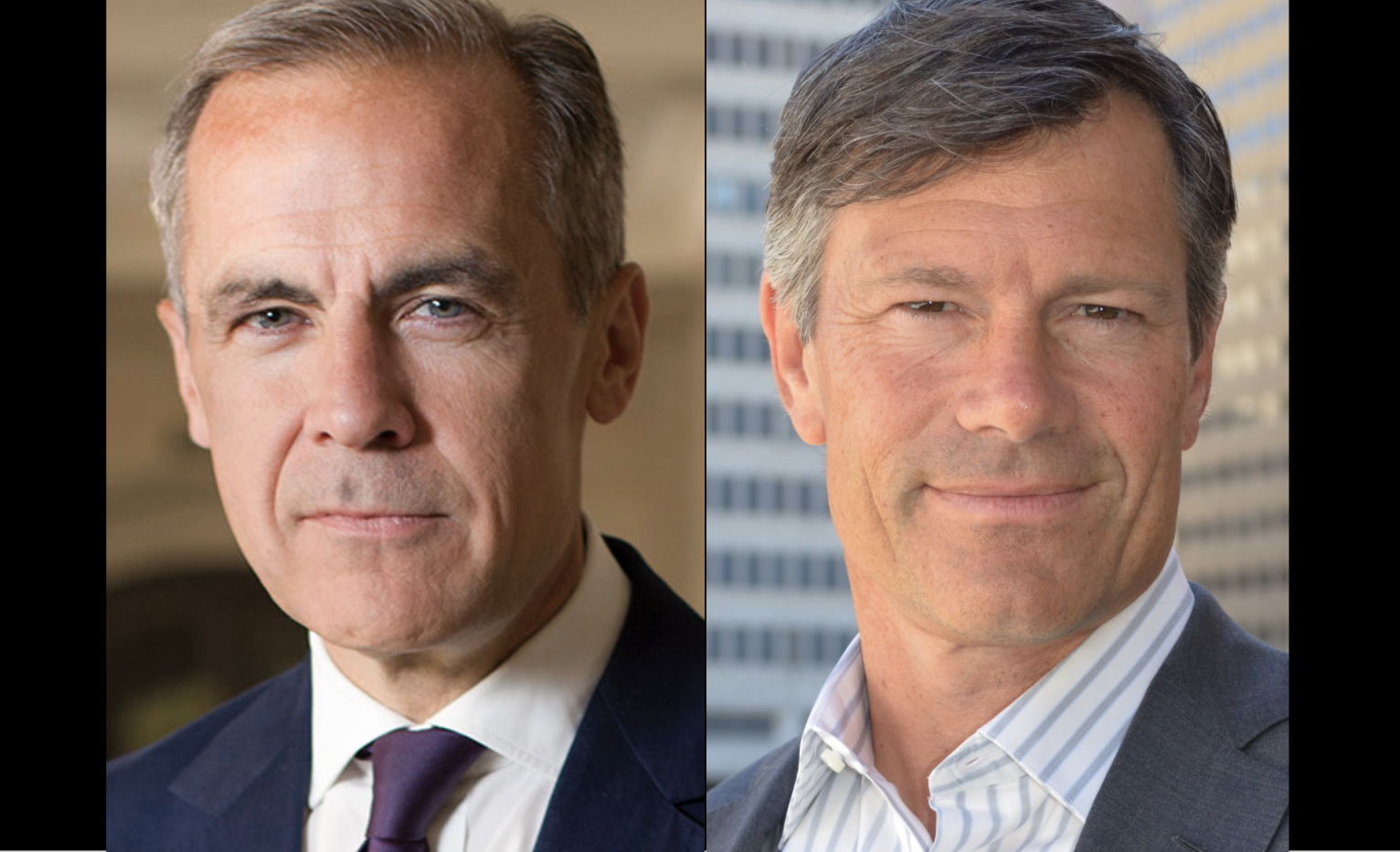

ImpactAlpha, Feb. 16 – Two blockbuster funds are targeting the “greatest commercial opportunity of our age,” as Mark Carney, former Bank of England chief, special climate envoy to the U.N. and vice chair of Brookfield Asset Management, has called the transition to a net-zero economy.

Toronto-based Brookfield is looking to raise a $7.5 billion Global Transition Fund to build out renewable energy projects and help companies transition operations to net-zero greenhouse gas emissions. Carney joined the $575 billion Canadian asset manager last summer to lead its impact strategy.

“We’ve got one objective, which is to put assets and companies on a path to net-zero to be part of the climate transition,” Carney told Bloomberg.

Activist investor Jeffrey Ubben is aiming for $8 billion for Inclusive Capital’s Spring Fund II fund, Reuters reports. The new firm’s first fund would invest in 15 companies committed to improving their social and environmental impact.

Change agent

Ubben founded Inclusive Capital last June with Lynn Forester de Rothschild of the Coalition for Inclusive Capitalism. The strategy is to push companies in oil, gas and other sectors to quickly transition to socially beneficial business models.

Ubben is said to be angling for a seat on Exxon’s board as the wounded oil major comes under pressure to reposition itself for a low-carbon future.

Last year, he bought up shares of BP after new CEO Bernard Looney pledged to transform the British oil giant into a diversified energy company. At ValueAct, his old firm, Ubben joined the board of power generator AES and pushed it in a greener direction.

“We’re trying to change the system,” he says.

Operating expertise

Brookfield is committing more than $2 billion of its own capital to the Global Transition fund, according to CEO Bruce Flatt. Brookfield operates 20 gigawatts of hydro, wind and solar power across four continents.

“There is growing demand for sustainable investing strategies, and in particular to invest alongside established and reputable investors that have operational capabilities,” Flatt told shareholders last November.

Impact FOMO

Between $1.6 trillion and $3.8 trillion is needed each year in low-carbon energy generation and other climate-smart infrastructure to stay within the global warming goals set by the Paris climate agreement. Financial markets are waking up.

In January alone, investors launched $26 billion in SPACs, or special purpose acquisition companies, many aiming to take public companies driving forward clean technologies like solar energy, electric vehicle infrastructure and fleets, and water and agtech. This month’s examples: ‘green hydrogen,’ and impactful consumer products.