Greetings! Here’s the latest impact investing deal news.

TPG Growth’s Evercare adds Bangladesh hospital group to its network. TPG Growth is acquiring a controlling stake in hospital operator STS via its Evercare Health Fund, the $1 billion fund originally known as Abraaj Growth Markets Health Fund that is anchored by the Gates Foundation (see “What impact multiple of money will TPG Growth generate with global health fund?”). STS, part of India-based Apollo Hospitals, runs a 425-bed hospital in Dhaka and is building a 400-bed facility in Chittagong that primarily cater to low- and middle-income patients. TPG Growth’s Rise Fund and CDC Group, the U.K. development finance institution, also backed the deal.

- Network effects. The acquisition is Evercare’s first in Bangladesh and represents a geographic expansion of the fund’s network for quality, standardized healthcare in global growth markets. Evercare’s portfolio includes more than 90 hospitals, clinics and diagnostic centers in Africa and South Asia. Its network of facilities have treated more than two million patients.

- Check it out.

CDC Group backs Africa’s banks to ratchet up small business finance. Quasi-public development finance institutions are often criticized for being overly risk averse. CDC Group, the U.K. development finance institution, has promised to take a more catalytic approach (see, “How CDC Group is innovating with catalytic capital”). The latest demonstration of its Catalytic Strategies: $275 million in commitments to African banks to encourage the banks to extend more financing to the continent’s small businesses, “the bedrock of any healthy economy,” according to CDC.

- Capital hurdles. For most small businesses, traditional bank financing may be more suitable than venture capital, which is usually reserved for high-growth enterprises. Emerging markets small businesses are often unable to attain bank financing because of banks’ perception of risk or intensive due diligence requirements. CDC is providing $100 million each to South African bank ABSA and Egyptian bank CIB, and $75 million to Pan-African bank TDB. Last year, CDC committed $100 million to a small business lending facility with Standard Chartered Bank Zimbabwe.

- Fund support. CDC also committed more than $100 million to five private equity and venture funds also supporting Africa’s small and growing businesses.

- Read on.

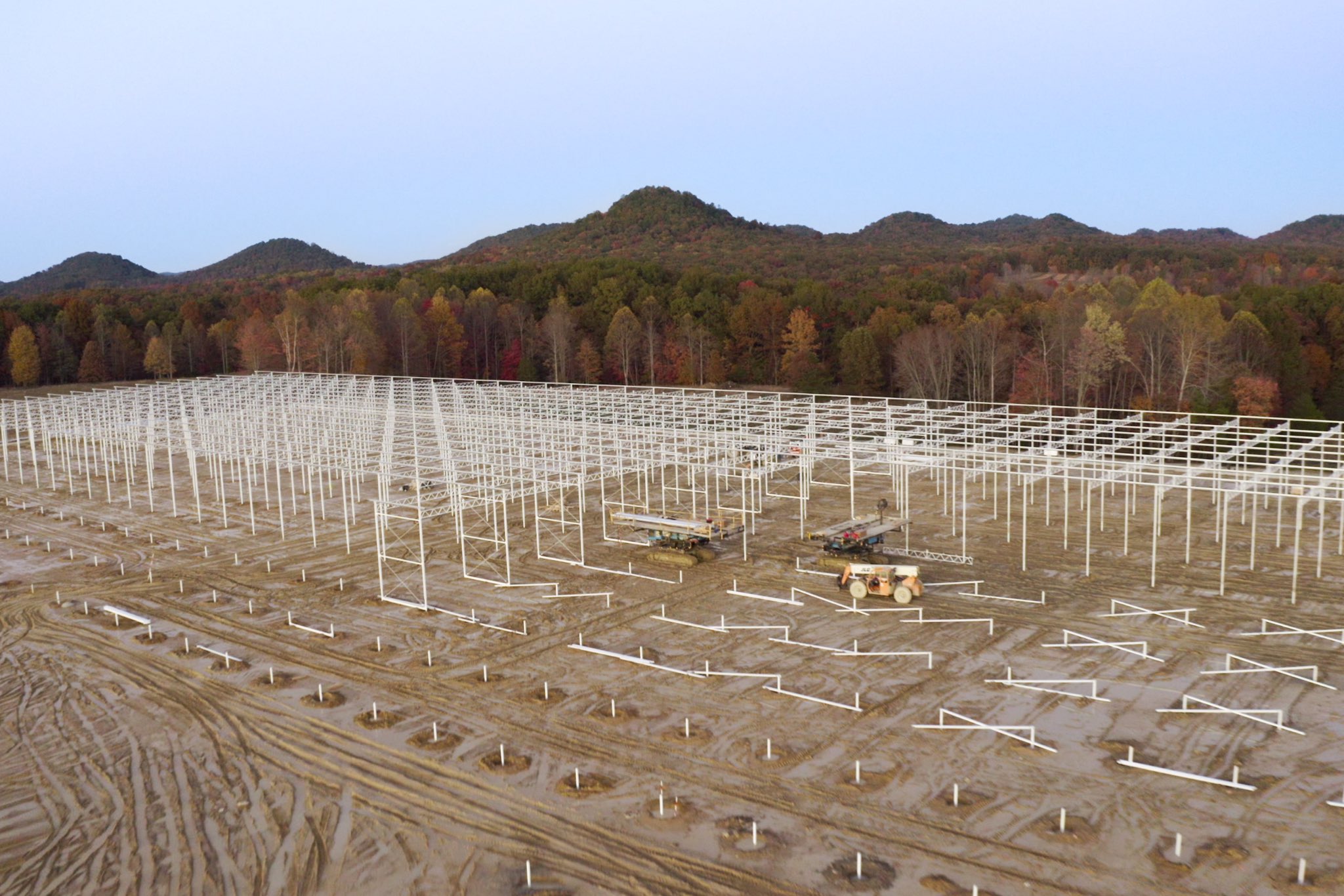

AppHarvest closes $11 million for high-tech greenhouse venture. The Kentucky-based company raised financing from Blake Griffin Enterprises and prior investors Equilibrium Capital, ValueAct Capital and Revolution’s Rise of the Rest fund. AppHarvest is building a 2.8-million-square-foot farm in Morehead, Ky., backed by $100 million from Equilibrium.

Arctaris leads $25 million initiative to back Baltimore’s business owners. The program, Arctaris Baltimore, will make loans of $1 million to $5 million to businesses in underserved areas. Boston-based Arctaris is partnering with the Abell Foundation and Baltimore city’s Neighborhood Impact Investment Fund.

New York State earmarks $6 million for clean energy co-investments. The funding is a sliver of Gov. Andrew Cuomo’s plan to make the state carbon-neutral by 2040. The state will invest through its Energy Research and Development Authority (NYSERDA), which has vetted and approved 18 potential co-investment partners.

–Feb. 4, 2020