ImpactAlpha, Dec. 15 – At the recently concluded COP28, nearly 200 nations agreed to triple global renewable energy by the end of the decade. To get there, we’ll need battery storage to balance out the intermittent energy flows.

“The next step is thinking about how we actually get these electrons delivered at the doorstep where they’re needed,” says Daan Walter of research firm RMI. “Batteries are a huge part of that story.”

Whether for energy storage or to power electric vehicles, battery tech is on a tear. Entrepreneurs are pursuing new materials and chemical processes that don’t rely on rare materials. They are helped along by policymakers in the US and Europe bent on creating domestic supply chains via generous tax incentives and subsidies. More than a dozen “gigafactories” with over 400 gigawatt hours per year of collective capacity have been announced since the IRA was passed in August 2022.

Battery deals, galore

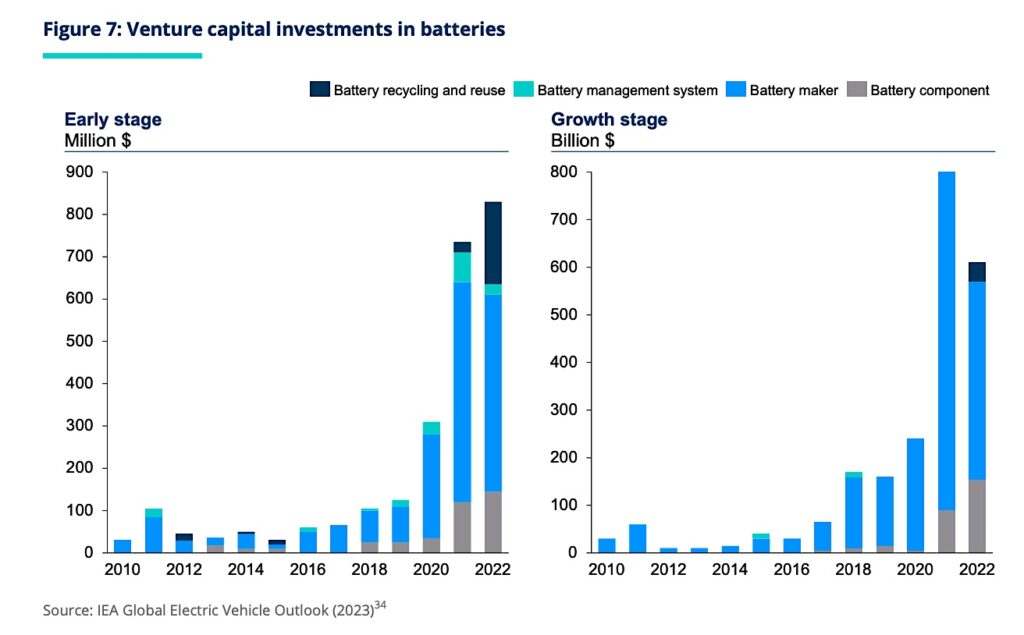

Investors are keying in. If it seems like there is a new battery deal every day, well, that is almost the case.

Just this week, Boston-based AM Batteries raised $30 million in Series B funding from the venture arms of Toyota and Porsche, among others, for its dry electrodes for lithium-ion EV batteries. Ion Storage Systems, a Beltsville, Maryland maker of solid-state lithium metal batteries, scored $15 million.

Recyclers are cropping up to feed the domestic supply chain and reduce reliance on Chinese inputs. Nth Cycle, a battery metals recycling and processing company, and Princeton NuEnergy, a Bordentown, New Jersey lithium-ion recycler, snagged $37 million and $16 million, respectively, this week.

For energy storage, Italy’s Energy Dome pulled in $65 million in project finance for its first-of-a kind CO2-based battery system. The financing included a grant commitment of up to $38 million from Breakthrough Energy Catalyst and $27 million in venture debt from the European Investment Bank.

Also this week, Fourth Power, a developer of novel utility-scale thermal battery solutions, raised $19 million from DCVC, alongside Breakthrough Energy Ventures and the Black Venture Capital Consortium.

“We need utility-scale energy storage that can grow with the grid to make this a reality on a global scale,” Fourth Power’s Arvin Ganesan told ImpactAlpha. “The question is, how can you store power generated from renewables to create a grid that is not only more reliable and more clean, but comes at equal or lower cost than what we pay now?”

Fourth Power forgoes rare materials for graphite, which stores renewable energy as heat, and tin, which acts as a conductor. Ganesan says the method is 10 times cheaper than the cost of existing battery technology. “We are not reliant on difficult supply chains,” he says. The batteries are also able to store energy for up to 100 hours. That, he adds, is appealing to cost-conscious utilities as they add more renewable energy to the mix.

Ramp up

Boston-based startup Fourth Power is the rare battery tech startup run by a diverse team. The technology was developed over the past decade by Asegun Henry, Ph.D. and professor at Georgia Tech and now the Massachusetts Institute of Technology. Ganesan, who formerly headed Apple’s global energy and environmental policy, joined as CEO earlier this year.

The company will use the $19 million to build a one-megawatt demonstration plant outside of Boston. “We’re focused on building a world class demonstration, and showing the receipts,” said Ganesan.

It’s all part of what RMI’s Walter calls “the fastest supply chain ramp up since World War II.” While negotiators at COP28 watered down language that would have called for a “phase out” of fossil fuels, RMI, in a new report, says batteries and renewables may do the trick. The battery ramp-up is “set to enable the phaseout of half of global fossil fuel demand,” Walter and his co-researchers conclude.

Roodgally Senatus contributed reporting.