ImpactAlpha, February 23 – India is emerging as a hub for high-value, deep science tech startups working on breakthrough solutions to climate change, food security and other global problems. What’s needed to scale locally-developed solutions: growth capital and corporate backing for research-based startups.

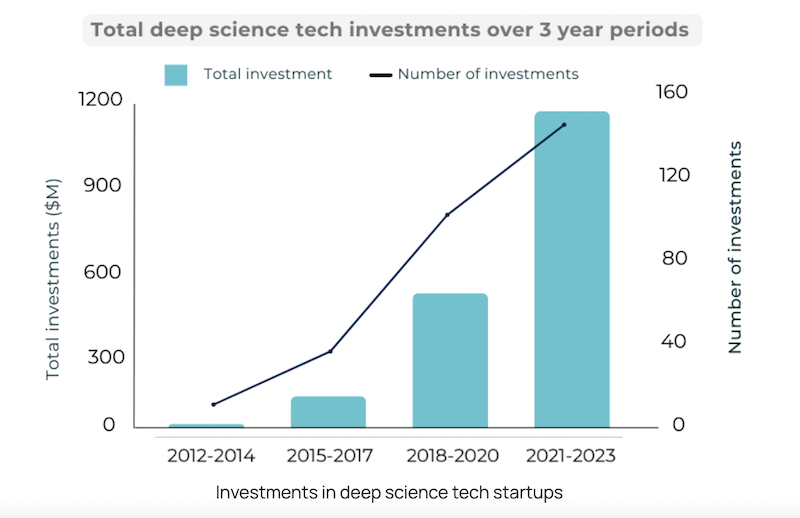

Capital flows to India’s deep tech ventures surpassed $1 billion over the past three years. That funding has largely come in the form of early-stage equity funding. Grants and support through incubators and labs has also buoyed deep tech startups, Mumbai-based impact tech investor Ankur Capital found in a new report.

“Investors need to wake up to the possibilities,” Ankur Capital’s Ritu Verma told ImpactAlpha.

Market potential

The proliferation of deep science startups in India over the last decade has the potential to unlock multi-billion-dollar markets and deliver products with global application.

In the agrifood sector, for example, Bangalore-based Sea6 Energy is farming seaweed to make biostimulants to increase plant yield. Synthetic biology company String Bio is making protein for animal nutrition and crop inputs for agriculture. Animal nutrition and crop inputs are each $100 billion markets.

Synthetic biology and battery storage are also estimated to be $100 billion markets. Molecular diagnostics is estimated to be worth $45 billion.

“The entire Indian deep science tech ecosystem is at an inflection point,” Ankur states in the India Deep Science Tech Report.

Growth-stage bright spot

Biotech startups have received the largest share of deep science tech funding in the past decade, raising nearly $900 million. A big chunk of the investment was growth-stage funding for therapeutics and diagnostics companies, such those developing technologies against Covid-19.

Molbio Diagnostics in Goa raised $85 million in 2022 for large-scale production of its chip-based rapid molecular test for infectious diseases, which is designed for the healthcare needs of low- and middle- income countries.

Bangalore-based Bugworks raised $18 million in 2021 for its pre-clinical and clinical studies for an immuno-oncology drug.

Overlooked needs

Companies are also targeting large but overlooked opportunities, like the decarbonization of rice production, low-powered mobility, and low-cost healthcare solutions.

One example is CAR-T cell therapy, a treatment for certain types of cancers, developed by Mumbai-based ImmunoACT. This therapy is expected to bring treatment costs by as much as 10x, according to Ankur’s report.

Another example is Niramai, a Bangalore-based company founded in 2016 that has developed an AI-based model to screen for breast cancer using thermal imaging. The company says it’s a cheaper and more accurate approach than mammograms.

“AI has addressed many problems in healthcare and agriculture such as disease screening, breeding climate-resilient seed varieties, and satellite imagery for agricultural advisory,” the report states.

Big payoffs

Growth-stage capital needed for companies to develop and commercialize products for the market is largely missing from India’s deep science tech scene, as is corporate research expertise and venture funding. Deep tech’s capital intensity and long product development timelines deters many venture capital investors. There is value in the wait, however, argues Verma.

“When they hit the market, then they hit the market big time,” she says.

Ankur’s report cites the foundational work in chemistry and electrodes done in the 1980s and 1990s that ultimately led to the creation of lithium ion batteries — a $50 billion market today.

“Today’s deep science is tomorrow’s mainstream tech,” the report states.

Investment trends in the space are nevertheless promising: capital flows to deep tech startups have roughly doubled every three years and are on track to reach $10 billion by 2029. Recent startups’ successes have inspired more specialists to become entrepreneurs and build innovative product companies rather than staying in research roles, observes Verma.

India is also an optimal place for nurturing deep science ventures, because of its large market size for testing new technologies. That, in turn, shortens the time it takes to get to market.

“A lot of science startups also are realizing the global potential of what they might do,” Verma says.

GreyOrange, an artificial intelligence-based warehouse robotics company, now counts Fortune 500 companies among its clients, for example.

Adds Verma: “The world is buying their products.”