Greetings, Agents of Impact!

Welcome to ImpactAlpha’s weekly “follow the talent” roundup of impact investing career moves, job openings, events and opportunities. Help the growing ImpactAlpha community follow your talent: Send job moves, mandates, event announcements and other news to [email protected].

– Dennis Price, editorial director

Agent of Impact

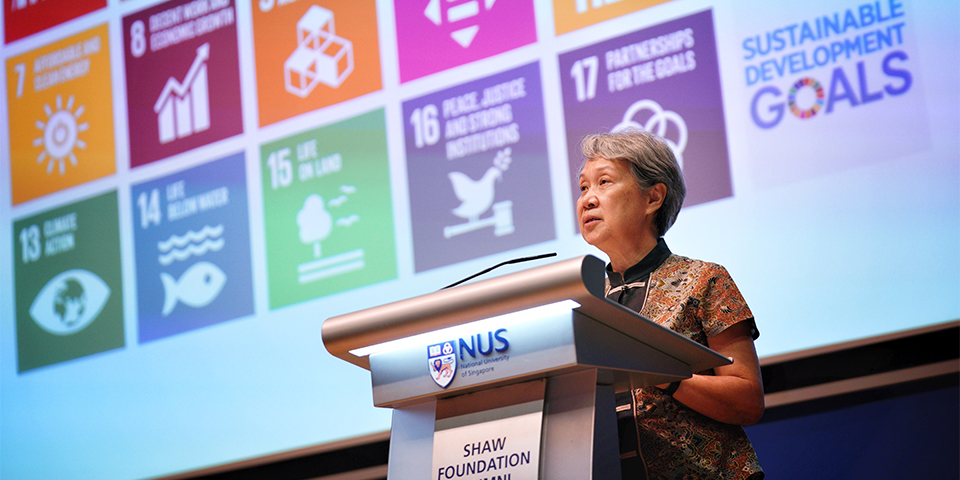

Ho Ching of Temasek Holdings. This week’s Ecosperity conference in Singapore could seem like another gathering of environmental activists, with dire warnings of global warming and ecological destruction. Instead, it’s the annual event of Temasek, one of the world’s largest sovereign wealth funds with $226 billion in assets. Singapore’s fund is showing up in an increasing number of impact deals, including Zipline, Impossible Foods and Calysta. Now Temasek is standing up its own impact private-equity fund to invest in an “ABC World” – Active Economies built around good jobs and sustainable cities; Beautiful Societies that are just, inclusive and resilient; and a Clean Earth.

The impetus comes from the top. Temasek CEO Ho Ching, who has led the fund for a decade, urges business leaders to consider the three P’s. Businesses can only thrive if they meet the needs of their customers as their Primary mission, says Ho, who is married to Prime Minister Lee Hsien Loong. Businesses must also invest in their People, she says, and give them knowledge to transition into a fast-changing future. And Ho urges leaders to protect the Planet, and combat climate change and its impacts. Ho’s independence from Singapore’s political establishment has been questioned and a succession plan is underway. Still, the urgency of her agenda remains. “The purpose of our capital – whether economic, human or knowledge capital,” she says, “must be to ensure life can survive on Earth.” Follow ImpactAlpha on Instagram.

Seize the Opportunity

The UK’s Impact investing Institute is recruiting a chief executive officer… Facebook is hiring a measurement and evaluation program manager for its global impact partnerships in San Francisco… Also in San Francisco, REDF is looking for an associate director of impact lending… New Forests seeks an associate director of investments in Sydney and an associate director of investor relations in, you guessed it, San Francisco… Soros Economic Development Fund is hiring an investment principal to lead its gender lens portfolio… Open Society Foundations is hiring a deputy director of impact investing in London… Upstart Co-Lab is looking for a senior associate… Online “ethical” bank Aspiration is hiring an impact product manager in Los Angeles.

Follow the Talent

Graham MacMillan, ex- of Ford Foundation, joins Visa Foundation as president… Coworking network Launch Pad opens a location in Stockton, Calif. (see, “A launch pad for businesses that can make Opportunity Zones thrive”).

Where to Be

New England Impact Investing Initiative is hosting “Donor Advised Funds + Impact Investing,” Tuesday, June 25… Moral Monday Movement’s Rev. William Barber II and Kat Taylor of Beneficial Bank will be featured guests at Confluence Philanthropy’s Annual Advisors Forum and Climate Solutions Summit June 24-26 in San Francisco (see “A minister’s call for moral, as well as economic, revival”).

Impact Watch

Big Society Capital made £90 million ($114 million) in commitments last year, according to its latest report. Since 2012, Big Society has helped finance 1,141 social enterprises and charities across the UK; three-quarters are located in underserved communities.

Apply, Respond, Submit

Businesses located in Opportunity Zones are encouraged to apply for the U.S. Small Business Administration’s Growth Accelerator Fund Competition which recognizes innovative accelerators, including incubators, co-working startup communities or other similar models.

That’s a wrap! Help the growing ImpactAlpha community follow your talent: Send your own job moves, new opportunities and event announcements to [email protected].