Greetings, Agents of Impact!

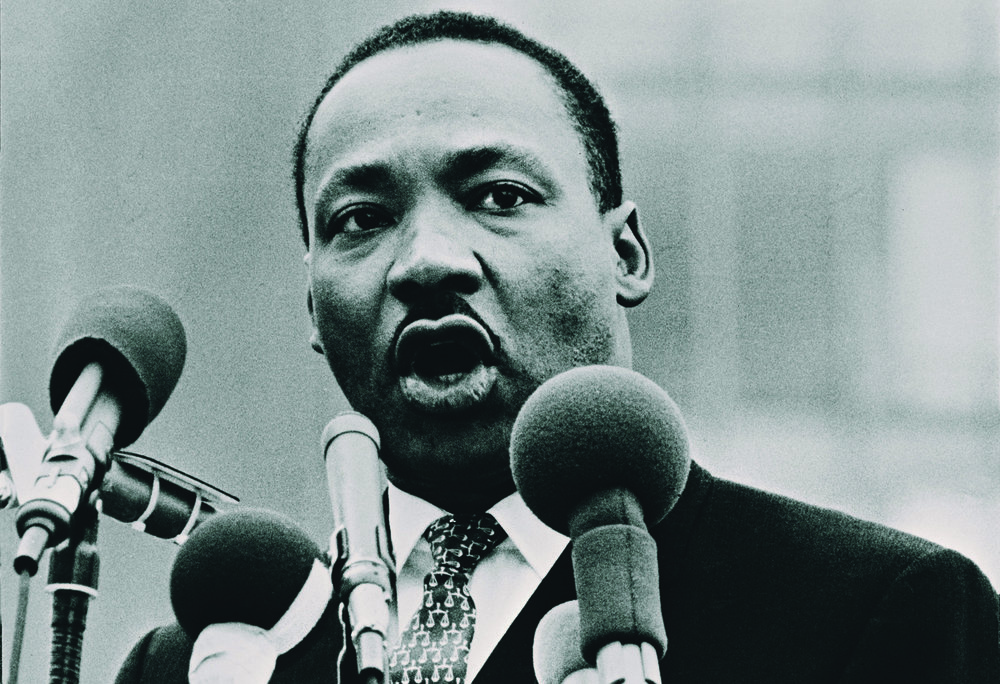

Recommitting to Martin Luther King Jr.’s dream of economic justice. Most commemorations of King’s birthday yesterday remembered the minister’s civil rights leadership. By the end of his life, King called for economic justice as well. “We don’t yet know what his vision for a ‘radical redistribution of economic and political power’ might mean for America,” writes Candide Group’s Morgan Simon. “All we can do is look at our own behavior in the present, and whether our actions support or suppress economic equality,” Simon says. Such arguments may – and should – take us out of our comfort zones. “Our problem isn’t that we don’t have enough money,” says the Rev. William Barber, who has revived the Poor People’s Campaign that King launched in the last year of his life. “It’s that we don’t have the moral capacity to face what ails our society” (see, “A minister’s call for moral, as well as economic, revival”).

Personal agency and moral urgency are the focus of rapper and activist Killer Mike’s new Netflix docu-series Trigger Warning. In the first episode, the Atlanta native spends three days trying to live wholly within the Black economy in Atlanta and Athens, Georgia. He visits WeCycle Atlanta, a bike shop that spurs kids to community service; discovers Hot Corner, Athens’ once-vibrant Black business district; and learns about “The Green Book,” a Jim Crow-era travel guide to help Black motorists find Black hotels, Black barber shops and Black-owned restaurants. Today, buying only from Black-owned businesses is “way more difficult than it should be,” he says. He called on viewers to pledge to make Fridays into Black Friday, “where everyone makes a conscious effort to buy Black and support a Black-owned business at least once a week.” The effort, he says, is “really about how to reconnect my community. And how, once reconnected, my community benefits not only us, but the bigger community.”

Dealflow: Follow the Money

Novo’s REPAIR Impact Fund backs three companies tackling antibiotic resistance. Antibiotic resistance is “one of the biggest threats to global public health,” according to the World Health Organization, which says that by 2050 resistance may cause more deaths than cancer. The Novo Nordisk Foundation launched the REPAIR Impact Fund last year to invest in U.S. and European startups and spinoffs developing new drugs and therapies for WHO-priority infections, like pneumonia, tuberculosis, and blood poisoning. The $165 million fund has invested roughly $20.5 million in companies addressing life-threatening newborn infections, new treatments for urinary tract infections, and a strain of bacteria commonly spread in healthcare settings. More about the companies.

Oui Capital to provide capital and mentorship for African startups. The new, $10 million venture capital fund will invest in African seed-stage companies “solving the everyday problems of Africa’s 1.2 billion people.” The firm, founded by venture investor Olu Oyinsan, aims to make six to eight investments of $50,000 to $150,000 each year in fintech, mobility, healthcare, and education startups “with strong growth and impact potential,” according to Oui’s website. It will pair entrepreneurial teams with mentors to help tackle “the most significant non-financial challenge that African founders face today.” Oui’s first two investments are in bike-sharing company AWA Bike and mvxchange, a provider of software for the shipping industry. Learn more.

Mexican digital bank Albo raises $7.4 million to boost access to finance services. Albo is among a growing crop of so-called “neobanks” accelerating Latin American’s access to financial services. The three-year-old online bank raised $7.4 million from Mountain Nazca, Omidyar Network and Greyhound Capital for its no-fee online banking services. Its Series A round follows notable investment rounds from several other Latin American digital banks, including including Tencent’s $180 million investment in Brazil’s Nubank and Argentina-based Ualá’s $34 million round led by Goldman Sachs. Read on.

Signals: Ahead of the Curve

The investment imperative of sustainable food. Impact investors look for inevitable imperatives. Case in point: The $7.8 trillion global food industry must become more environmentally sustainable. In a new report, “Growing a sustainable food system,” venture firm Village Capital details investment opportunities in firms improving the efficiency of farms, decreasing food waste and shifting eating habits toward healthy, plant-based diets. PepsiCo acquiredbaked fruit and snack-maker Bare Foods for about $200 million last May. In July, Canadian agtech investor Clean Seed Capital Group acquired Iowa-based precision planting company Harvest International for $13.1 million. New Brunswick, Canada-based Chinova Bioworks, which is developing a mushroom-based preservative, raised $1.9 million from food-tech investors last August.

-

Augmenting the farm. Industrial agricultural is a drain on water and land. Farm labor shortages are getting worse. Artificial intelligence, robots, the internet of things and other information technologies are helping more than half of farmers regulate greenhouse temperatures, harvest fruits and reduce pesticide use. In 2017, investors made 28 investments in early-stage firms in precision agriculture, a market expected to reach nearly $8 billion by 2022.

-

Reducing food waste. Actors in the food supply chain are losing annually about $160 billion in unsold produce. Some 125 startups are innovating in food logistics, a market set to top $150 billion by 2023. Data and logistics companies like FoodLogiq, which raised $19.5 million in March, are improving supply chain efficiencies. Biotech firms, including Chinova Bioworks, are helping extend the shelflife of food and drinks.

-

“Earth-functional foods.” Small brands are pressing foods that have environmental benefits beyond health, such as lower carbon footprints and recycled ingredients. A growth market: alternatives to meat for a growing global middle class. Consumers also are demanding more sustainably produced food and transparent supply chains. More than a dozen large food companies, such as Campbell Soup Company, Cargilland Land-O-Lakes, have launched corporate venture funds.

-

Heartland startups. Go where it’s grown, says Village Capital. Almost 90% of the more than 100 startups that applied to its 2018 food and agriculture accelerator were headquartered outside the venture capital corridors of New York, San Francisco and Boston.

Agents of Impact: Follow the Talent

Follow the talent. Former CDFI Fund director Annie Donovan becomes a senior fellow at the Center for Community Investment at the Lincoln Institute of Land Policy… Minnie Allison joins Admiral Capital Group as a senior asset manager.

Seize the opportunity. Illumen Capital is hiring a vice president of business development and investor relations in Oakland (see, “Tackling investors’ racial and gender biases to unlock hidden value”)… Calvert Impact Capital is looking for a director of institutional relations, analyst/officer of investor relations and an analyst/officer of syndications and strategy… Apparel Impact Institute seeks a chief of staff… The Sorenson Impact Center is recruiting a senior associate to manage an Opportunity Zone project in Salt Lake city… Drashta Ventures is looking for an associate in London… Sonoma Clean Power is hiring a chief operating officer in Santa Rosa, Calif.

Where to be. Join ImpactAlpha Feb. 19-21 in Merida, Mexico, for the Latin American Impact Investing Forum. Register with code IMPACTALPHA19 to save 40%.

Apply, respond, submit. Applications are open for the MovingWorlds Institute global fellowship program.

— January 22, 2019.