ImpactAlpha, February 12 – Limited partners are demanding more rigorous impact underwriting by fund managers. Successful projects also require ongoing impact management.

On ImpactAlpha’s Agents of Impact Call No. 7, Y Analytics’ Maryanne Hancock said impact measurement tools developed by TPG Growth’s Rise Fund will help the firm drive impact throughout the life of the fund’s investments. TPG Growth spun out Y Analytics as an independent research and consulting business last month.

Can we put a dollar value on impact? Reactions to the Rise Fund’s ‘impact multiple of money’

The Rise Fund’s “impact multiple of money” methodology “allows you to see up front the pathways that you have to manage to ensure you’ll have impact down the road,” Hancock told nearly 200 ImpactAlpha subscribers on the conference call last week.

The entrance into impact investing of major private-equity players like TPG has made impact measurement a hot topic, as skeptics fear a new wave of so-called “impact washing.” The Rise Fund has committed most of its $2 billion first fund and is raising a second fund targeted at $3.5 billion.

What impact means

Limited partners are demanding more rigorous management of impact from fund managers because “they now have a better idea of what that means,” said Tideline’s Ben Thornley. “The reality is a phenomenal amount of progress has been made in recent years.”

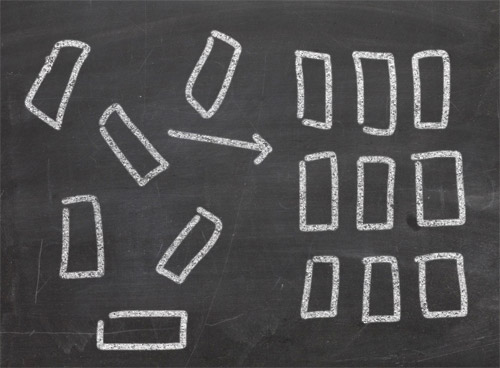

One shift is in emphasis, from impact measurement to impact management. “Management is an ongoing process. You measure the positive and negative impacts that matter to people and the planet. You compare those impacts when possible and appropriate. You know whether what’s happening is bad, good, or as good as it could be. And then you improve,” says Clara Barby, who as head of the Impact Management Project has brought together thousands of investors to forge a consensus on the underlying components of impact management.

“The ramification is now we’re not only measuring and comparing actual performance better but using that to set more systematic, thorough goals to improve,” she said.

Investors are asking for rigor and transparency, says Bridgespan’s Stephanie Kater. Kater has helped Rise Fund analyze more than 100 deals using the impact multiple of money. It’s not that investors are looking for an exact estimate of impact, she says. “But they are looking for a rigorous understanding of what that impact will be and something they can hold the managers accountable to.”

Evidence base

Another sign of progress is an increased focus on evidence, not simply data and metrics, said Wharton Social Impact’s Michael Brown. Last month Brown penned a piece in Stanford Social Innovation Review last month suggesting that evidence-based research could be used, not only to calculate impact, but to cultivate it throughout the investment. “Data is just information. It doesn’t demonstrate anything,” he said. “Evidence has been collected, processed and sheds light on a hypothesis. When that is actionable, it’s a logical starting point.”

Deeper, focused customer impact assessments can also deliver business value

Kelly McCarthy from the Global Impact Investing Network agreed. Comparable, transparent, consistent data is important, says McCarthy. McCarthy has helped test investment strategies and select metrics for various investment themes through the GIIN’s Navigating Impact project. But “to actually vet those metrics against something that holds water, requires some sort of evidence base that has been collated and curated and can help prove or disprove that strategies that the investment community are looking at.”

All the talk of impact measurement and management can leave entrepreneurs’ heads spinning, said Liza Mueller of Echoing Green, which supports thousands of early stage social ventures. Entrepreneurs “need more patient capital and time to think through and collect that early info,” she says.

Participants in the call turned up some excellent resources for underwriting and optimizing impact. We rounded them up:

Participants in the news.

- Maryanne Hancock of Y Analytics. ImpactAlpha’s coverage of the Y Analytics launch.

- Wharton Social Impact’s Michael Brown. Brown authored, “Cultivating, Not Just Calculating, Social Impact,” in Stanford Social Innovation Review.

- Impact Management Project’s Clara Barby. An ImpactAlpha Q&A.

- Tideline’s Ben Thornley. Thornley co-authored, “Best Practices in Impact Management Begin to Take Hold” in Stanford Social Innovation Review.

Evidence portals. Wharton Social Impact’s Michael Brown mentioned various databases of systematic reviews and evidence synthesis for evidence-based practice.

Cost-benefits databases. Policies that can lead to better outcomes coupled with a more efficient use of dollars.

- Benefit-cost results from the Washington State Institute for Public Policy.

- Cost-effectiveness analysis registry from Center for Evaluation of Value and Risk in Health.

Navigating Impact. A project from the Global Impact Investing Network to help investors select impact strategies and adopt metrics that indicate performance toward their goals. Sectors include affordable housing, clean energy access, smallholder agriculture, financial inclusion, health and gender lens. Quit guessing.

IRIS. The GlIN’s catalogue of generally-accepted performance metrics. The set.

Impact performance study. Current study underway at the GIIN to explore the feasibility and gaps in benchmarking impact performance using real data and participants. The background.

The state of impact measurement and management practice. The GIIN collected up data from 169 impact investing organizations to provide insights into why impact investors measure and manage their social and environmental impact, how they do so, and challenges that remain. The report.

Impact classes. The Impact Management Project has developed a set of impact classes that group investments based on their impact characteristics. In short, an impact class combines the impact of an investment’s underlying asset(s) with the contribution the investor makes to this impact. The different kinds of impact.

Impact carry. Media Development Investment Fund is pegging its carried-interest compensation to the fund’s impact performance. Here’s the scoop.

- Other case studies. Transform Finance produced a brief on fund managers that have adopted the practice. The brief.

- A carrot-based approach to boosting impact. Bamboo Capital’s Arun Asok wrote a guest post for ImpactAlpha on how using an incentive to deliver social-return could used to generate further return. How it would work.

Calculating impact potential. Few tools exist to enable investors to assess the long-term impact of today’s businesses technologies. Here are few:

- Emissions reduction potential. Early state climate investors PRIME Coalition developed the metric to estimate a company’s climate impact as it scales its technology and services in the future. The calculation.

- Impact multiple of money. The Rise Fund’s impact multiple of money methodology relies on academic research to estimate the economic value of social impact associated with a set of business outputs. How it works.

Driving value through stakeholder. “Measure Better,” an ImpactAlpha series in partnership with Acumen, features investment practitioners and thought leaders who are putting customers at the center of their impact strategies. The series.

Applying the Impact Management Project norms. Swiss investment manager Partners Group has applied the IMP norms to develop an impact management strategy for PG LIFE, its $1 billion impact strategy. The case study.

Survey: True cost of impact data collection. Aneri Pradhan of ENVision Mobile is preparing a white paper on the true cost of data collection facing social enterprises that work with micro-entrepreneurs and small businesses in developing countries. Take her five-minute survey.