“There’s an inherent power dynamic in investing. Full stop.”

That’s Margot Kane, the chief investment officer of Spring Point Partners, in an Agents of Impact podcast conversation with ImpactAlpha contributing editor Monique Aiken (a portion of their conversation was featured on the weekly Impact Briefing podcast earlier this month).

Spring Point Partners is a Philadelphia-based social impact organization, founded by siblings Graham, Jessica, James and Joanna Berwind, the fifth generation of a family that first made its fortune in coal mining. Spring Point “champions community-driven change and promotes justice by investing in transformational leaders, networks and solutions.”

In a recent guest post on ImpactAlpha as part of our series, Seeding Impact, Kane laid out some of ways Spring Point is seeking to rebalance the power dynamic in investing by supporting emerging and first-time fund managers to help build wealth through business ownership for BIPOC and other underrepresented founders.

“Without risk-tolerant capital that can be deployed in unconventional approaches, such as in seeding a first-time fund or warehousing early investments, these fund managers may never have an opportunity to prove out their investment thesis and grow into sustainable businesses with long-standing impacts.” Kane wrote.

Spring Point Partners began supporting emerging fund managers in 2020, focusing on wealth-building opportunities through business ownership for BIPOC and other underrepresented founders. Since then, Spring Point has supported 10 emerging managers who turned to investing in order to address the market inefficiencies and bias they experienced as BIPOC operators, investors and founders themselves.

Since Spring Point is structured as an LLC, it has flexibility that many other investors don’t. Asset managers of other people’s money are bound by fiduciary responsibilities that may not let them take uncompensated risks. As an asset owner, “We’re not we’re not crafting our investment strategy for tax optimization of any sort or to meet compliance requirements,” she says.

Deal warehouse

In the podcast, Kane expanded on Spring Point’s decisions to back emerging managers such as Plain Sight Capital’s Sylvester Mobley and Ruthless for Good’s Aaron Walker.

Plain Sight invests in early-stage tech and tech-enabled companies led by underrepresented founders. Mobley, a veteran of the war in Iraq, served in the Marines, the Air Force and the Army over a period of a dozen years. When he returned from Iraq, he tutored kids in coding at his local rec center, and later launched the nonprofit Coded by Kids to help Black and Brown people get jobs with tech companies.

“They needed some support to get this up and running,” Kane said. Spring Point provided support for operating expenses to enable the firm to staff up in advance of raising its fund and earning management fees.

In addition, Spring Point, with Philadelphia’s Ben Franklin Technology Partners, provided advance “warehouse” financing to let Mobley make initial investments “and build that ‘new team track record’ before they go to market later this year to raise the fund in earnest, because that’s another really key barrier first time fund managers and particularly fund managers of color face.”

Technical assistance

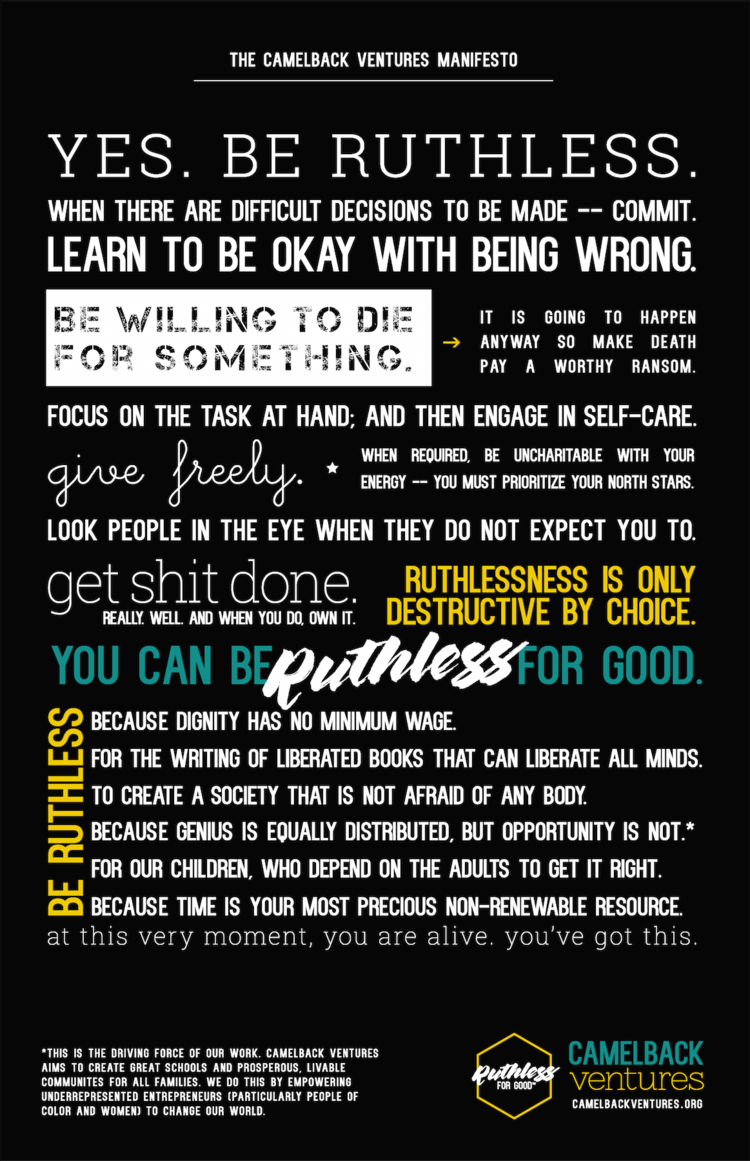

Spring Point, along with Gratitude Railroad, helped anchor the Ruthless for Good Fund, launched by Aaron Walker. In 2014, Walker had founded Camelback Ventures in New Orleans, an accelerator that has invested $4 million in nearly 100 social impact entrepreneurs who are women and people of color.

Examining the Camelback Ventures portfolio, Walker saw that the founders were generally outperforming their peers, but were getting outraised by founders who were more white and more male.

“That must mean one of two things,” Walker told VC Include, which selected Ruthless for Good for its own fund accelerator, “either that sophisticated investors are OK paying three times as much for the same thing, or that there’s really deep bias in the system.”

Ruthless for Good has raised about $12 million toward its $30 million goal to make seed and pre-seed investments in companies targeting education, the future of work and access to resources for underserved communities.

“We knew Aaron from his Camelback Ventures days, so we knew we were backing someone who is going to be not only an excellent investor, but also an excellent field builder, and coach and mentor for the founders that he’s supporting,” Kane said. She said Spring Point provided early feedback on technical details, including governance structure, advisors, investment policies and limited partnership agreements.

“We see a lot of limited partnership agreements and created a safe space for the push and pull of that conversation with Aaron as he was putting it all together,” Kane said. “I think that that hopefully helped him on the fundraising journey. And it was really a great way for us to get to know him a lot better, too.”