Greetings, ImpactAlpha readers!

ImpactAlpha is beaming today. Roodgally Senatus, our digital producer intern, graduated last week from Long Island University with a B.A. in journalism and a minor in photography. Many congrats, Roody, and thank for all of your contributions to ImpactAlpha. Show some love to Roody!

Featured: Returns on Investment podcast

Lata Reddy on Prudential Financial’s investments in equity and inclusion – and Newark. Prudential Financial may be the biggest impact investor you’ve never heard of. The insurance company’s impact investment portfolio stands at more than $715 million and is on track to meet its commitment to reach $1 billion by 2020. Last year, the company moved $250 million into investments that foster social and financial mobility. Some of Prudential’s investments overlap with the company’s $1 billion commitment to Newark, New Jersey, where it has been headquartered since 1875. That makes Prudential one of the country’s largest place-based investors as well.

ImpactAlpha caught up with Lata Reddy, Prudential’s head of diversity, inclusion and impact at last week’s Mission Investors Exchange conference. Reddy began her career as a civil-rights attorney with the U.S. Department of Education. “I was passionate about the work but frustrated by the outcomes,” she says now. “If we want to get this impact at scale, we’ve got to get this embedded in business models and change the way we think about capital.”

Listen to David Bank’s conversation with Lata Reddy, “Prudential Financial’s investments in equity and inclusion – and Newark,” in the new episode of ImpactAlpha’s Returns on Investment podcast. And catch up with all the episodes of Returns on Investment.

Signals: Ahead of the Curve

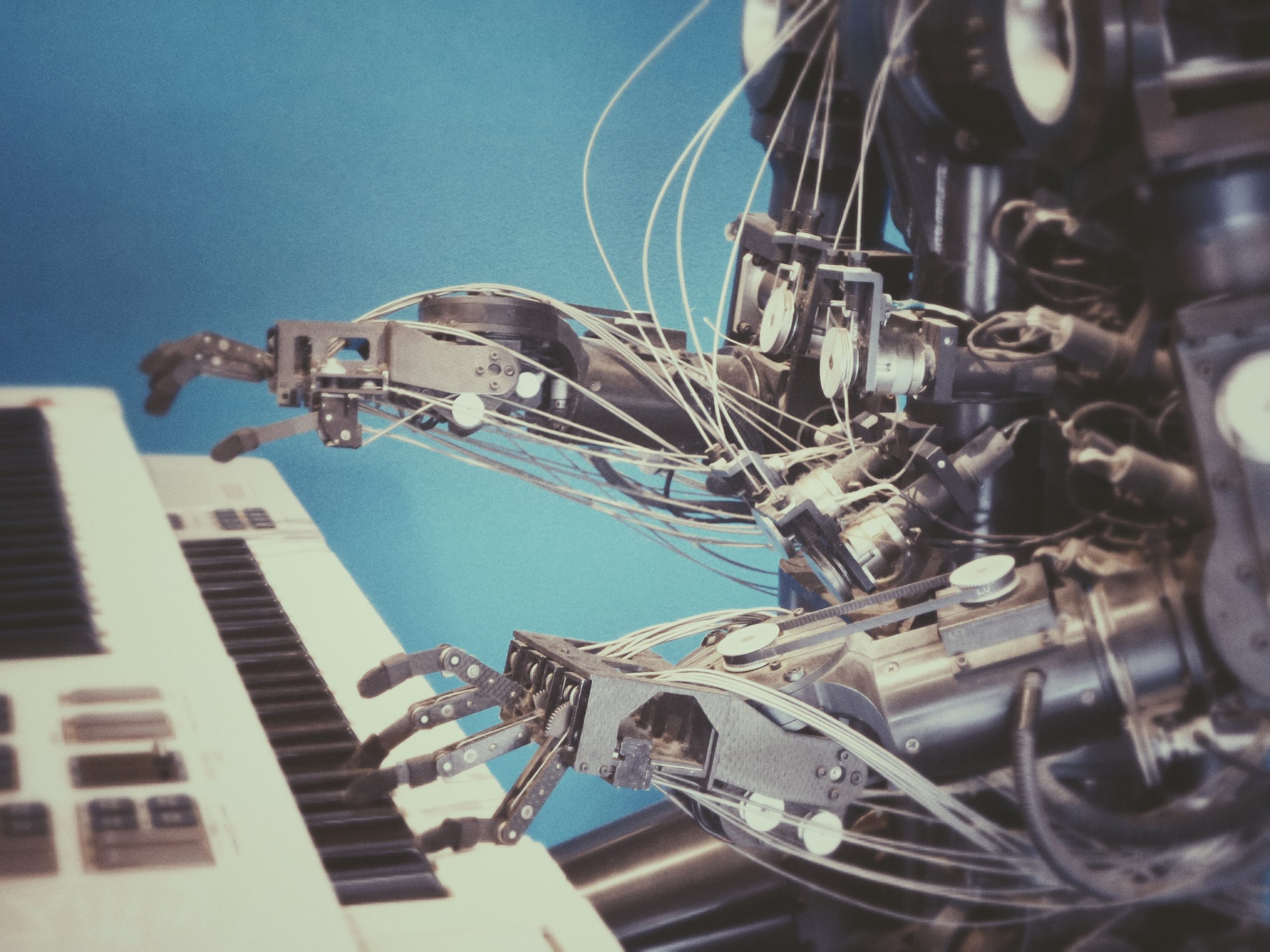

Can artificial intelligence boost global financial inclusion? Artificial intelligence has a big role to play in extending financial services to the next billion customers. A wonky new report highlights financial service providers in Africa that are wielding AI to lower costs, boost revenues and gain a competitive edge with low-income populations. The report from FIBR, a partnership of BFA consulting and MasterCard Foundation, makes the case that automation, machine learning, statistics and programming can help providers “micro-segment” customers and suit services to their finances. The use cases:

- Credit assessments. Kenya’s Branch and Tala are using behavioral data from phones to provide mobile credit to individuals directly. South Africa’s Lulalend is using machine learning to score and lend to small businesses.

- Personal finance. Abe AI in the U.S., in partnership with Absa Bank in South Africa, is predicting customer spending and savings activity and providing nudges toward healthier financial behaviors.

- Interactive interfaces. South Africa-based DataProphet is helping insurance companies introduce machine-learning enabled chatbots to lower customer-service costs.

- Voice recognition. More than a billion illiterate individuals (as well as the elderly and blind) may potentially be reached via voice-recognition AI that completes tasks over the phone without a human. In India, 28% of Google searches are conducted by voice.

Artificial intelligence algorithms are only as good as their data, notes the report from the consulting firm BFA. “More diverse individuals — including women, for example, or individuals from under-represented groups — may identify sources of bias inherent in the data and processes that might have been missed otherwise.” Go deeper: BFA is hosting a webinar on AI applied to financial services in Africa on June 6.

Agents of Impact: Follow the Talent

The Audacious Project is accepting submissions (through June 10) of bold ideas for solving global problems for next year’s program (see ImpactAlpha’scoverage of this year’s winners)… Fledge announced eight new “fledglings” in its Nature Accelerator, including sustainable fuel startup Green Charcoal in Uganda and environmental blockchain firm Oxyn in New Jersey… Capria is looking for a business development representative in “a new role to research and develop the market opportunity for Capria to invest in the Southeast Asia region.”

Dealflow: Follow the Money

CDC and Standard Chartered share risks in $100 million fund for post-Mugabe Zimbabwe. The new lending facility for small businesses is among the largest investments in the country’s private sector in years. Get the details.

Town Hall Ventures seeks a “massive and necessary shift” in health care for low-income Americans. The fund from the Obama administration’s Andy Slavitt will focus on companies that improve Medicare and Medicaid services, risk-based care and social determinants of health. Learn More.

Connxus raises $2 million to help corporations diversify supply chains. The firm helps companies build supply chains that include minority and women-run businesses. Dig in.

Social Impact Ventures takes a stake in biofuels company GoodFuels.GoodFuels’ biofuels can reduce CO2 emissions by 75% to 100% and eliminate sulphur emissions. Read on.

–– May 21, 2018