mission-aligned investors, universities, foundations and non-governmental organizations. Going beyond the usual suspects provides a more differentiated set of mission-aligned opportunities.

2. Deep market expertise. Tuning into overlooked and untapped markets allows impact alpha investors to see value and execute deals where others don’t. Less competitive deals mean more economic upside for managers.

3. Eye-to-eye with founders. Mission-driven founders and owners want impact alpha investors. A laser focus on purpose can lead to constructive negotiations, invitations to invest in later rounds and favorable valuations.

4. Impact trends are business trends. Impact alpha investors understand values-driven consumers and meeting other human needs. Impact alpha managers can help entrepreneurs hone their value-propositions and design solutions that meet real needs to drive growth in revenues.

5. Impact is authentic. Which makes it good branding. Impact alpha investors can help investees tell their impact stories, driving both new revenues and customer retention, Differentiation can mean pricing power for purpose-driven brands.

6. Impact is a talent magnet. Purpose is sticky. Impact alpha investment firms attract and retain top talent, and invest in companies that do the same. That lowers the cost of recruitment and turnover.

7. All capital on deck. Impact alpha investors and their portfolio companies align with philanthropic and public funders that can deploy grants, low-interest loans, guarantees, and other alternative forms of financing. Such funding can lower the cost capital and broaden investment sources.

8. Accounting is destiny. Good impact measurement practice unlocks business value (see, “Measure Better”). Impact alpha investors drive discipline and efficiency around operational metrics that deliver long-term economic returns.

9. License to operate. Impact goals, reporting and transparency help win the hearts and minds of policymakers, advocates and other beneficiaries in sometimes tough operating environments. Favorable policies can bolster the bottom lines of mission-driven companies.

10. Impact beta. Impact alpha investors generate data and insights that expose hidden or long-term environmental, social and reputational risks. Such visibility can help optimize supply chains and operations and avert product- and worker-safety problems.