ImpactAlpha, September 15 – Climate finance in India surged in 2021, reaching about $20 billion in equity, green bonds and other types of capital. Only a quarter of those investors identify as impact investors, according to an investor survey from Unitus Capital and climate tech accelerator Climake.

That shows that investors are choosing to invest in climate solutions because of “the opportunity a new technology or sector offers, and less specifically on the mission to combat climate change,” the survey’s authors note.

Mainstream investors’ interest in climate solutions could be good news for a market that requires at least $1 trillion in additional capital by 2030.

“Private investment is crucial to meeting India’s climate goals,” the partners wrote in their 2021 climate finance report, which preceded the investor survey.

Funding the goals

India emits 3.2 gigatons of CO2 annually, or 7% of global CO2 emissions; its per-capita emissions are just 1.8 tons (compared to 14.2 tons in the U.S. and 7.4 tons in China). The country, long stalling on setting emissions targets, effectively committed at last year’s COP meeting in Glasgow to maintain its current annual emissions output of 3.2 gigatons until 2030, while the economy grows, and reach net-zero by 2070.

A better target: 2.6 gigatons, or a 20% reduction from 2019 numbers.

“While lower than the global 50% target that the IPCC calls for, this accounts for the common but differentiated lower share of developing countries as compared to developed nations that were historically high-emitters,” state Unitus and Climake. “Based on our current national policies, this is an extremely ambitious target to achieve, and will need private action aligned with net-zero movement globally.”

So far, most of India’s climate financing is invested in renewable energy generation. The country has more than 100 gigawatts of installed capacity. It’s eyeing 500 gigawatts by 2030, including 280 gigawatts of solar capacity. Its solar targets alone will cost $120 billion in the next eight years.

Renewables are “more mature than other climate action sectors as policy directions incentivize adoption, and large pools of capital are available from diverse sources: private funders, governments, and development finance,” Unitus and Climake find.

The solar sector has, in the past decade, consolidated from more than 100 small players to a handful of dominant actors, like Reliance, which committed to investing $80 billion over the next 10 to 15 years to develop 100 gigawatts of solar plants and manufacturing of modules, fuel cells and storage facilities. Adani has committed $50 billion in new renewables projects by 2030. Renew pledged $9 billion by 2025.

Climate tech

Venture capital and private equity investments in India’s emerging climate technologies reached $7 billion in 2021—a four-fold increase over 2020. More than 200 funders backed at least one climate deal.

“This progress in 2021 gives some indication that climate tech is inching towards mainstream finance,” according to the climate finance report.

More than 85% of funding went to 25 growth- and late-stage deals, and primarily focused on renewables. Earlier-stage investments were more diversified: 68 deals focused on electric mobility, the second most-funded sector.

“We expect this trend to continue,” the report’s authors note.

Notable deals in 2022: Ola Electric, which raised $200 million in January for EV production, and Greaves Electric Mobility, which raised $150 million in June for its electric two- and three-wheel vehicles. Small vehicles are leading India’s EV transition, though electrics still only make up just over 1% of India’s two-wheeler market. Most of the sales are for delivery fleets. Sales surged last year, however.

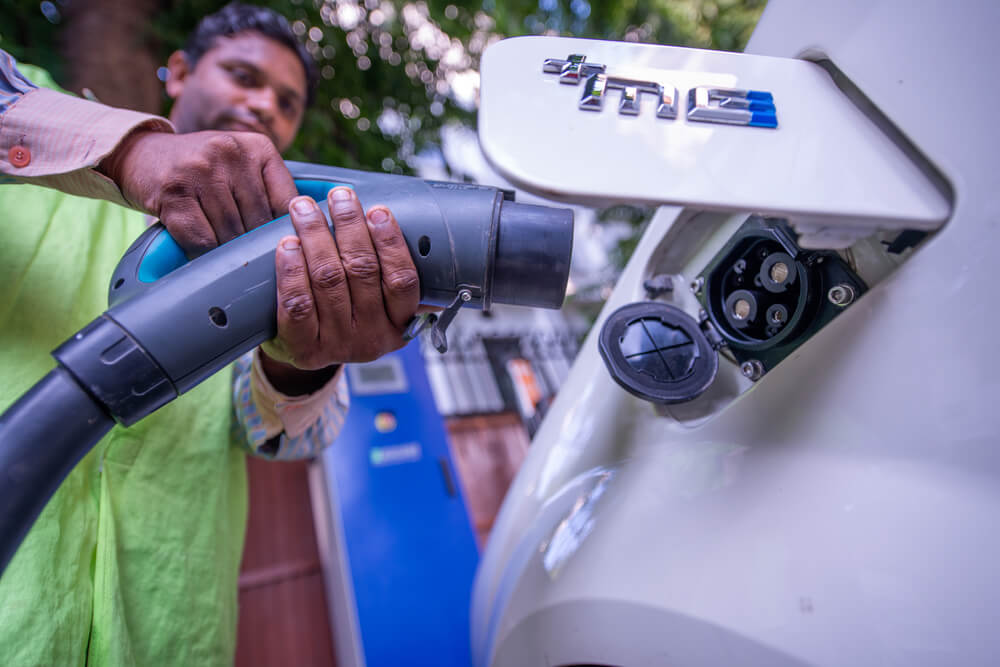

“EV today is where solar was a decade ago,” Unitus Capital and Climake note. “With the Indian government actively laying down favorable policies for the adoption of electric vehicles, private investors want to be actively involved across the EV ecosystem.”

Big names like Hero, Tata and Mahindra, “not startups, look set to win the EV war,” however.

Half of climate tech investors are interested in investing in EV charging infrastructure. “The sector has a lot of potential for scale, but charging standards need to be defined and standardized for growth investment to follow,” Unitus and Climate say.

The majority of India’s climate investors are interested in sectors beyond renewables and EVs. Nearly 75% are keen to back early- and pilot-stage technologies.

This signals a healthy risk appetite, given the small number of climate tech exits in India, note Unitus and Climake. “We are yet to see many full cycles of climate tech startups offer significant return multiples to private investors.”

Adaptation in agriculture

Agtech investment in India is climbing—and maturing. Last month, impact investor Omnivore notched a big exit in the sector, selling its stake in aquaculture software firm Eruvaka to Nutreco.

Little capital is flowing to farm-based solutions that help farmers mitigate climate impacts, like cutting methane emissions, or adapt to them. “Agriculture’s adaptation story—about how we ensure quality food security in the face of droughts, floods, anomalous temperatures, and indirect contributors (excessive fertilizer and water use)—is far more critical” than mitigation, Unitus and Climake say.

String Bio, which raised $20 million in July, is redirecting methane into sustainable animal feed production. Ecozen raised $7 million in June for its renewably-powered cold storage systems. BioPrime, an Omnivore portfolio company, is making biological crop treatments.

Funding for agriculture adaptation tech is expected to hit $15 billion by 2030 “as adaptation focus picks up and policies around climate-smart agriculture roll out,” the report says.

Overall $280 billion is needed by 2030 to build a more sustainable and resilient food system in India.

Corporate action

Eight out of the 10 biggest companies in India have set net-zero climate goals. Net-zero commitments from companies like Amazon, LG and Hyundai are pushing suppliers in India, including small businesses, to make green upgrades.

“We believe that a significant part of India’s climate action,” Unitus and Climake write, “will be driven by net zero commitments of private corporations and funders, both in India and globally.”