If material factors are those that would affect the judgment of an informed investor, gender is decidedly material.

The decline in women’s employment, for example, is expected to reduce global production by $1 trillion in 2020 alone.

Since the onset of the pandemic, women have left the workforce in greater numbers than men and women have higher representation in low-wage sectors that have been hit the hardest. The increasing demand for unpaid care, which falls disproportionately on women, is slowing economic growth.

While the human and economic risks are well documented, less analysis has been done about how these patterns will impact investment outcomes. But one thing is clear: the scope and magnitude of the economic and social impacts of gender inequality and the ways in which they are being exacerbated by the pandemic will change how companies, sectors and markets perform.

Over the past eight months, the Criterion Institute and GenderSmart have been fielding questions from investors about how to meaningfully incorporate a gender lens into their COVID-19 recovery plans. As governments design their stimulus packages and investors and portfolio managers choose their next investments, they want to know what data they should be paying attention to in order to maximise impact and returns.

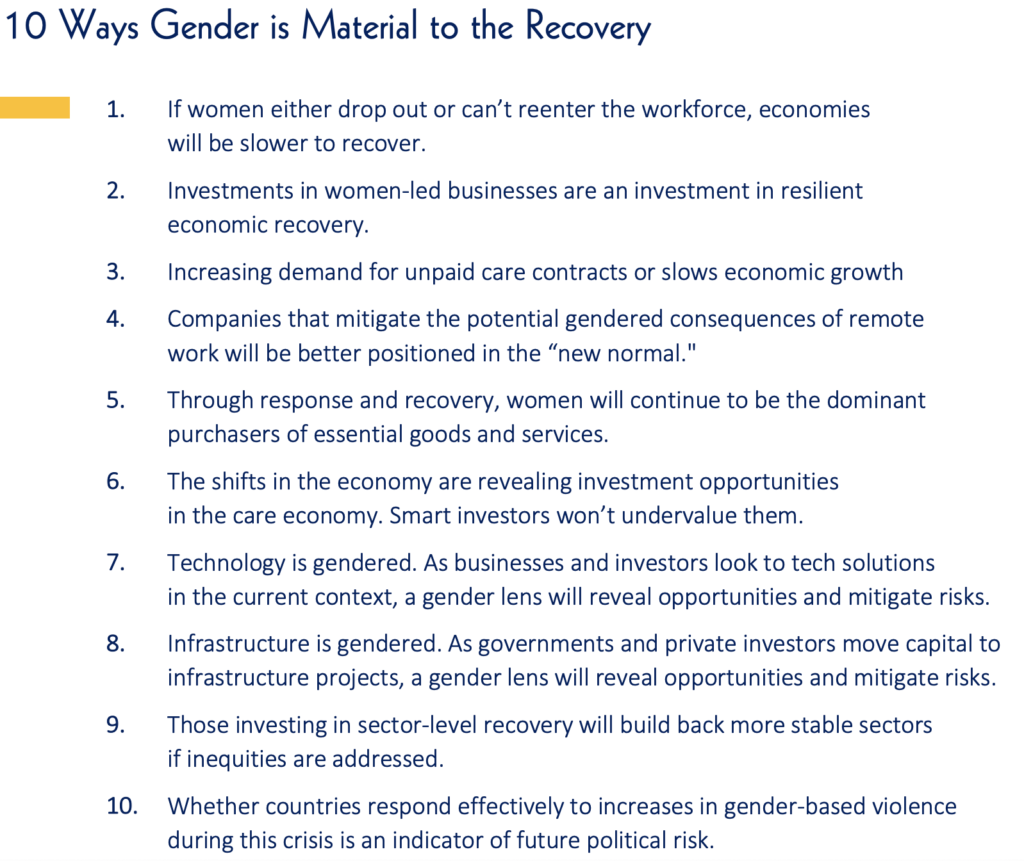

In response to these conversations, this week the Criterion Institute published a paper detailing 10 gender-related indicators that will be relevant, or material, to the recovery. If you’re deploying capital in the recovery, you should make sure your investment team is paying attention to these factors as part of their broader ESG efforts and investment decisions. If you are managing a portfolio, you should be incorporating them into your risk analysis and identification of market opportunities.

To use one example that has attracted a lot of attention in recent months, we know that the burden of unpaid care, which falls disproportionately on women and girls, presents a risk to sectors, countries, and markets. Women’s labor force participation is correlated with stronger economic growth. If women are leaving the workforce in significant numbers because of the need to care for children, parents or others, economic recovery and growth will be slower.

When examining risks and opportunities, smart investors will be looking at how current and potential portfolio companies are responding to the new burdens placed on staff in order to identify businesses that are more likely to grow or be stable during the recovery. Sectors that rely on hourly labor or that disproportionately hire women are particularly at risk. There are also overlooked opportunities in this area: the care economy is one of the fastest-growing sectors in the world and many businesses with consumer and government revenue streams are investable.

As working from home becomes “the new normal,” investing in companies that are working to mitigate the gendered impacts of remote work – including navigating care responsibility, exposure to online harassment, and increased risk of domestic violence – can be a way to mitigate risks and secure potential alpha. Similarly, as people become more dependent on technology to do their jobs and live their lives, investors who pay attention to the gendered differences in tech needs and impacts will likely have better investment outcomes.

Investors wanting to emerge well from the pandemic would also do well to pay attention to the gender balance of their portfolios. Research shows that women-led companies – as well as companies led by people of colour and other groups who experience structural inequities in business – tend to perform better with less investment. Because it is harder for them to access capital, they have had to identify ways to be successful without the resources available to more privileged groups and are often set up to optimise investment capital. For this reason, women-led businesses can make a particularly strong investment option during COVID-19, as well as an investment in resilient economic recovery.

On a country level, tracking changes in women’s labour force participation, as well as a country’s efforts to bridge the gap, can be a useful indicator of long term sustainable recovery prospects.

When investors fail to pay attention to these social patterns, they make mistakes. You don’t price risk appropriately, and you miss out on market opportunities. This isn’t only true for gender, of course – it’s true of race, disability, and sexuality, as well. But given the gendered impacts of COVID-19, gender is one essential lens through which to analyse your investments at this time.

The good news is that the data you need to make smart investment decisions exists. You may just need to look beyond your usual sources to find it – to advocacy groups, nonprofits, and public sector and economic think tanks, as well as the International Center for Research on Women, World Bank, UN Women, OECD, Equality Institute, Equileap, International Finance Corporation, and others.

We are already seeing asset owners like pension funds using the indicators in this paper to shape their investments and approach to the pandemic. We hope you’ll find it useful, too.

Joy Anderson is the president and founder of the Criterion Institute. Suzanne Biegel is the co-producer of the GenderSmart Investing Summit.