Engage communities. Measure impact. Share data. That’s the call to action for investors and other stakeholders considering investments in the 8,700 federally certified opportunity zones after a day-long convening of policymakers, development practitioners and researchers at the New York Federal Reserve in July.

In their report-out (See: “Opportunity Zones: Moving Toward a Shared Impact Framework“), Beeck Center’s Lisa Green Hall, U.S. Impact Investing Alliance’s Fran Seegull and the NY Fed’s Chelsea Cruz and Adrian Franco argue better impact data can also serve as an “important risk management tool and produce better results.”

The July meeting at the NY Fed included Rockefeller Foundation president Raj Shah, representatives from the offices of senators Tim Scott and Cory Booker, and leaders from Aeris, B Analytics and the Impact Management Project. More takeaways:

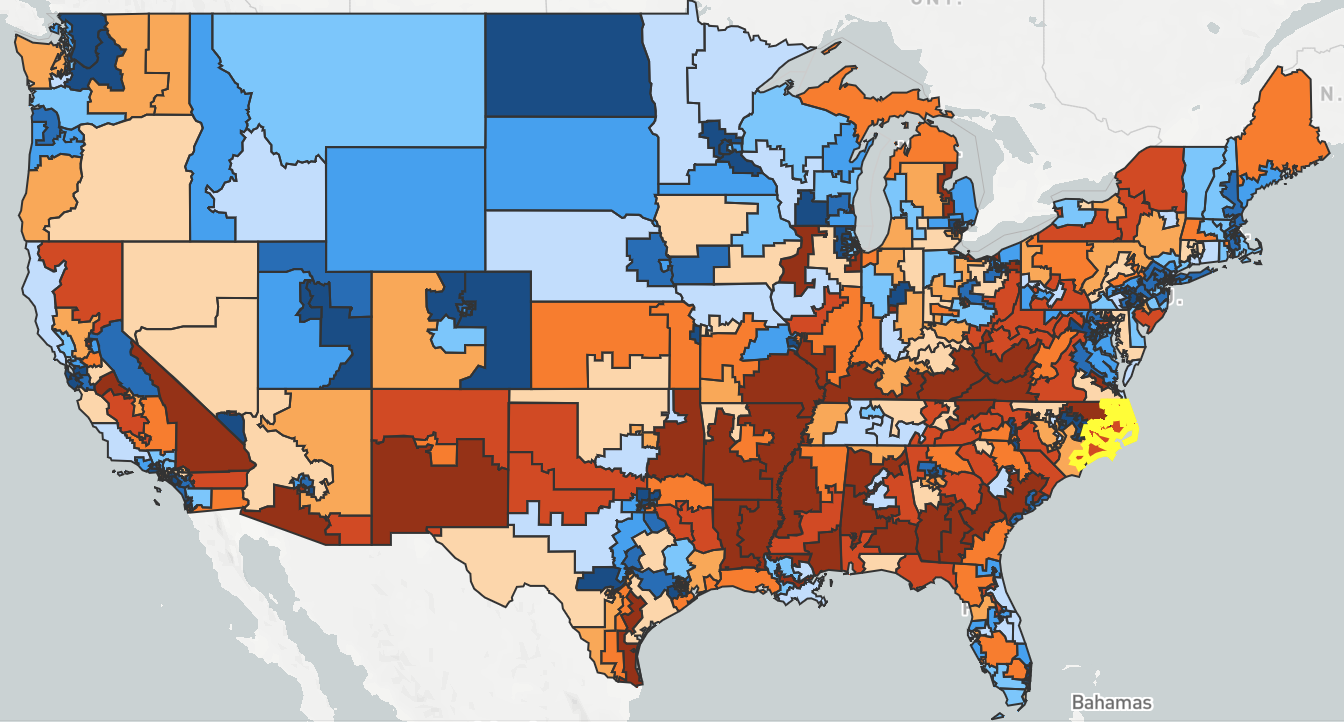

- Identifying needs. Investors can use tools like Enterprise Community Partners’s Opportunity 360 database to create community profiles and Economic Innovation Group’s Distressed Community Index to track community-level progress over time.

- Evaluating impact. Impact data collection and analysis can help businesses create, and unlock, greater value. Impact measurement benchmarks could be set at five-, seven-, and 10-year marks, with annual progress reports. Businesses should have the flexibility to adapt if they’re not meeting community needs.

Next up: The group is building a shared framework for measuring impact in opportunity zones. “We should look at this as an opportunity to enable the flow of capital to the places most in need and also those most ready to use it.”