ImpactAlpha, Sept. 14 – The New York Stock Exchange is seeking approval for a new kind of publicly traded asset based on the valuable services provided by nature.

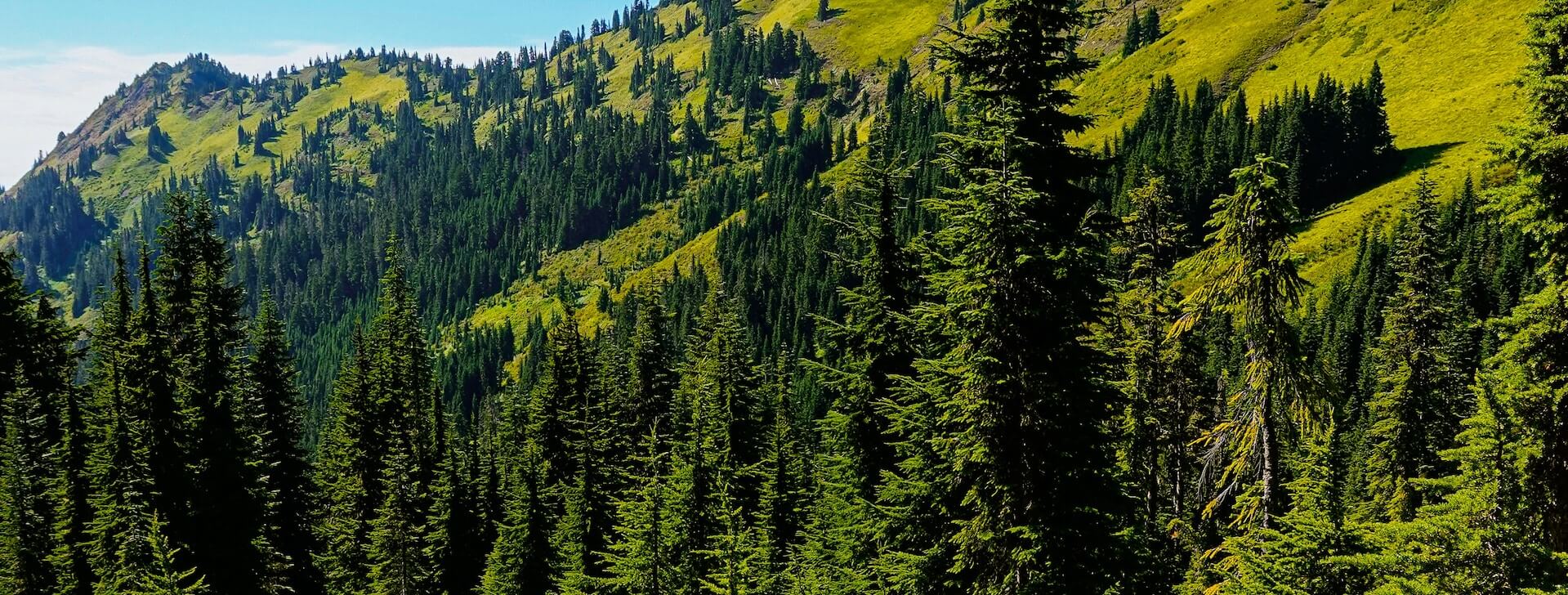

Natural asset companies, or NACs, will manage ecosystem services, such as forests that provide clean air, wildlife habitat, carbon sequestration and timber, or farms that provide healthy food and soil. NACs would go public through a traditional IPO process.

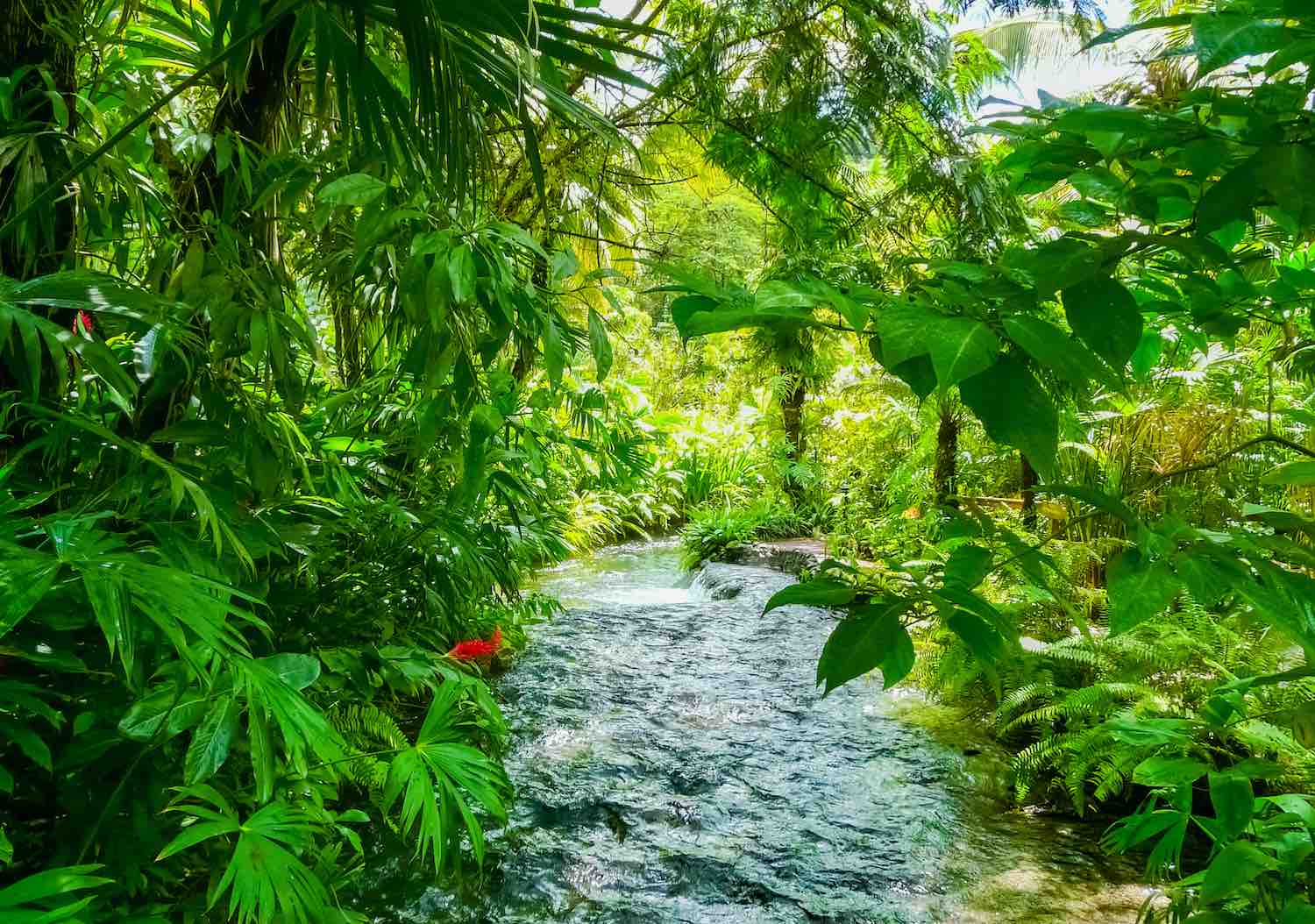

The government of Costa Rica is developing a NAC to protect 400,000 hectares of forest and marineland. It hopes to file for approval by the end of the year. If all goes as planned, the first NAC could begin trading in early 2022.

Just as SPACs have helped electric vehicle startups and other companies tap the public markets, NACs would enable a new class of nature-based companies to convert natural assets into financial capital.

Key to the system: an accounting framework to measure the ecological performance of natural assets and complement traditional financial accounting.

“Nature has value and we want to give investors the ability to directly invest in it,” said Douglas Eger of Intrinsic Exchange Group, which has developed the NAC idea with initial grant funding from the Rockefeller Foundation, IDB Lab and Inter-American Development Bank. “Countries are looking for a way to finance and have a value for their conservation efforts,” he added.

The notion is that a natural ecosystem need not be a cost to manage, but rather, a productive asset that attracts financial capital and provides wealth for governments and citizens.

Fully valued, Eger says, ecosystem services, including carbon sequestration, biodiversity and clean water could be worth as much as $125 trillion annually, more than the entire industrial economy of about $90 trillion a year. Hundreds of natural asset companies, he adds, could “generate a huge amount of capital at rates we haven’t seen before.”

With the NYSE, Virginia-based Intrinsic is seeking approval from the U.S. Securities and Exchange Commission. NACs would be subject to unique listing requirements and have their own listing section on the Big Board.

The accounting framework includes 18 categories of ecosystem services, from water and soil quality to medicinal resources and recreation. The Big Four accounting firms helped fine-tune the system, as did Robert Herz, former chair of the Financial Accounting Standards Board.

Scaling impact

As world leaders race to stem planetary warming and biodiversity loss, NACs could encourage conservation and regeneration efforts.

There is growing demand among investors for pure-play green investments that go beyond environmental, social and governance, or ESG, offerings, Eger says. And there are limits to what regulation, tax schemes, carbon markets and philanthropy have been able to accomplish.

“The world has seen the magnitude of the problem and the paucity of solutions,” Eger told ImpactAlpha. “We need to raise this to capital market scale if we’re going to get anywhere.”

How it would work: an NAC would be granted rights to a set of natural assets and associated ecosystem services, similar to concessions granted to companies for mining or timber concessions. A study would identify the value of the ecosystem services, such as water quality, wildlife habitats and biodiversity, carbon sequestration and more. The NAC would be valued based upon the natural asset itself as well as its revenue-generating potential and associated ecosystem services. The analysis would take into account, for example, the amount of carbon sequestered and the local price of carbon, among other factors.

Once an initial value is determined, the NAC would go public through a traditional IPO process. Ideally, a NAC would appreciate in value based on the production of timber, food or other products, the underlying value of the asset and the provision of ecosystem services, including carbon offsets. Carbon prices, for example, have risen dramatically this year on the European emissions trading scheme and other markets.

Moonshots

The Rockefeller foundation provided an initial $750,000 grant to Intrinsic out of its Zero Gap Fund, which supports innovative financial mechanisms to scale impact. The Zero Gap portfolio is a mix of nearer term solutions and riskier “moonshots,” like the NAC concept, which require significant ecosystem building.

“We’re trying to get access to the biggest range of investors, which public ownership can facilitate, and the biggest pool of capital,” Rockefeller’s Adam Connaker told ImpactAlpha.

The foundation is reviewing a new, recoverable grant for Intrinsic. The funding would help the company develop a pipeline of NACs with state and national governments as well as private companies.

Intrinsic makes money by advising companies and countries on designing NACs and would also collect fees from the exchange. It may also put up seed money for NAC projects that lack a sponsor. It expects later this fall to announce a partnership with a multinational food company to create a NAC to convert its supply chain to regenerative agriculture practices.

“We are leaning into this as we always do when we think that momentum has built around an idea where there’s a real live shot,” said Connaker. “This is us doubling down and tripling down. This is a big idea.”