Featured

Science Based Targets Initiative meets realpolitik on the path to Net Zero

An apparent reversal by one of the main arbiters of corporate climate action plans has roiled climate activists and advocates and highlighted tensions …

Podcasts

Conversations with Agents of Impact

The Call

Exclusive video calls with industry insiders

The Call: Moving from the ‘why’ to the ‘how’ of impact incentives

ImpactAlpha, January 19 – Impact investors have for years debated the need for embedded structures to incentivize impact outcomes for impact fund managers. …

Metrics Madness: Wealth, ownership and ‘quality adjusted life years’ (video)

ImpactAlpha, Mar. 31 – The search for a universal metric to guide investments in racial justice and equitable wealth-building was…aspirational. “We are still a …

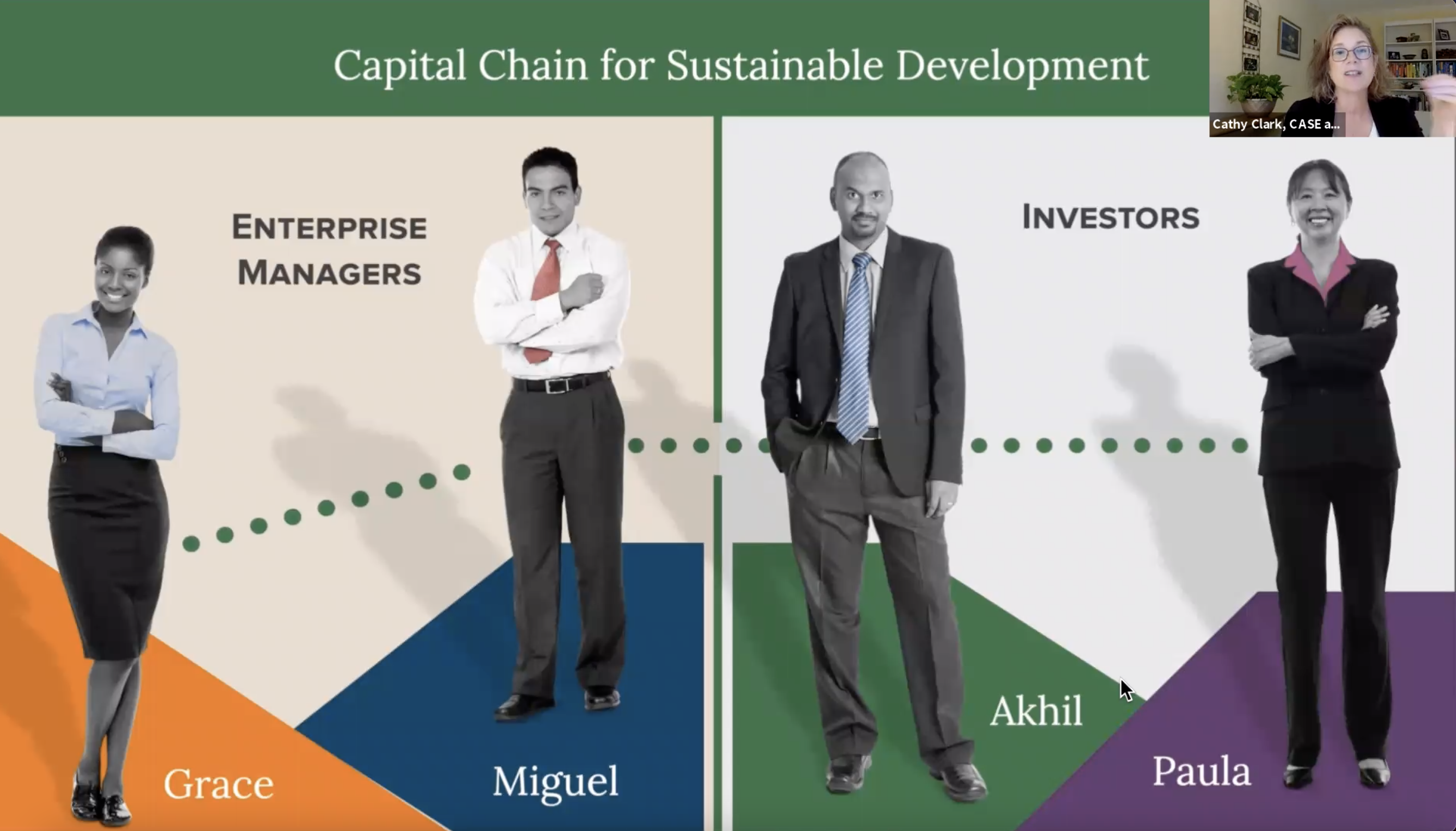

Call No. 31: Making sense of the ABCs of measurement to optimize for impact

ImpactAlpha, Oct. 1 – Metrics. Standards. Dimensions. Frameworks. SDGs. Cathy Clark of the Center for the Advancement of Social Entrepreneurship at Duke University’s Fuqua …

Impact management is hot: Recapping Call No. 15

ImpactAlpha, Apr. 30 – The first annual assessments of impact investors are coming in under the International Finance Corporation’s Operating Principles for Impact …

Underwriting – and optimizing – for impact on Call No. 7

ImpactAlpha, February 12 – Limited partners are demanding more rigorous impact underwriting by fund managers. Successful projects also require ongoing impact management. On …

Impact Voices

Provocative opinions and insightful analysis from the community

Six impact performance reports that go beyond the basics to give investors needed insights

Impact Frontier’s Impact Reporting Norms target a leverage point in the impact investing system: impact reporting. They promise to provide greater clarity and …

Elevating impact reporting to raise the performance of impact fund managers

“One million lives touched.” “800 jobs created.” “50,000 acres of land restored.” Capital allocators often see these types of punchy headlines in the …

Seven red flags institutional investors should avoid when evaluating impact fund managers

As more investment firms launch impact funds, it has become increasingly difficult for institutional allocators to identify the most qualified fund managers to …

A case study in private equity’s role in realizing impact

Essential insights: The core of the debate Recent discussions have raised critical questions about the role of private equity in fostering resilient, inclusive …

How three investors are measuring their impact on climate resilience

2023 closed with a flurry of new climate finance commitments announced at COP28. These commitments–notably including $30 billion from the UAE and $12.8 …

Agents of Impact

Bold leaders. Taking action. Driving impact.