ImpactAlpha, July 30 –– The daily outrages consume Twitter. Within the impact investing bubble, you might not even know there is an election coming up.

With less than a hundred days to Nov. 3, it’s time to break out. As if there were a need for any more triggers, two recent incidents helped clarify for me why, and how, impact investors must step up – as impact investors.

>>>Hop on The Call. Today’s Agents of Impact Call No. 21 will explore the responsibilities of impact investors in this fall’s U.S. election and beyond. Join Beeck Center’s Sonal Shah, Nonprofit Finance Fund’s Antony Bugg-Levine, Blue Haven Initiative’s Liesel Pritzker and i(x) investment’s Trevor Neilson in a provocative conversation with David Bank and Monique Aiken, today at 10am PT / 1pm ET / 6pm London. Zoom right in.

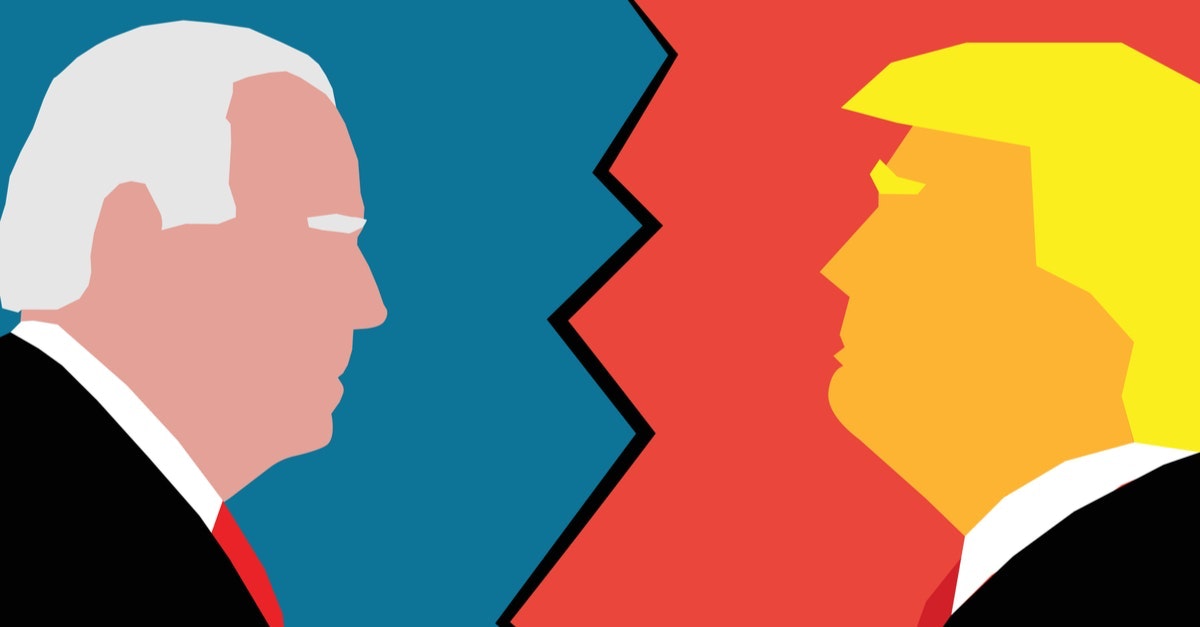

The first was a spate of stories about ‘investor worries,’ triggered by polls showing former Vice President Joe Biden’s on the rise and President Trump in decline and the raised odds of a Democratic takeover in the Senate as well. Exactly which investors are worried about the end of the “business-friendly thrust of the current administration,” as one New York Times reporter put it?

Letter to the Editor: Traders and investors may have different worries

Impact investors may be more worried about the risks of the U.S. withdrawal from the Paris climate agreement, currently set to take place on Nov. 4, a day after the election. Or the risks of bankruptcy and eviction of thousands of small businesses and tenants, disproportionately people of color, as a result of the bungling of the COVID crisis. Or the collapse of painstakingly constructed ecosystems in Africa, Asia and Latin America nurturing scalable enterprises delivering high-quality, low-cost goods and services to low-income consumers.

ImpactAlpha has argued that it is youthful climate marchers, last year’s rallies around the world against inequality and corruption and, more recently, massive protests against police brutality and racial injustice that are truly pro-business. Aggressive action against such systemic risks is inarguably better not only for workers and communities and natural ecosystems, but for investors and companies as well.

The second recent object lesson was the strong investor response to the Department of Labor’s proposed rules raising hurdles for so-called ESG, or environmental, social and governance, investing by regulated pension funds.

The investor outpouring, in hundreds of comments submitted to the DOL, pointed to a broader rebellion still largely repressed. Climate change, pandemics, social strife – systemic risks of the sort identified by ESG analysis are no longer hypothetical. It is the failure to consider long-term drivers of value, including ESG factors, that is now seen as a breach of fiduciary duty. Even the determinedly nonpartisan U.S. Impact Investing Alliance called the proposed rule “the latest example of a short-sighted and ideological crusade to stifle the growth of ESG investment market.”

U.S. Department of Labor: Green Light for ‘Economically Targeted’ Impact Investments

ImpactAlpha has tried hard to hold up the poles of the Big Tent of impact investing. That impact investing is different things to different people has made it fertile ground for collaboration and innovation, and thus a great beat.

And there’s another reason we have largely stayed out of the mosh pit of American politics. Since we launched our daily newsletter, The Brief, on Inauguration Day, 2017, it seems as if almost every other media outlet has been all-Trump, all the time. We have built our brand on counter-programming.

So while we’re still not keen on bringing politics into impact investing, it would seem a dereliction of ImpactAlpha’s duty not to bring the same impact investing lens to U.S. politics as we do to other systemic factors. What score would the Trump administration receive, we wondered, if presidencies were assessed on ESG?

“The Trump administration has itself become a systemic risk,” we wrote earlier this month.

Investors often talk about the ‘enabling environment’ or ‘the policy agenda.’ Rule of law is a precondition for business operations. In other countries, “political risk” can be enough of a reason to pass on a deal. Even before the COVID crisis. Eurasia Group named U.S. politics as the No. 1 global risk of 2020, citing fears that voters won’t accept election results as legitimate.

At stake in the election is the enabling environment for effectively all of the investments impact investors are making, in the U.S. and around the world. The mobilization of capital for long-term, sustainable, inclusive prosperity requires effective leadership. Which is why ImpactAlpha is calling on impact investors – as Agents of Impact – to step up to ensure the decisive defeat of Donald Trump.

Catch up on all of David Bank’s columns, The Impact Alpha.