ImpactAlpha, September 9 — Emerging economies are helping lead the clean energy transition by attracting private investment to larger-scale renewable energy projects, the World Bank says.

Morocco has the largest solar power plant in the world. India has the fastest renewable energy growth rate of any major economy.

Governments with ambitious climate targets, investor-friendly regulations and which bring in global development financial institutions to mitigate risks can pave the way for private capital to enter.

Green finance

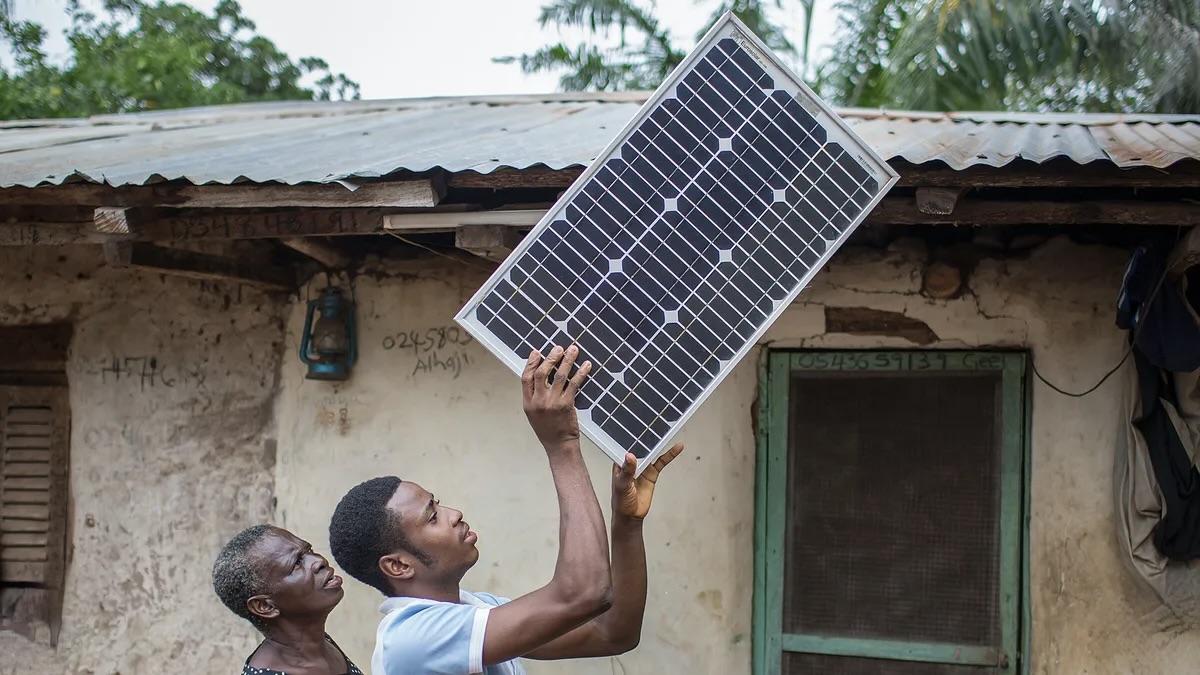

Pay-as-you-go solar provider Bboxx this week acquired peer PEG Africa to expand its business in West Africa.

U.K. development agency British International Investment made a $25 million loan to Nepal’s NMB Bank to boost the bank’s renewable energy lending, specifically for hydropower.

Italy’s development finance institution Cassa Depositi e Prestiti, or CDP, provided a $100 million loan to the Africa Finance Corp. for renewable energy, energy efficiency and climate resilient infrastructure projects.

And the World Bank-funded Off Grid Electricity Fund, which aims to electrify more than 140,000 Haitian households by 2024, invested in Paon Bleu to expand solar lending in Haiti’s rural areas.