December greetings, Agents of Impact!

You may be pleased to learn that our new artificial-intelligence overlords are hip to impact investing. Take a look at the results of our queries of OpenAI’s new chatbot:

- “How do I measure the social impact of an investment?“

- “How can I make impact investments in my personal portfolio?“

- “What’s the difference between ESG and impact investing?“

Our favorite: “What’s the best website for impact investing news?” “The best website for impact investing news is ImpactAlpha.com. The website provides in-depth coverage of impact investing topics, such as sustainable investing, ESG investing, and impact investing. It also features interviews with experts, news, and analysis of the latest trends in impact investing.” Gotta love those bots! (Share this)

In this week’s newsletter:

- Pro-ESG forces strike back;

- Employee ownership trusts;

- December’s Liist of open impact funds; and

- TPG Rise’s $7.3 billion climate plan.

Let’s jump in. – Dennis Price

Must-reads on ImpactAlpha

- Pro-ESG strike forces back. It took awhile, but advocates for the integration of environmental, social and governance factors in investment decisions are mobilizing their allies and their arguments to counter the well-coordinated campaign to demonize ESG, reports ImpactAlpha’s David Bank. Bank is moderating “Reclaiming ESG,” with Ford Foundation’s Roy Swan, Sorenson Impact’s Jim Sorenson, Capricorn Investment’s Kunle Apampa, and Lisa Woll of US SIF, today at the Mission Investors Exchange conference in Baltimore.

- Ownership economy. Employee-focused purpose, or ownership, trusts address yawning wealth gaps by cutting employees in on the wealth they help create, Common Trust’s Zoe Schlag told me (hear Schlag for yourself on this week’s Impact Briefing podcast).

- Inclusive gentrification. Developers and investors reviving the once-thriving manufacturing and port city of Baltimore are using real estate to close racial wealth gaps, ImpactAlpha’s Jessica Pothering reports.

- Catalytic climate capital. MacArthur Foundation is mustering the full spectrum of capital, including “impact-first” catalytic capital and “returns-first” sustainable investments, as well as grants, to address the climate crisis, the foundation’s John Balbach, Caixia Ziegler and Jorgen Thomsen explain in a guest post. (Open)

- Returns on inclusion. Strong Haulers’ Ibrahim Rashid lays out six ways to build a Long COVID economy to help the 100 million people who have never recovered. (Open)

- Uplifting Capital’s Toussaint Bailey is structuring investment strategies to get ‘the quietly bothered’ off the sidelines (podcast).

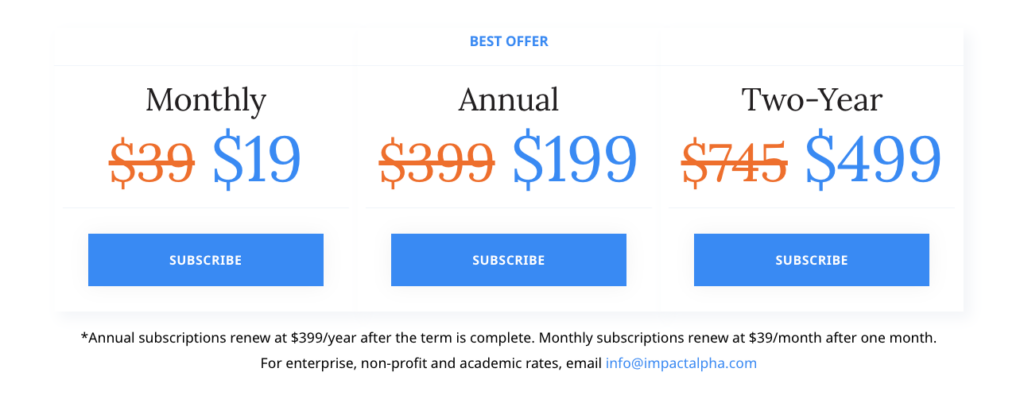

Up to 50% off monthly, annual and two-year subscriptions

⚡ Take up to half off. Sample a full-access ImpactAlpha subscription with 50% off your first month. Ready to commit? Grab 50% off a one-year. For the biggest savings, lock in a two-year subscription for just $499. Learn more.

Agents of Impact

🌠 Seth Bannon, Fifty Years: Big swings at big challenges (podcast)

Seth Bannon and his partner Ela Madej launched the venture capital firm Fifty Years “to back founders that are taking incredibly big swings and incredibly risky paths but ones that might fundamentally push the world forward if they succeed,” Bannon told ImpactAlpha’s David Bank in an Agents of Impact podcast.

Fifty Years’ big swings include chemical decarbonization firm Houston-based Solugen, now valued at more than $2 billion and satellite internet company Astranis, valued at $1.4 billion. Upside Foods, the lab-grown meat producer whose cultivated chicken was green lit by the FDA, is valued at over $1 billion.

- Keep reading Seth Bannon’s Agent of Impact profile and listen to the podcast.

🏃🏿♀️ On the move

- Kate Turner is promoted to global head of responsible investment at First Sentier Investors, succeeding Will Oulton, who will retire at the end of the year.

- Lisa Neuberger Fernandez, ex-of Accenture, joins 374Water as global head of sustainability and ecosystems.

- Sebastián Welisiejko, Global Steering Group for Impact Investment, joins New Ventures as a partner.

The Liist

📈 Seven impact fund managers raising capital right now (December 2022)

It’s been a difficult year for many run-of-the-mill tech funds seeking fresh powder. Impact funds, from climate tech to gender-lens vehicles, are leaning into more resilient (and urgent) trends. Many in turn are surpassing their fundraising targets. This month’s Liist, in partnership with Realize Impact, showcases the diversity of impact themes, with some funds nearing their fundraising close and others fresh out of the gate.

- Better Ventures;

- I2I Ventures;

- Deetken Impact;

- New Way Homes;

- Acumen LatinAm Impact Ventures;

- Amazonia Impact Ventures; and

- Sangam VC.

Deal Spotlight

🌱 TPG Rise’s $7.3 billion climate plan takes shape

Jim Coulter has gotten climate religion. Since taking the helm of TPG’s impact-focused Rise fund last year, Coulter has completed his transformation from buyout buccaneer to climate apostle (see, “The education of Jim Coulter”). Last week, Rise Climate stood up Rubicon Carbon, a marketplace for buying and selling carbon offsets, with $300 million and a pair of former Bank of America heavyweights.

Six Signals

🇪🇺 European impact. Impact investment assets under management in Europe grew 26% year-over-year to €80 billion, or 0.5% of the European mainstream investment market. (EVPA / GSG)

🏢 Ownership economy. Kresge Foundation’s Erika Brice and Elwood Hopkins explore how to assess models and capital sources for community-owned real estate. (Mission Investors Exchange)

🎮 Inclusive creative economy. Big video games such as World of Warcraft, The Sims and even a Harry Potter game are dropping old gender restrictions on character creation. (Axios)

⚡ Energy transition signal. A former coal-fired power plant in New Jersey was imploded last week; the site will be replaced with a $1 billion battery storage installation to store power from clean energy sources including wind and solar. (Reuters)

🌱 Buying carbon removal, explained. Spotify’s carbon removal buyer guide for companies explores how to get buy-in from internal stakeholders, construct a portfolio and retire credits you receive. (Spotify)

🌡️ Future of heat pumps. Around 10% of space heating needs globally were met by heat pumps in 2021. The low-emission heating technology has the potential to reduce carbon emissions by at least 500 million tons in 2030 – equal to the annual CO2 emissions of all cars in Europe today. (IEA)

Get in the Game

💼 Step up

- UBS is recruiting a social impact program manager.

- Blue Dot Capital seeks a remote senior associate for ESG research and integration.

- BlueMark is looking for a senior associate for impact investing research and development.

🎬 Take action

- Maycomb Capital and the ZOMA Foundation’s Outcomes Finance Accelerator Fund invites social innovators to apply for loans.

- Ford Foundation and JUST Capital are soliciting proposals to advance research and data on human capital management.

🤝 Meet up

- Fran Seegull of the U.S. Impact Investing Alliance, Cambria Allen-Ratzlaff of JUST Capital and other field leaders will make the case for SEC action on mandated, standardized human-capital management disclosures for corporations at “E, S, G and W: Examining Private Sector Disclosure of Workforce Management, Investment, and Diversity Data.” The House Financial Services Subcommittee on Investor Protection, Entrepreneurship and Capital Markets hearing will be held today at 2pm ET. Watch it live.

- BlueMark is hosting “Raising the Bar 2.0: Introducing BlueMark’s Framework for Evaluating Impact Reporting,” with Margot Brandenburg of Ford Foundation, Philipp Essl of Big Society Capital, Ka-Hay Law of TELUS Pollinator Fund for Good, Impact Engine’s Roger Liew and Impact Frontiers’ Mike McCreless in conversation with BlueMark’s Sarah Gelfand and Tristan Hackett, Tuesday, Dec. 13 at 11am ET.

- The White House Office of Science and Technology Policy will host an electrification summit, Wednesday, Dec. 14.

📬 Get ImpactAlpha Open in your inbox each Tuesday.

Sign up for FREE at ImpactAlpha.com

Partner with us, including by sponsoring this newsletter. Get in touch.

Don’t be strangers. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

See you back here next Tuesday!