ImpactAlpha, June 1 – Getting deals done in emerging markets costs more than in developed markets, both in absolute terms – due to peculiarities and opacity of tough markets – and in relative terms, due to smaller average deal sizes. Real and perceived information asymmetries, which often stem from eroded social capital, also drive up transaction costs, as investors and capital seekers work to overcome distrust.

Donor-supported investment facilitation can help break emerging markets’ deal deadlock by easing the costs for a trusted, neutral intermediary to serve as an honest deal broker. The presence of intermediaries in deals reduces transaction costs by reducing information asymmetries and improving trust.

Successful investment facilitation has several key features, including credibility, trust and mission alignment of the intermediary with investors and donor partners; a team based in the market with the requisite skills and expertise to alleviate the bandwidth constraints of investors and entrepreneurs; and the full range of capabilities to support investors and entrepreneurs across the deal lifecycle.

As an example, CrossBoundary worked as the investment facilitation team to support the founder of an East African medical business through their capital raising process. The entrepreneur had previously been forced to buy another investor out of the business due to unfavorable terms, causing the company to incur substantial debt. As a result, the entrepreneur was mistrustful of investors and wary of bringing new ones into the business.

We supported the capital raise process by providing an in-depth valuation perspective, enabling the entrepreneur to evaluate whether the investors’ proposal was reasonable. Our team served as an honest broker, offering trusted advice to help the company determine which of the proposed deal terms were market-standard, and which could or should be negotiated to ensure a productive long-term partnership with their investors. Eventually, the transaction was brought to a successful close.

The difficult negotiations were helped by the presence of a neutral intermediary who understood the needs of both parties involved. Our role and work helped the entrepreneur overcome his initial distrust, come to the negotiating table with a strong grasp of the issues that mattered to his business and himself, and reach a deal in which he felt confident.

Critical elements

Investment facilitation is increasingly becoming part of the standard toolkit for economic development. Prior CrossBoundary research with the Center for Strategic and International Studies (CSIS) offers up lessons learned and new opportunities to enhance investment facilitation’s impact by spotlighting examples from CrossBoundary’s portfolio of work over the past seven years. Collectively, our facilitation efforts closed over $500 million across 45 deals in Mali, Nigeria, Rwanda, Ethiopia, Malawi, Mozambique, Iraq, Afghanistan and other markets, and ranged in size from $500,000 to tens of millions. The key takeaways:

Patience and persistence are necessary to close the deal. Investment facilitation mandates should be structured with time for the process to work and achieve results. We worked an average of nine months to reach financial close in our portfolio of deals. In many cases, it took two to three years to close a deal—some took as long as five years. But without an investment facilitator’s ongoing support, financial close can be delayed or never realized.

Local advisory players should be integrated into the process. It is only through the successful engagement of local intermediaries, as well as the permanent localization of regional and international players, that the successes of investment facilitation can be institutionalized.

Investment facilitation is best suited for regional deployment. Given the regional lens of most investors and companies, and the fact that some countries will have periodic macro slow-downs (for instance a contested election), investment facilitation is often most efficiently applied with a regional mandate and a hub-and-spoke team approach.

Transaction work should be in a feedback loop with necessary policy and regulatory reforms. Transactions are the point of greatest scrutiny for a country’s ability to work with the private sector. Having empirical data from which to suggest policy reforms is critical in markets with poor transparency. By providing tangible examples of where certain policies can prevent economic growth, transactions motivate governments to take action. Feeding this information into policy efforts allows for a virtuous cycle between accelerated policy reform and increased investment in the local economy.

Investment facilitation can serve the public good. As noted above, the effects of facilitating go beyond a specific investor and company helped and can benefit sectors and countries as a whole through the path-breaking nature of pioneer transactions and the demonstration effect of others seeing successful investments.

Challenging markets

An example from our work under the USAID-backed Mali Investment Facilitation Platform (MIFP) demonstrates this thesis. MIFP was instrumental to the decision of a Europe-based impact investor to start investing in Mali, despite many initially perceived difficulties. Working as transaction advisors under MIFP, we approached the investor to explore interest in extending their coverage to Mali, given their interest in other fragile African countries. We supported the investor in overcoming their information gaps on Mali and completing an analysis of opportunities in SMEs and the microfinance sector. Reassured by the Platform’s on-the-ground presence and hands-on approach to supporting projects and sharing information, the impact investor ultimately made credit investments in three MIFP-supported local SMEs.

After the end of our mandate under MIFP, Mali has remained a priority country for this European investor, with three additional investments completed to date, and several other opportunities under consideration.

Building on its track record and experience in the region, the impact investor will be launching in 2021 a regional SME-focused fund extending its coverage to Burkina Faso and Guinea. This demonstrated the inherent sustainability of the investment facilitation approach, because after the initial fixed costs of understanding the market and making pioneer commitments have been absorbed, the investor chose to extend and deepen their investment presence.

Smart metrics

The success of investment facilitation should be measured by the amount of investment unlocked and the development impact of the transactions, as well as the level of additionality of the facilitation provided. Donors sometimes address this by applying overly strict criteria for selecting transactions, which can be very restrictive and actually slow down development impact.

Donors can provide a more flexible approach to achieve their priorities and to adapt opportunistically to the interests of the private sector. Multipliers of private capital per donor facilitation dollar is a reasonable metric for performance targets (we typically suggest minimum leverage targets of 5-20x). But progress towards these multiplier targets could also incorporate development impact metrics that incentivize support to smaller, high impact, and pioneer transactions.

For example, a higher multiplier could be applied to transactions into women led companies or in neglected value chains so that these transactions are more attractive to the facilitator.

These nuanced metrics combined with a portfolio approach would allow flexibility to avoid mandating that every transaction must meet every criterion.

Predictable payments

Transactions in nascent markets are tough for advisors to support commercially because they are too small, risky, and time-consuming. Thus, payment for investment facilitation is not as straightforward as simply introducing larger donor-backed success fees.

What is needed is a combination of predictable deliverable-based payments and performance-based incentives. This will allow intermediaries to take on a portfolio of transactions of different levels of difficulty, providing the long-term support that will allow them to work on riskier and highly catalytic transactions, while still providing strong incentives to ensure that some transactions successfully close.

For example, we are working through the Haiti USAID INVEST program on transactions across the energy, agriculture, manufacturing, financial and consumer goods sectors. Because our mandate is not sector or geographically specific, we can take a portfolio approach to transaction support. Predictable payments allow us to work on deals that could not be supported by purely commercially motivated advisors. Some transactions are highly pioneering and early-stage, while others are more mature businesses in sectors that have not traditionally attracted much international investment, like agribusiness.

One such client is an agribusiness in Haiti that works closely with both buyers and smallholder farmers to boost production quality and volumes, efficiently aggregate products, and provide logistical solutions to ensure timely deliveries. The business serves farmers primarily within the peanut value chain, but expanded to new crops, including mango, lime, and moringa in 2016.

We recently facilitated a successful capital raise for the agribusiness to expand its business operations, increase production and export of a consumer product, and construct a moringa processing facility. For the raise, we helped the client to develop and refine its business assumptions, investment marketing materials, and financial model.

The level of advisory assistance provided over a long period of time to a small transaction in a difficult market would not have been possible without USAID support.

Public-benefit, cost-sharing and other features

Donor supported investment facilitation must protect confidential material, while seeking to share generalizable lessons and insights to benefit the market. For example, the investment facilitation firm may use both company data and aggregated public data to provide an estimate of market size and profit potential for a selected sub-sector. Subsequent to the transaction, the market sizing conclusions drawn from public data might be published, whereas company-specific analysis should remain confidential.

Also, sustainability can be encouraged by the phased introduction of cost-sharing with clients. This could include a structured approach to intermediary fees, gradually reducing their subsidization as the donor-supported efforts are shifted to support more difficult and catalytic transactions. Given time, this could build a functioning private market, support the growth of the investment ecosystem and prove the value of intermediaries to clients.

Finally, support for the creation of new investment and capital supply players would also be beneficial to the market. In some cases, institutions interested in investing in a given sector or country may choose not to do so because they lack a trusted channel with a local team to deploy that capital. Development finance institutions and donors should continue to support the creation of capital vehicles to unlock those investments.

Second, the potential returns in some sectors, such as rural mini-grids, may not yet reach a risk-return rate considered commercially viable on standalone basis. For such projects, blended finance can help to crowd in private investment.

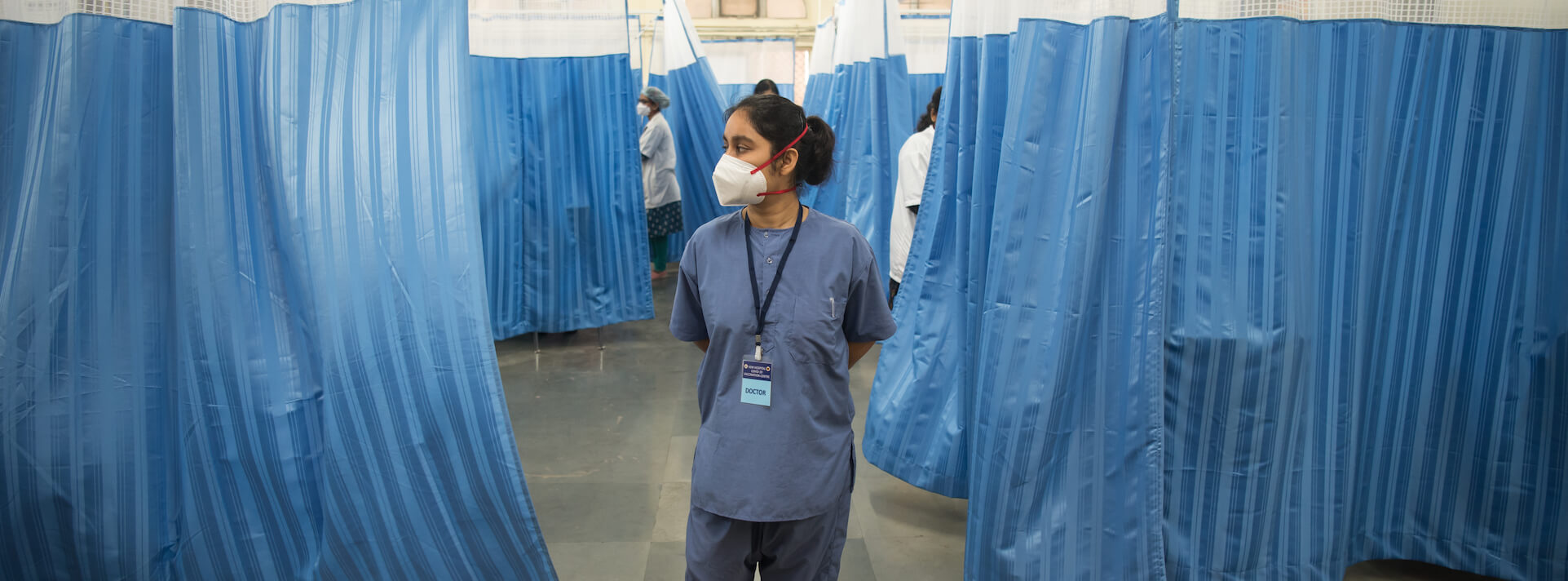

Our experience over the past year indicates that investment facilitation during the COVID-19 crisis created a lifeline between new funding vehicles and businesses who most need that capital. While impact investors and development finance institutions have created pools of capital to provide liquidity to businesses in frontier markets, the barriers to deploying it are higher than ever.

Through our existing investment facilitation mandates, we have provided much needed bandwidth and advisory support to businesses and investors so they can renegotiate their existing obligations, while raising additional capital to get them through the storm. At a time when these businesses and investors are the most bandwidth constrained, trusted advisors are critical. We believe we can continue to refine this model to drive even greater efficiency, development impact and sustainability, both in times of crisis and in times of relative stability.

Jake Cusack and Matt Tilleard are co-founders of the CrossBoundary Group, an investment firm that seeks to unlock private capital to drive sustainable growth in underserved markets. Tom Flahive a partner at CrossBoundary, responsible for the firm’s advisory services.