Greetings, Agents of Impact! As we ramp back up after the summer and enter the fall event season, ImpactAlpha Open is grateful to be your connection to all things impact.

In this week’s newsletter:

- Parsing the ESG regs;

- The competitive advantage of lived experience;

- The social cost of carbon;

- The LiiST of impact funds raising capital; and

- Systems-level investing 101

(Post) Labor Day thought bubble: “The American worker has already proven that it is the engine of productivity. It has not captured the profits from that productivity,” says Roy Swan of the Ford Foundation, who has built an investment strategy around quality jobs. One sure way to build popular support for ESG and impact investing: share the wealth. – Dennis Price

👋 P.S. We’ve extended our Labor Day sale just for you. Today is the LAST DAY to save 50% on an all-access ImpactAlpha subscription. What you get: A daily briefing. Unlimited access to ImpactAlpha.com. And more ways to connect with other Agents of Impact.

Must-reads on ImpactAlpha

- Parsing the ESG regulations. Strategies to speed the clean energy transition that come with attractive risk-adjusted returns need not call themselves “green,” ImpactAlpha contributing editor Imogen Rose-Smith writes in her latest Institutional Impact column. Indeed, in states like West Virginia, Florida and Texas, they probably won’t.

- Climate adaptation. Epic floods in Pakistan highlight the gaps in climate funding for emerging markets, reports ImpactAlpha’s Amy Cortese.

- Muni impact. Cities like Nashville, Las Vegas and St. Paul are covering or removing highways to reconnect communities, reports Andrea Riquier for ImpactAlpha.

- Education innovation. Education funders can leverage innovative financing instruments to flip the odds in favor of students in the Global South, write guest authors Kusi Hornberger and Ines Charro from Dalberg and Nirav Khambhati of Kaizenvest. (Open)

- Lived experience. “I am a Black fund manager,” writes Living Cities’ Thaddeus Fair, who shares the personal toll of deploying capital to redress racial wealth gaps. “I don’t have the luxury of putting on the racial equity suit when I come to do this work only to remove it once I clock out.” (Open)

- Competitive edge. Founders who have faced challenges themselves offer fresh insight “into invaluable opportunities to drive incredible impact,” argue Taylor McLemore of Techstars and Angela Jackson of Kapor Center. (Open)

ImpactAlpha follows the impact…

… to help you avoid greenwashing. Stay ahead of the curve with an all-access ImpactAlpha subscription.

Agents of Impact

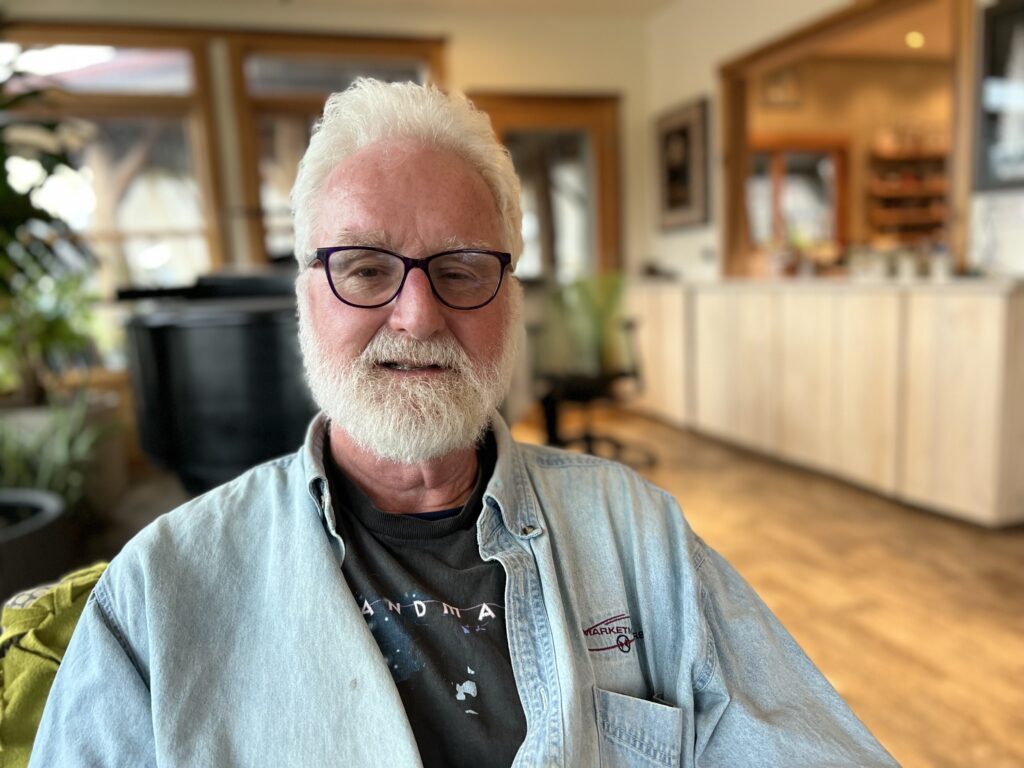

🤝 Kevin Jones, Neighborhood Economics: Turning strangers into unlikely allies

Kevin Jones played an early role in convening the disparate and sometimes unruly tribes of impact investing under the tents of SOCAP, before he and his partners sold the conference in 2017. With Neighborhood Economics, Jones is again bringing together “strangers who could become unlikely allies” in shifting capital and power.

- Share, “Kevin Jones, Neighborhood Economics: Turning strangers into unlikely allies,” by David Bank, and like the story on Instagram.

🏃♀️ On the move

- Lisa Mensah is stepping down as Opportunity Finance Network’s president and CEO (see “Agent of Impact: Lisa Mensah”). Mensah, who joined OFN from the Obama administration in 2017, has accepted a position in her home state as CEO of the Oregon Community Foundation. Beth Lipson, a 25-year veteran of OFN, will assume the CEO role on an interim basis.

- Andy Jarvis, ex- of the Alliance of Diversity and CIAT, will join Bezos Earth Fund as director for the future of food. “We have to decarbonize our food systems and protect nature in and around farms across the globe,” he says.

- Climate and sustainable finance expert Ilmi Granoff, formerly of ClimateWorks Foundation, will be a visiting senior fellow at the London School of Economics’ Grantham Research Institute on Climate Change and the Environment. His research interests include the function of public and private capital markets in the transition to a net-zero economy.

The LiiST

📈 Seven impact funds that are raising capital now

Welcome to our second edition of The LiiST, an initiative of ImpactAlpha and Realize Impact to highlight impact funds and other opportunities that, based on public or accessible information, are believed to be in active fundraising mode. Our inaugural edition of The LiiST was published last month. September’s LiiST includes:

- Conservation International’s venture fund, CI Ventures

- Seedstars second International Ventures fund

- Amplifica Capital, a gender-lens fund focused on Latin America

- Community Credit Lab’s returnable grants vehicle

- E8’s Decarbon8-US Fund

- Mission Driven Finance’s Regenerative Finance Fund

- BlackRock’s Impact Opportunities Fund

Learn more about September’s LiiST.

Deal Spotlight

🌱 Apple accelerates Black-, Latinx- and Indigenous-owned suppliers to meet its climate goals

The second cohort of the tech giant’s Impact Accelerator includes Navajo Power, a majority Native-owned firm led by Brett Isaac that develops utility-scale clean energy projects; Camden-based energy efficiency company IJB Electric, led by Ibrahim Branham; and Atlanta-based water data analytics company Aquagenuity, founded and led by Doll Avant. Rather than funding, the group receives business training and tools to succeed as an Apple supplier. Apple says several companies from the earlier cohort joined Apple’s supply chain.

- Climate tech. Other members of the latest group include soil management company Solena Ag, led by Irving Rivera, in Foster City, Calif.; Slater Infrastructure Group, a water stewardship firm founded by Jeanne Simkins Hollis in Alpharetta, Ga.; and RENUoil of America, led by Isabell Ysassi, an on-site recycling company in Las Vegas.

- Share this post.

Six Signals

💰 The Social Cost of Carbon: A new estimate of the economic damages resulting from the addition of an incremental ton of carbon dioxide into Earth’s atmosphere. (Resources for the Future)

👷🏽♀️ Assessing the Biden administration’s record for workers. (Economic Policy Institute)

🔎 For job searchers, $20 per hour is the new $15. (Axios)

🌱 Fund manager beats 100% of peers using toughest ESG strategy. (Bloomberg)

🧸 Wind turbine blades could be recycled into gummy bears, scientists say. (The Guardian)

🗞️ The Headlines: Solar arrays in New Hampshire. A battery plant in Kentucky. Electric buses in West Virginia. Electric vehicles in Alabama. (Ali Zaidi)

Get in the Game

💼 Step up

- LeapFrog Investments seeks a ‘profit with purpose’ analyst in Mumbai or Singapore.

- The Clinton Foundation is looking for a senior community manager for inclusive economic growth and recovery, based in New York.

- Big Society Capital is looking for an ESG and equality, diversity and inclusion manager in London.

🤝 Meet up

- Tideline is hosting “Systems-level investing: What is it, and how does it differ from or reinforce sustainable and impact investing?” with Monique Aiken and Bill Burckart of The Investment Integration Project, Carole Laible of Domini Impact Investments, Brian Minns of University Pension Plan, and Tideline’s Ben Thornley, Wednesday, Sept. 7.

- Full Spectrum Capital Partners’ Taj James and Integrated Capital Investing’s Jen Astone will explore how BIPOC-led funds create opportunities for entrepreneurs and businesses, Thursday, Sept. 15.

- Mission Investors Exchange and the U.S. Impact Investing Alliance are hosting “Impact in the Balance: Refreshing the toolkit,” Wednesday, Sept. 21, featuring the Alliance’s Fran Seegull, LOCUS Impact Investing’s Jim Baek, Robert Wood Johnson Foundation’s Kimberlee Cornett, Morgan Stanley’s Grace Chionuma, and Ford Foundation’s Mai-Anh Tran.

🎬 Take action

- There are just two days left to apply to the Zinc Venture Builder, which seeks 70 entrepreneurial individuals from across the globe to build businesses that will transform the industries that have the most impact on our environmental crises.

- Check out the Circulars Accelerator from Accenture and the World Economic Forum, a six-month accelerator program for start-ups working on “circulating” products and services to reduce waste and pollution.

- And finally, add to Unconventional Ventures’ lists of investors, angels, accelerators and resources with diversity as a thesis or interest for underrepresented founders in Europe.

📧 Get ImpactAlpha Open in your inbox each Tuesday.

Sign up for FREE at ImpactAlpha.com.

Don’t be strangers. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

And please connect with ImpactAlpha on social media (below). See you back here next Tuesday!