Regulation Crowdfunding allows startup founders to raise capital from unaccredited investors as well as accredited investors, and publicly promote their offerings. Part of the 2012 JOBS Act, Regulation Crowdfunding (aka “Reg CF”) was rolled out by the Securities & Exchange Commission in May 2016.

Over the last few years, Reg CF has opened up a powerful new way for startup founders to more easily raise capital and to recruit an army of loyal customers and passionate brand ambassadors. For social entrepreneurs, it has proved especially valuable.

In a world where conventional investors might raise their eyebrows at a number of bottom lines that exceeds one, the ability for socially-minded entrepreneurs to raise capital from ordinary people (not just millionaires and billionaires) who are passionate about the problem they’re tackling, and perhaps more willing to consider social returns as well as financial returns, is invaluable.

NovoMoto raised $418,000 from 349 investors to bring affordable solar electricity to the Democratic Republic of Congo; Participant raised $211,000 on a revenue-share deal from 176 investors to make better wheelchairs for kids around the world; and SmartGurlz has raised over a million dollars from close to 2,000 investors to engage and educate girls and minorities in STEM (science, technology, engineering and math).

Compared to conventional angel investing, venture capital, and bank lending, Regulation Crowdfunding is delivering more capital to under-represented founders – be they founders of color, female founders, or founders outside of California, New York and Massachusetts, which currently account for 77% of venture funding.

New rules

Today, several rule changes go into effect that will significantly improve Reg CF for both founders and investors.

- The headline is that the maximum amount startups can raise each year through Reg CF is increasing from $1.07 million to $5 million. This change alone should see Regulation Crowdfunding investment exceed $1 billion in 2021 (up from around $250 million over the last 12 months).

- Special purpose vehicles, or SPVs, will now be allowed as a vehicle to roll up investors to one line on the cap table. Reg CF platforms have sought creative ways to achieve this “clean cap table” objective over the last few years (e.g. Wefunder’s Custodian structure, or Republic’s Crowd SAFE).

But SPVs are much more familiar to conventional investors (and lawyers!) and unambiguously solve for 12(g) of the Securities Exchange Act, which requires companies to publicly report if they cross 500 unaccredited investors and $25 million in assets. - Founders will be able to “test the waters” (i.e. explore potential investor demand) before officially launching a Reg CF round and filing a Form C. Historically, founders looking to raise more than $250,000 have had to get an independent CPA to conduct a review of two years of GAAP financials – before they even launched their Reg CF round.

For companies with complicated and messy financials, this meant a delay of weeks, sometimes even months, before they could begin raising capital. Starting today, they will be able to communicate about their intent to raise capital immediately. - The amount that investors are permitted to invest in Reg CF deals each year is increasing, and accredited investors will be able to invest an unlimited amount in Reg CF deals, as they can in Reg D deals.

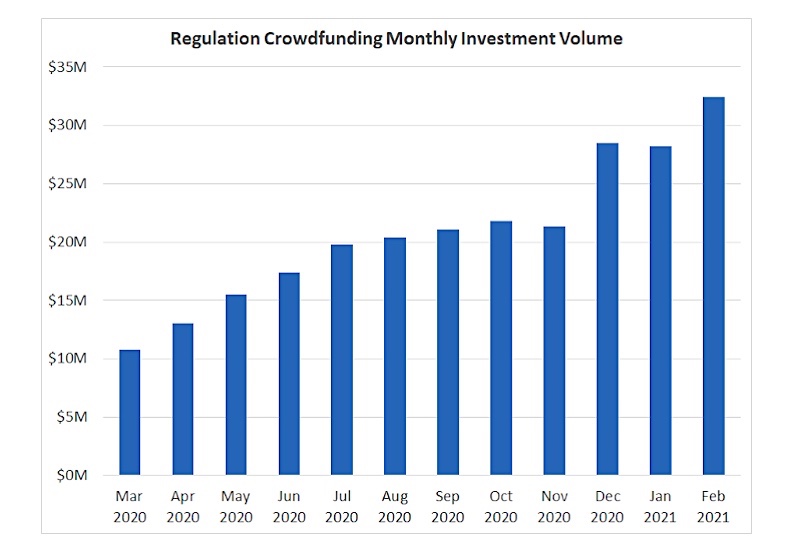

Regulation Crowdfunding has grown quickly over the last 12 months, as the pandemic has made it harder for startups to raise capital from conventional sources. Wefunder’s monthly investment volume has grown four-fold, from $2.8 million in February 2020 to $11.4 million in February 2021. The overall Reg CF investment volume roughly tripled in the same time period.

These rule changes are going to massively accelerate that already robust growth. Founders who were previously limited to raise $1.07 million on Wefunder will now be able to raise up to $5 million. More importantly, because of the higher amounts of capital they can raise, many more founders – and higher and higher quality founders – will now opt to raise capital from their customers and community through Reg CF, as opposed to rich people and institutions only.

Wefunder published its Public Benefit Corporation Impact Report last month. As the report makes clear, our mission is to get more capital flowing to founders throughout America, especially under-represented founders, by enabling their friends and fans to invest in them. And to enable those “ordinary people” to vote with their dollars, invest in startups they love, and participate in the wealth that is being created through the rapid growth of those startups.

These rule changes to Regulation Crowdfunding are huge strides forward as we aim to achieve that mission.

Jonny Price is VP of Fundraising at Wefunder, a PBC and B Corp that allows anyone to be an angel investor in startups they love, for as little as $100. To view the hundreds of investment opportunities currently open on Wefunder, click here. And if you are a social entrepreneur interested in raising $50,000 to $5 million on the Wefunder platform, you can learn more here.