ImpactAlpha, November 27 – The twist in the A$600,000 loan (US$407,000) from Impact Investment Group: the more social impact employment startup Xceptional delivers, the less it has to repay. The Sydney-based investment firm selected Xceptional as the first borrower under a structure it calls Beneficial Outcomes Linked Debt, or BOLD.

Xceptional, a “neurodiverse” jobs placement firm, works with candidates with autism to identify companies and roles suited to their skills, which include pattern recognition, sustained concentration and precision. (Watch this space: U.S.-based Ultranauts raised $3.5 million to prove neurodiversity can be a competitive advantage in business.)

“Other types of finance, like traditional venture funding, or a loan from a standard finance company, can drag a purpose-driven founder away from their mission,” notes IIG in its product brief.

How it works

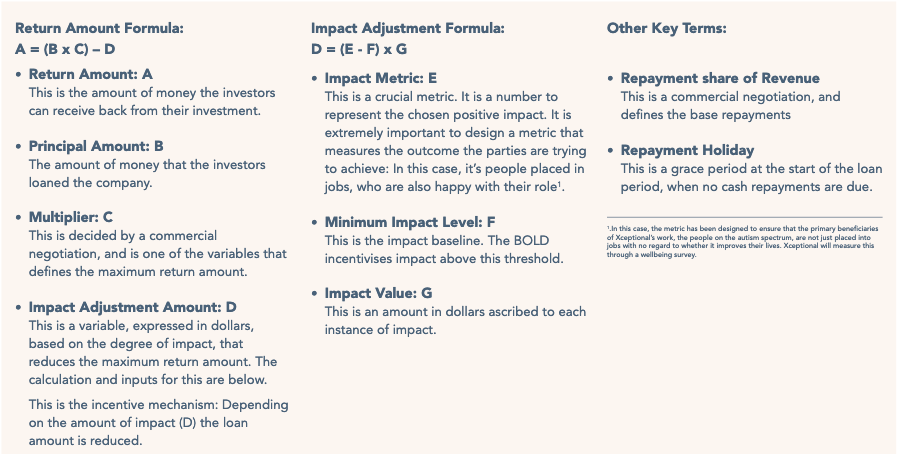

BOLD starts with choosing a target impact metric. Xceptional is measuring the number of people placed in jobs, and who report being happy with their roles. That metric is assigned a baseline and a dollar value. As Xceptional grows, the tally of impact above the baseline gets deducted from the loan’s principal.

Xceptional also gets a grace period before it has to start repaying the loan, and it’s allowed to make revenue-based repayments to minimize financial pressure (see, “As unicorns stumble, investors warm to revenue-based financing for ‘zebras’ and ‘Clydesdales’”).

Xceptional’s five backers in the deal include IIG’s foundation, IIG Catalyst Fund, Tripple, Community Impact Fund, Disability Impact Fund and Snow Foundation.

Impact incentives

U.S.-based Beneficial Returns has backed at least seven social enterprises with loans whose final payment is waived if an impact target is achieved. UBS Optimus Foundation’s “Social Success Note” is a similar concept. Germany’s Roots of Impact is testing impact “bonus” payments with its “SIINC” model (see, “Impact-linked financial rewards help high-impact companies attract growth capital”).