Hi there, Agents of Impact!

👋 Join The Call. The next call in ImpactAlpha’s “Muni Impact” series, “How asset allocators are driving racial equity in municipal bonds,” features Renaye Manley of the Service Employees International Union, Harvard’s David Wood, and other Agents of Impact, Wednesday, June 14, at 10am PT / 1pm ET / 6pm London. RSVP today (thanks to the Robert Wood Johnson Foundation for making this subscriber-only call open to all).

In this week’s newsletter:

- This month’s Liist of open impact funds

- Corporate impact reports

- Fusion investments are heating up

- Carbon-tilted index

Ok, let’s dig in. – Dennis Price

Must-reads on ImpactAlpha

- Catalytic capital in this month’s Liist. A $10 million pilot fund from Energy Peace Partners and impact fund manager Cameo is one of several catalytic capital vehicles on this month’s Liist of impact funds actively raising capital, report Jessica Pothering and Roodgally Senatus.

- ESG backlash. Legal threats from a coalition of 21 Republican state attorneys have chilled support among asset managers for climate and ESG resolutions, Amy Cortese and David Bank report.

- Manifest Social’s Ryon Harms chimes in with a helpful roundup of the mounting costs of the ESG backlash.

- Muni impact. In the face of dwindling water supplies from the Colorado River, Los Angeles’ Department of Water and Power issued $484 million in bonds to finance capital improvements to the water system, including $300 million for recycled water production.

- Corporate solutions. Tesla, Sunrun, 3M and other public companies are going beyond ESG to tout their climate and community impact, as ImpactAlpha details in our latest roundup of annual impact reports.

- Outsourcing impact alpha. Capricorn Investment Group is riding on its impressive record of cleantech investing to attract families and foundations to its “outsourced chief investment officer” model, as Capricorn’s Kunle Apampa tells David on the latest Agents of Impact podcast.

Special introductory offer

⚡ Take 25% off – that’s $100 in savings

Enjoying ImpactAlpha Open? Upgrade to an all-access subscription to get daily, in-depth coverage of impact investing dealmaking and trends.

Agents of Impact

🏃 On the move

- Demetric Duckett, ex- of Living Cities, joins Known as managing partner. Known will house Living Cities’ $100 million Catalyst Fund III, which aims to address underinvestment in Black, Indigenous and other communities of color (listen to Demetric in ImpactAlpha’s podcast, “New decision-makers for the new majority”).

- Ford Foundation’s Roy Swan joins the board of Global Impact Investing Network.

- Bamboo Capital’s Florian Kemmerich will lead Palladium’s fund placement team. Kemmerich will remain managing partner at Bamboo.

Impact Briefing

🎧 On the podcast

David Bank joins host Monique Aiken to talk about the ownership economy, ESG backlash and system-level investing. Plus the headlines.

- Listen to the latest episode, and follow all of ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

Charting the energy transition

📈 Net-zero pathway

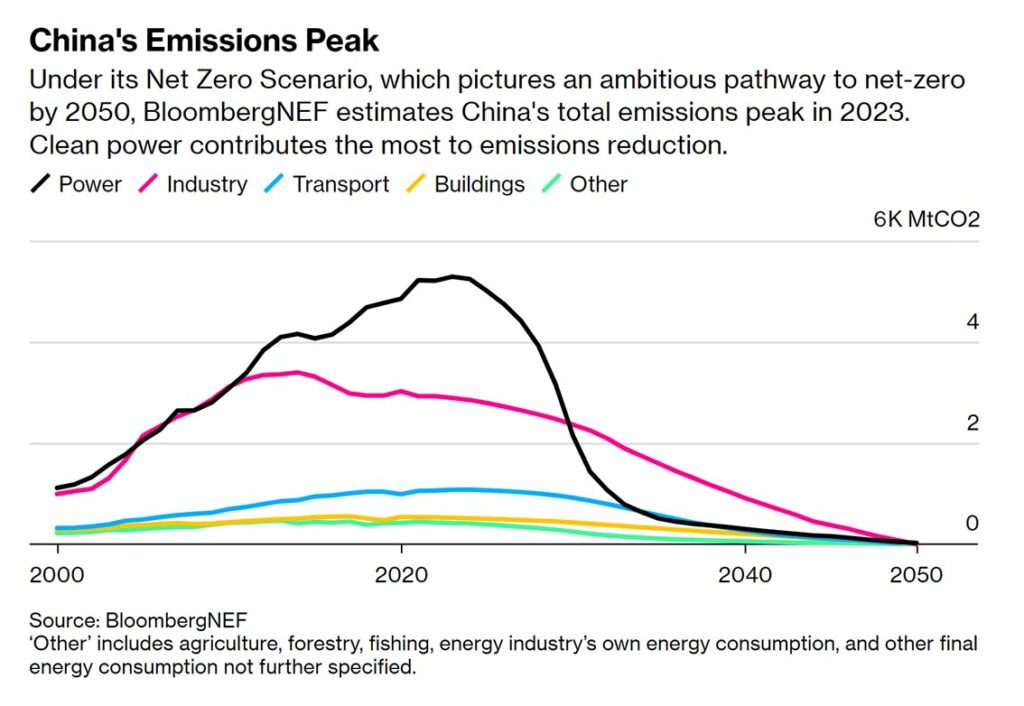

A boom in solar and electric vehicles is driving down emissions and pushing the world’s largest carbon-emitter toward an energy tipping point. The excitement, says Bloomberg’s Dan Murtaugh, “suggests China is nearing an inflection point in its energy transition more than a half-decade before a 2030 target to peak emissions.”

Deal Spotlight

💸 Fusion is heating up

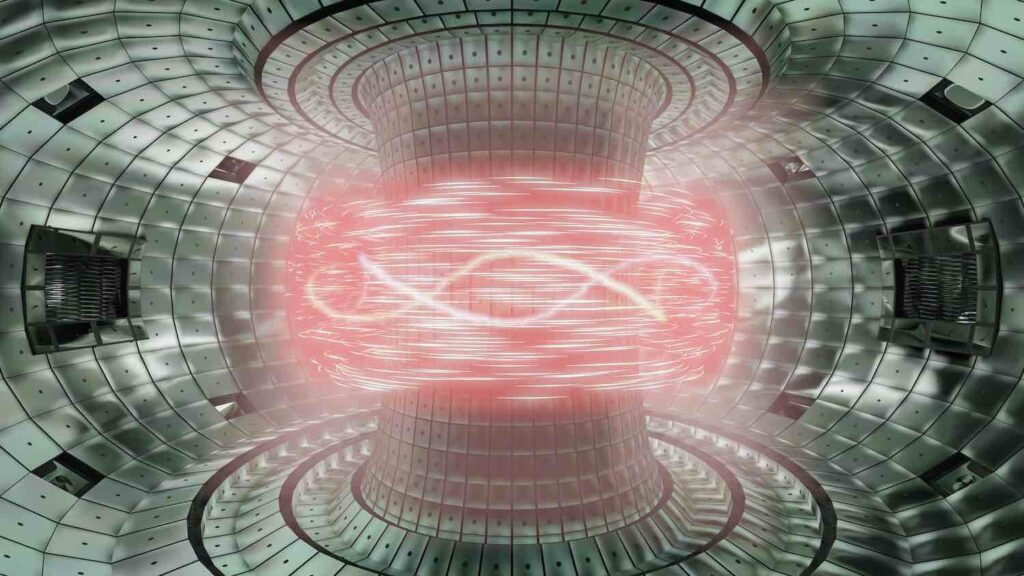

Some $5 billion in private capital already has been invested in fusion energy startups. Last month, Microsoft inked the first pre-purchase agreement for grid-connected fusion power – to be delivered by 2028. Last week, the U.S. Department of Energy awarded $46 million to eight fusion companies to help commercialize the technology, contingent on milestones to be met over the next 18 months. “It’s no longer a question of possibilities,” said Energy Secretary Jennifer Granholm. “It’s a question of ingenuity and whether we can muster up the investment and the commitment that this challenge demands.” As ImpactAlpha’s Climate Co-Investor Tracker, developed by Vibrant Data Labs and SecondMuse, shows, the DOE and National Science Foundation have long been the hub of the climate-tech ecosystem.

- Close to a reality. Commonwealth Fusion is among a handful of firms that have recently raised capital to bring fusion energy to market.

- Keep reading, “Fusion is heating up,” by Amy Cortese on ImpactAlpha.

Six Signals

💱 Guarantees for a just transition. The high-level Summit on a New Global Financing Pact in Paris in June will take up a $100 billion plan produced by the Bridgetown Initiative, spearheaded by Barbados leader Mia Mottley, to catalyze capital for climate and development finance in poorer countries by providing currency guarantees to investors. (Reuters)

🇮🇳 India impact investing. Almost 400 impact enterprises in India received roughly $5.8 billion in investments across 411 equity deals in 2022. Climate tech emerged as the most active sector even as total impact investment in the country fell by $1 billion. (India Impact Investors Council)

👨🏾🌾 Farmer wellbeing. A Farmer Thriving Index from 60 Decibels will seek to answer the question, “How are farmers doing?” by measuring living incomes, financial resilience, livelihood sustainability and food security. (Small Foundation)

🌾 Carbon-tilted index. The Bloomberg Commodity Carbon Tilted Index will overweight commodities with a lower carbon footprint. “There is a growing want to support the transition to a low-carbon economy while remaining aligned with their investment goals across all asset-classes,” said Bloomberg’s Allison Stone. (Bloomberg)

- ICYMI: “Index Impact: Passive investors are actively tilting stock indexes toward sustainability,” by Amy Cortese.

☀️ Texas dodges a bullet. Proposals to kneecap renewables and stick Texans with costly new gas power plants were removed from bills at the end of the legislative session. (Canary Media)

- The backstory: “Don’t mess with Texas’s lead in the low-carbon energy transition,” by Dennis Price.

👩🏽💼All hands on deck. Climate tech needs more than engineers. Thousands of job listings from the site Climatebase show strong demand for non-technical, general business skills in operations, human resources and marketing. (Bloomberg)

Get in the Game

💼 Step up

- Ontario Teachers’ Pension Plan seeks a sustainable investing principal for a 16-month contract in Toronto.

- Triple Jump is hiring a seed capital investment manager in Amsterdam.

- Elemental Excelerator is hiring a chief of staff in the San Francisco Bay Area.

Don’t miss dozens of more impact jobs curated this week on ImpactAlpha.com.

🤝 Meet up

Don’t miss these upcoming impact investing events:

- June 20-22: Asian Venture Philanthropy Network Global Conference 2023 (Kuala Lumpur)

- July 13-14: Africa Impact Summit, hosted by GSG, African national advisory boards for impact investing, and the University of Cape Town’s Bertha Center (Cape Town)

- August 27-30: Latimpacto’s 2023 Conference (Rio de Janeiro)

📬 Get ImpactAlpha Open in your inbox each Tuesday

Don’t be a stranger. Connect with us. Tell us who you are and what you’re up to. Share your news, tips, data points, introductions and high-impact ideas, to [email protected].

‘Til next Tuesday!

Partner with us, including by sponsoring this newsletter. Get in touch.

Get ImpactAlpha for Teams. Save with substantial group discounts. Start here.