ImpactAlpha, September 27 — Paris-based Mirova is the $27 billion impact unit of French asset management firm Natixis Investment Managers. The B Corp has raised $1.5 billion for its energy fund from the European Investment Fund and the Netherlands’ Pensioenfonds van de Metalektro, as well as investors in North America and Asia.

The B Corp has raised nearly $1.5 billion across four funds since 2002 to invest in more than 330 energy infrastructure projects, with over 6.5 gigawatt of installed generation capacity in Europe and Asia.

Roughly a third of the fifth fund’s capital came from investors in Mirova’s previous funds, said Mirova’s Raphaël Lance, who launched the fund in February last year.

Cleantech portfolio

Mirova has deployed €600 million from the new fund for investments in on-shore wind energy, hydroelectric power, green hydrogen, low-carbon mobility and energy storage projects in France, Poland and Belgium. The firm will continue to look for similar deals in Asia to invest the rest of the fund.

Mirova has also launched a pair of sustainable bond funds. Mirova Euro High Yield Sustainable Bond will invest in bonds financing health, green mobility, waste treatment, recycling and sustainable real estate. Mirova Euro Short Sustainable Bond will target bonds from companies needing short and medium-term financing for sustainable projects.

Impact M&A

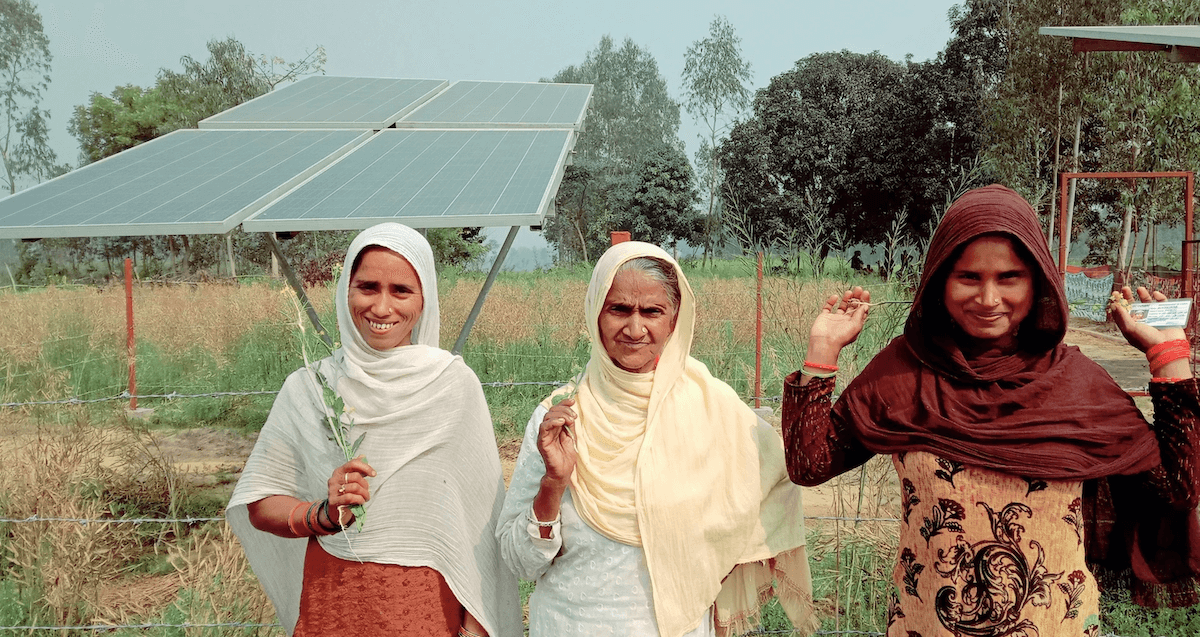

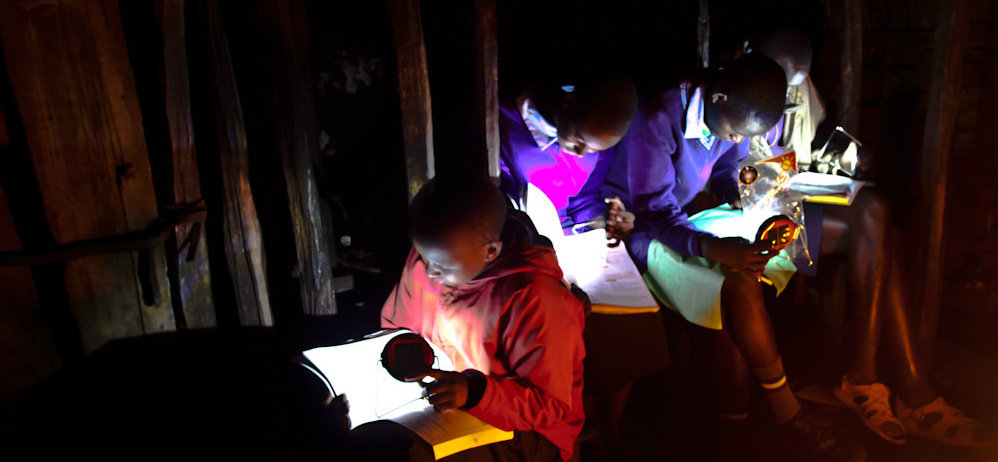

Earlier this year, Mirova acquired Nairobi-based SunFunder to create a $500 million energy debt fund to invest in about 70 solar projects in Africa, Asia and Latin America.

“In order to thoroughly address the challenges that come with the fight against global warming and social inequalities, having a local presence in emerging markets is critical,” said Mirova’s Philippe Zaouati at the time.