ImpactAlpha, July 24 – Rapid development of new clean energy capacity may be what’s needed amid an increasingly urgent climate crisis. But fast is often in tension with just.

A solar developer on the Navajo Nation is out to prove that it’s possible to profitably decarbonize the economy while strengthening and building wealth in communities that have been historically exploited and left behind.

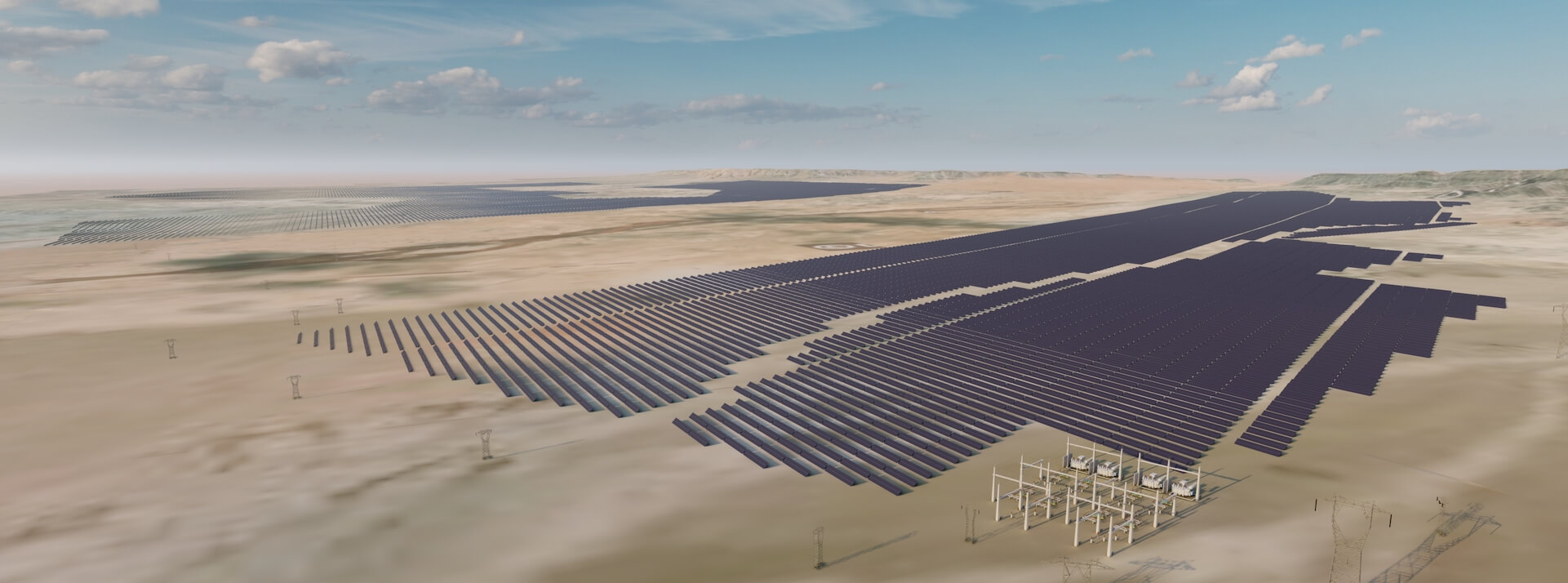

Navajo Power has for the past five years been building up a three-gigawatt pipeline of solar-plus-storage projects in tribal communities across the United States. It is cleared to develop a 750-megawatt solar facility an hour’s drive south from Navajo Generating Station, the now defunct 2.3-gigawatt coal-fired power plant and one of the biggest employers on the reservation. The company is also working on a 230-megawatt project in Oregon.

Once those projects come online, local communities will get a cut of the profits to use for any kind of community development they see fit.

“It’s a way for us to reinvest in communities beyond traditional land leases and taxes. And we’re able to utilize the benefit of working with communities to build our company,” says Navajo Power founder Brett Isaac.

Isaac launched Navajo Power in 2018 with a vision of flipping the traditionally extractive energy industry on its head. Coal mining was until recently the key source of jobs on the Navajo Nation, the largest reservation in the US. Power was always exported; much of the reservation is disconnected from the electricity grid.

“Everyone asks, when we come out to start these projects, ‘What are you going to do for us?’” says Isaac.

Navajo Power, a public benefit corporation, designed its business model so communities benefit from its growth and success. It allocated 10% of company shares to a trust controlled by Navajo CDFI for community investment. When it raised debt in 2019, it included a clause that requires Navajo Power to invest the savings from its highly concessional interest rates into the communities where its projects are based. And it has set up a joint venture with off-grid solar provider Mexico City-based Ilumexico to bring solar home systems to the most energy-poor Indigenous households in the US.

In an interview with ImpactAlpha, Isaac and Navajo Power’s Cox, spoke about Navajo Power’s approach and vision to a just energy transition for Indigenous communities, and how philanthropic and commercial investors alike are stepping up.

“What comes up in forum after forum about a just transition are things like community benefits, stakeholder engagement, transparency,” says Isaac. “We’re not just trying to execute on theory, we’re stretching it.”

ImpactAlpha: One of the biggest economic drivers for a long time on the Navajo Nation has been the coal industry. Did that have a role to play in your decision to build a renewable energy company?

Brett Isaac: I grew up on the Navajo Nation in a coal community. My grandfathers worked in coal.

Around 2009, I was working for my dad’s community of Shonto, and they were already talking about transition and diversification. The majority of people either worked at the coal mine or coal plant and knew they were lingering around a problem: if those jobs left, they knew people would have to relocate to find another opportunity.

One of the opportunities there that they were looking at was an off-grid company, because there were people who needed access to power. So early on, I started looking at inequity. We were exporting all of these resources, yet we weren’t able to finance [services for] people who just needed basic access to energy and water.

ImpactAlpha: What did you find in terms of the opportunity for renewable energy on the Navajo Nation and other tribal communities?

Isaac: We’ve done an assessment of the national opportunity for investing into [solar energy in] tribal communities. Conservatively, there are over 200 gigawatts of potential for solar and storage projects.

ImpactAlpha: Navajo Power has a pipeline of three gigawatts of solar energy projects lined up. That’s enough energy capacity to power several million homes. Your model is very different from most solar project developers because of its community benefit approach.

Isaac: When we’re talking about equity, the question for us was how to put tribes in a position where they can invest. We wanted to create incentives beyond just solar panels for the community to invest.

Ten percent of our company was put into a trust, called the Turquoise Share, and those shares are held by the Navajo CDFI, which participates like an investor in terms of distributions, but those streams go into a fund that is accessible by the communities we build projects in. We wanted to make something like a rainy-day fund that they could utilize for things they really need, like social programs, infrastructure, making energy affordable, and access to water. It’s a way for us to reinvest in communities beyond traditional land leases and taxes.

Otherwise, everytime these communities get grant dollars, those dollars come with a lot of restrictions. A lot of times those restrictions make that funding unusable or very hard to use.

The other thing this allows us to do is share in our growth. As we learn, these initial communities we’re working with benefit from that learning. It’s a way for us to give back to them. And we’re able to utilize the benefit of working with communities to build our company.

ImpactAlpha: You all worked with Candide Group to design the community-equity aspects of your business, including a $10 million syndicated loan fund in 2019 that has helped Navajo Power set the wheels in motion for its early projects. What other types capital have supported Navajo Power thus far?

Isaac: We got our first grant from the Sandler Family Foundation to get our startup filings together and seed a bit of the initial work. From the W.K. Kellogg Foundation, Sierra Club Foundation, The Schmidt Family Foundation, Grove Foundation, Catena Foundation, Wallace Global Fund, Align Impact and others, we received loans—program-related investments—and some smaller amounts of grant funding. A lot of that was used to fund education-oriented activities and guidance to communities to help them quantify the opportunity, and for feasibility studies, permitting, engineering and interconnection deposits.

A large hang up with development in Indigenous communities is the feasibility study process. The traditional strategy is to get a consultant to do the feasibility study, then put out a request for proposals to developers. That’s at least a 24-month process and by then, there could be a new political regime or a new economic reality. Data would be unusable by then.

We told our funders, let us take on that process, and if we do that early-stage work, it’ll unlock a lot more investment. The most undefined piece is how to get from concept to construction, and that’s the part that our early investors helped us figure out.

ImpactAlpha: Where does Navajo Power stand now in terms of its capital needs?

Michael Cox: We’re planning to do another impact debt facility of $10 million to $20 million with impact investors and philanthropists. We’re also targeting a $10 million equity round this year. There might be a little bit of impact investor participation in the equity round, but most likely it’ll be led by a combination of tribal investors and commercial infrastructure and energy investors.

One of the ways we’re unlocking millions of dollars in development capital is we formed a co-development partnership with a Fortune 500 independent power producer for some of our projects. Once a project gets sold, they pick up all of the capital needs going forward, which could be $10 million plus for any given project.

It would be next to impossible for us to do this work with only impact funding given the scale of the projects. Capital is going to have to come from a lot of different sources over time.

ImpactAlpha: The interests of tribal, impact and commercial investors are very different. How are you thinking about potential conflicts as you grow?

Isaac: Part of our thesis is that we have to create these tensions. In the past, most traditional financial institutions didn’t want to invest alongside tribes. We have to force their hand a little bit.

With our IPP partner, we’ve created a purchase option that Navajo Power holds on behalf of tribes to invest in the cash-equity position. We hold that position all the way up to “material completion” of a project. We did that so we could define a contractually-held place for tribes. Otherwise, we’re still just talking about the theory of equity not mechanisms.

The Inflation Reduction Act is also helping solidify that because tribes have to be considered as investment partners, and that now gives them some unique advantages in being able to attract capital.

Cox: Having impact and philanthropic funding at the base layer of the stack is extremely beneficial for protecting our mission and maximizing economic benefits for the tribal communities and nations we partner with.

Commercial investors bring more than just commercial expectations, though: they bring expertise and strategic value, because they either really understand the project development business or they have relationships with off-takers that the impact world may not have. That the tribal world may not have.

Those commercial investors may end up being the key to unlocking tribal capital, because tribes can ride on their due diligence and trust that [commercial investors] are there to make money, so tribes will make money too.

Isaac: A lot of times like the risk profile of tribes is much more conservative than the commercial market.

Cox: Tensions can exist. But if we do our job right, we’ll turn tension into alignment.

ImpactAlpha: You mentioned that tribal communities can be very risk averse. What is your engagement process with communities as you’re scoping out new development prospects?

Isaac: We always start with “what does the impact look like for the people near where you’re going to build,” and what is their viewpoint? We know people are skeptical, so you have to start from a communal place. Every stakeholder has their own value system, and they need to feel like that is acknowledged and can be built into the process.

Also, I grew up similarly to a lot of people in our tribal communities. I know what it was like to look at these projects and know they’re potentially good, but also potentially really harmful. It’s unique that projects like these are being carried out by people like them. Being able to connect with them at that level really enhances their experience in working with us.

What comes up in forum after forum about a just transition are things like community benefits, stakeholder engagement, transparency. We’re not just trying to execute on theory, we’re stretching it.

ImpactAlpha: Do you see opportunities for this approach in other social and economic sectors?

Isaac: We also want to expand the ecosystem we’re working in, to translate these activities into housing and other financial markets to unlock the investment potential in these communities beyond just energy projects.

Tribal communities get less than 1% of investment and philanthropic capital out there. One of the issues we’ve seen from mission-aligned investors is that they invest in very binary opportunities. One tribe, one project—it’s very go, no-go. Indigenous communities are some of the most underinvested places.

Pre-energy development is similar for the energy sector. We’re playing in a market where there’s a lot going against us. But it’s shifting.

We’re trying to operate as more of a platform with a portfolio of different project opportunities to spread out the risk variables that make it hard for investors to back projects on tribal lands.

ImpactAlpha: Navajo Power is now gaining momentum. Does fundraising get easier from here on?

Isaac: People are really starting to grasp what we’re doing. Now we have to convert that interest to investment potential. What we’re trying to think through is how many different ways can we innovatively bring capital into these projects.

Fortunately, money moves when there’s incentive and right now there’s a lot of incentive.

Cox: What’s been hardest for us, and I think for any developer, is just raising early-stage capital to set up and operate a company and get projects to their first phase. That’s where impact and philanthropic capital has been so valuable. Government programs and incentives don’t meet that need, and commercial capital for that is priced very high.

I don’t know that we would have been able to get this company off the ground without the impact and philanthropic world taking this risk with us.