ImpactAlpha, September 7 – African countries top the list of the world’s most climate-vulnerable places, despite having contributed little to the greenhouse gas emissions that are causing global warming.

African leaders gathered in Nairobi this week to voice for their climate concerns. Their message: The world needs Africa’s help in the climate fight just as much as Africa needs the world.

“Yes, every village and every community is undergoing distress by drought and other mechanisms,” the president of Kenya, William Ruto, declared at this week’s Africa Climate Summit. “But we are looking at the opportunity.”

Kenya hosted the summit with the African Union to kick off a busy fall climate conference schedule that includes Climate Week NYC later this month and the UN’s COP28 global gathering in Dubai in December.

Africa has the capacity to produce nearly 40% of global renewable energy, and contains 30% of the world’s mineral reserves, many of which are critical to the energy transition.

“We have an opportunity to unlock the renewable assets available on our continent, whether they are minerals, whether they are energy, whether it is our young people, whether it is smart agriculture,” said Ruto. “We have an opportunity to turn the climate crisis into an opportunity for our continent.”

What’s needed to do that, of course, is money. Just $30 billion in annual climate finance flows to Africa. The continent needs at least $250 billion annually to meet its climate goals, much less support other countries with resources to meet theirs.

At the Summit and gatherings on the sidelines, 30,000 policymakers, NGOs, entrepreneurs, private sector and civil society representatives, and citizens convened to discuss critical climate finance gaps and solutions to fill them. Some of the takeaways:

Carbon tax and debt reform

The Nairobi Declaration, announced on the third day of the Summit, called for a global carbon tax to redirect financial flows from highly industrialized, high-polluting countries to lower-income countries needing access to climate capital.

The declaration also took aim at many African countries’ crippling debt burdens, which are preventing them from investing in their climate resilience. Leaders called for revision of the International Monetary Fund’s “special drawing rights” currency reserves to unlock more climate finance.

“We demand a fair playing ground for our countries to access the investment needed to unlock the potential and translate it into opportunities,” Ruto said in announcing the declaration.

Missing: Significant attention to climate adaptation strategies and how to fund them.

“This is concerning, because we know already that we are spending well over 30% of our government budgets on adaptation and resilience that we can not afford,” said Bogolo Joy Kenewendo, the UN Climate Change High-Level Champions’ special advisor for Africa.

Catalyzing local capital

Developed countries have failed to live up to a promise to direct $100 billion annually in climate finance to lower-income countries. The forum spotlighted opportunities to ramp up local capital in the climate fight.

Pension fund consortiums in Kenya and South Africa have mobilized more than a half-billion dollars for infrastructure investments on the continent, including a bond that was de-risked by a guarantee from GuarantCo to finance new road construction in Kenya.

GuarantCo also provided a partial credit guarantee for Kenya’s first green bond, which catalyzed private-sector financing for green, affordable student housing.

Off-grid solar company d.light is raising debt from African banks through a securitization vehicle that was de-risked by the US International Development Finance Corp. Peer company Sun King earlier this year raised debt in local currency through a similar structure.

Catalytic capital will continue to be essential to the energy and infrastructure transition in Africa and other emerging markets where too little commercial capital is available. Kenewendo said in particular there needs to be more innovative finance to scope and plan new projects. “There is very, very little funding for project orientation.”

Karin Isaksson of the Nordic Development Fund spotlighted portfolio examples, including a $10 million junior debt investment in the Africa Go Green Fund for renewable energy development and a $2 million grant to the Africa Circular Economy Facility.

Isaksson called out her development finance institution peers for being too risk averse and inflexible. “You cannot change the world without taking risks,” she said. “And someone has to also pay for this risk.”

All about renewables

Africa’s leaders are collectively aiming to increase renewable energy generation from 56 gigawatts today to 300 gigawatts by 2030.

Kenya launched the Accelerated Partnership for Renewables in Africa, in partnership with the International Renewable Energy Agency, Denmark, Germany, the UAE, Ethiopia, Namibia, Rwanda, Sierra Leone and Zimbabwe to mobilize finance and technical assistance to Africa’s renewables sector.

Virunga Power, which supports small-scale hydro projects in Africa, announced a $1.4 billion initiative to privatize Burundi’s power distribution and help the small, landlocked African country transition fully to renewable energy, while giving 70% of the country access to power by 2030.

USAID and the DFC announced $200 million in investments to Mirova SunFunder, Sun King, the Africa Renewable Energy Fund and South Africa’s Just Energy Partnership for renewable energy development and access.

Minigrid developer Husk Power is aiming to build 2,500 new systems and install 150 megawatt of commercial and industrial rooftop solar by 2028.

Accelerating e-mobility

High fuel prices in Kenya and other countries are increasing interest in e-mobility alternatives, like Rwanda-based electric motorcycle maker Ampersand. Ampersand has scored backing from impact investors including Factor[e] Ventures, Ecosystem Integrity Fund, ImpactAssets, and most recently, AlphaMundi. Kenya’s Roam Electric is also making electric motorcycles, as well as buses. BasiGo, also in Kenya, is making electric buses.

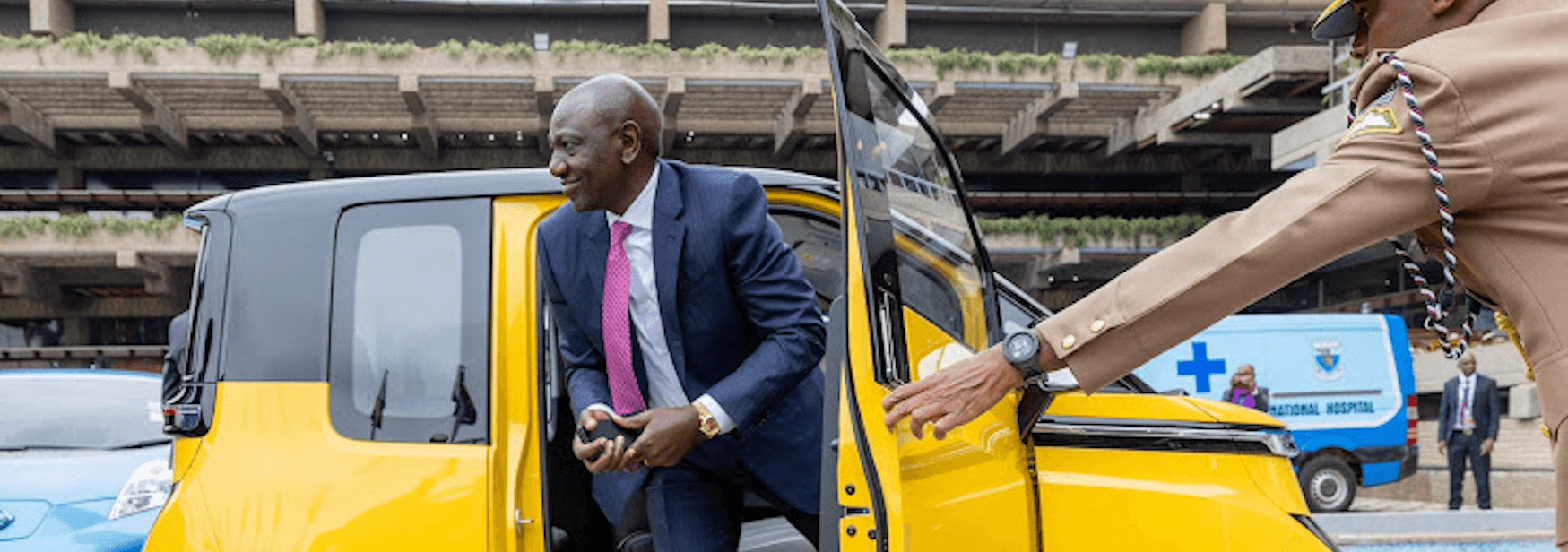

Ruto arrived on Monday in a bright yellow Air Yetu, a small electric four-wheeler made by local manufacturer Autopax with China’s SGMW.

Africa’s e-mobility market is at a very nascent stage. Ampersand is among the only companies to tout some measure of volume, putting about 1,200 of its motorcycles on East African roadways. Entrepreneurs are building the ecosystem as much as a business, offering everything from products, to financing, to battery swapping and vehicle charging.

“We’re working as fast as we can,” said the founder of a motorbike company that is still in stealth mode. “The Summit and the Kenyan President is giving visibility to the sector.”

The e-mobility transition in Africa is as much a livelihoods issue as a climate issue. Kenya’s full-time ride hailing drivers make about 3,000 to 4,000 shillings ($20 to $25) per day on a good day.

A few said they were optimistic about the demand the Climate Summit would bring in, only to be deterred by the extent of congestion in Nairobi’s already notoriously terrible traffic. Traffic jams consume too much fuel, one driver told ImpactAlpha. “The moment you make 3,000 shillings, you have to use it to refill your fuel.”

Southern solidarity

More than 30,000 people registered to attend the Summit. Colombian environment minister María Susana Muhamad González attended in solidarity with African countries, which are similarly struggling to finance climate change adaptation and green development because of the cost of international debt.

“It is a very unjust system,” Muhamad González said. “The more climate change hits our countries, the more our [credit] rates go down, and access to capital becomes more expensive.”

“The answer in some of these meetings is that private sector financing will help us fill that gap of finance. From Colombia we don’t believe that to be true. Private money will go where there’s profitability,” she continued. “And when you have whole populations who need adaptation, or when we need to attend humanitarian crises caused by climate change, this is not profitable.”

More needed to be done to “strengthen the public sector and the capacity of governments,” she said.

Muhamad González echoed the Nairobi Declaration’s call for “special drawing rights” reforms, and called for countries to be able to use the funds to respond to urgent climate-related issues as they used them to weather COVID. She called for a guarantee fund for vulnerable countries, to help countries improve their sovereign credit ratings, so they can then refinance their debt at lower interest rates.

Frontline solutions

Examples of new climate solutions—both for adaptation and mitigation—developed for local contexts were visible throughout the Summit and sideline events. Ghana’s Farmline’s is helping smallholder farmers build climate resilience with digital tools, logistics, field agents, farm resources and agribusiness partnerships.

SunCulture shared how its solar irrigation pumps have helped 42,000 farmers weather droughts and improve yields. The company is aiming to get its product to roughly 275,000 farmers, which can meaningfully impact Kenya’s food production and security problems.

Rwanda-based Earth Enable, which makes low-cost, eco-friendly flooring for homes with dirt floors, is looking to build a home mortgage market for whole homes made of similar materials.

With about $26 billion in commitments made at the Summit, Kenewendo said entrepreneurs and tech ecosystem enablers need to dial up the pressure to ensure funding is “getting to the innovations that will actually lead to changing people’s lives, [since they] have been told there is a climate Action summit that is going to lead to change and reduce their vulnerabilities to climate stress.”

Lyndsay Handler, co-founder of Nairobi-based venture studio Delta40, called on investors to dial up support for such frontline interventions on the continent. She recalled how crucial both capital and hands-on support was in building off-grid energy company Fenix International, which was acquired by French utility ENGIE.

“We hope that this week has inspired many investors to start investing and supporting entrepreneurs by taking risks, and growing and learning with them,” she said, “and then helping to find the real commercial growth capital needed to scale.”

Nairobi-based ImpactAlpha contributor Lucy Ngige contributed reporting.