“We need economies and enterprises that are distributive by design, sharing value, power, and opportunity far more equitably with all involved—throughout their supply chains—in creating that value.” – Kate Raworth, “Doughnut Economics“

The conventional enterprise ownership model–and the investments that are designed for it–are creating an economy that works only for the few. An extensive body of work is building new possibilities: Alternative Ownership Enterprises.

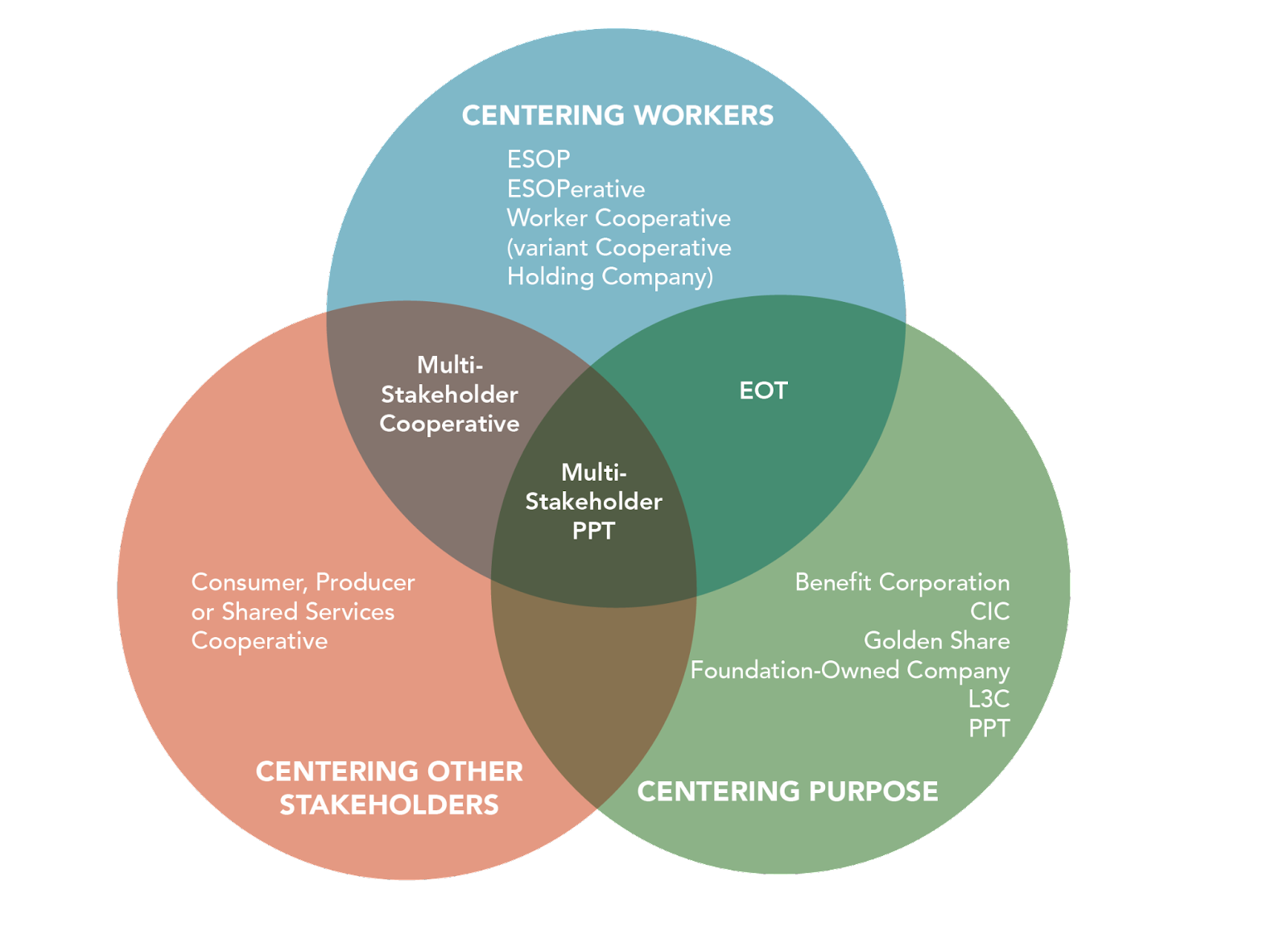

Alternative Ownership Enterprises, or AOEs, are firms that significantly shift economic value and decision-making power toward non-investor stakeholders, such as workers. Many AOEs go beyond that to include producers, consumers, community members, or even a non-financial purpose.

While the concept might feel foreign, many well-known companies are structured as AOEs. The retailer Publix is employee-owned (via an ESOP). The food distributor Organic Valley is a cooperative co-owned by farmers. The clothing company Patagonia is governed by a trust to guarantee it stays true to its purpose. And OpenAI, the maker of ChatGPT, is controlled by a non-profit tasked with ensuring the technology benefits humanity.

AOEs are at an exciting juncture in their development. The seeds planted over decades are now maturing, and momentum is building. First, there is a massive need to identify succession plans for the millions of businesses owned by baby boomers reaching retirement age, a phenomenon which has been dubbed the “silver tsunami”. This is a once-in-a-generation opportunity to support business conversions to employee ownership or other forms of Alternative Ownership.

Second, AOEs have captured interest from a surprising range of players, from billionaires Yvon Chouinard and Michael Bloomberg to private equity giant KKR, which has backed the new Ownership Works initiative, creating new norms for private equity firms to share some equity with all employees at the companies they acquire.

Finally, support for Alternative Ownership Enterprises, particularly employee ownership, is seeing momentum in the political sphere. There is bipartisan support for the Employee Equity Investment Act, which would provide loan guarantees for funds that convert businesses to employee ownership (via ESOPs or worker cooperatives).

Alt-ownership models

In response to this growing interest, Transform Finance has compiled information for investors to help them deploy capital to AOEs in effective ways. Our research – which focused on the United States and Europe – identified 10 core AOE models and several variants, each with its strengths and limitations.

While the goal and structure of each model can vary tremendously, a helpful way to categorize each AOE model is by looking at the beneficiaries they center.

Purpose. The beneficiary is a cause or other non-financial mission.

Workers. People employed at the enterprise. These models are often categorized as Employee Ownership models.

Other stakeholders. Suppliers, customers, community members, or other people and organizations who don’t directly work at the enterprise, but do have a direct relationship with the enterprise or are directly impacted by its decisions.

This variety of models means that every founder, retiring business owner, investor and stakeholder can find the option that best suits their needs. Below is a summary of what each model is generally best suited for. Our recent report also offers additional context and a more in-depth evaluation of each model.

Models centering purpose

Benefit Corporations are a distinct form of incorporation that allows directors and managers to pursue a public benefit in addition to shareholder value (example: Lemonade, Dr. Bronner’s). They are an easy step for traditional corporations to take, as it is the most similar to conventional corporate structures.

Benefit, or “public benefit” corporations are helping to reframe the narrative about the role and power outside investors should have in corporations. That said, they fall short in terms of providing employees or other stakeholders with wealth or power to influence their working conditions.

In Perpetual Purpose Trusts (PPTs), a trust owns a majority of the voting shares in a company to benefit a specified mission. Governance of corporate activities is entirely flexible, but stewards of the trust ensure that all corporate activity is pursuing the stated purpose in perpetuity (Patagonia, Zingerman’s).

The flexibility of PPTs is their greatest strength: they can be used to protect any mission a typical social enterprise would have and mandate profit sharing to one or more stakeholders. Multi-stakeholder PPTs can implement complex governance structures across stakeholders, each with specifically designed rights. The form is very nascent in the United States, which can make transactions complex and resource intensive, but that is likely to shift as the field grows.

While few foundation-owned companies exist in the US, they are legal structures that allow all profits to go to charity because the business is owned, partly or entirely, by a foundation (Newman’s Own, Novo Nordisk).

Such companies are governed by the charitable entity, meaning that the entire business is by and for its purpose, rather than for its investors (or any other stakeholder, for that matter). Foundation ownership can be a great way for founders to cement their legacy, but it requires them to forgo any financial benefit from selling their ownership stakes.

Golden Share models can be a more lightweight way to enshrine an enterprise’s purpose and keep control of the company in the hands of founders and key “stewards,” by providing them a special share that confers veto power over decisions that would jeopardize the company’s mission, such as a sale (Tony’s Chocolonely, Sharetribe).

The model does not necessarily change how the company operates on a day-to-day basis. Golden Shares can achieve similar mission protection as a PPT but are much cheaper to establish, making them potentially attractive for start-up enterprises (although at this time, there are still only a handful of Golden Share companies in the US).

Low-Profit Limited Liability Companies (L3C) is a US state-level corporate form established in the late 2000s in order to meet IRS stipulations for program-related investments, or PRIs, by foundations. They are legally mandated to prioritize charitable mission and social impact over profits (example: Verde). They were initially promising as a tool to harness foundation program-related investments, but they haven’t achieved much traction in the US.

Community Interest Corporations, the UK counterpart of the L3C, continues to show great promise as a model that ensures that an enterprise pursues its mission in perpetuity by mandating a stated community purpose, enshrining protection against a sale, and limiting the financial returns to owners and lenders (City to Sea, Mydex).

Models centering workers

Employee Stock Ownership Plans (ESOPs) are a benefit account trust structure that holds all or part of a company’s stock on behalf of employees (Publix, Amsted, King Arthur Baking Company). Shares are vested to a broad base of employees individually, at no cost, over time, and employees are cashed out upon leaving the firm.

ESOPs are very well suited for building wealth for employees due to their provision of real, appreciating assets. Additionally, the favorable tax treatment makes financing ESOPs possible at scales that compete with private equity firms. Because ESOPs are usually created out of mature, cash-positive businesses, they typically generate meaningful amounts of wealth for their employees.

The model is not without its downsides, though. The working capital requirements to pay out employees as they retire or leave the company can add challenges to a company’s cash flow. Additionally, the lack of asset lock and potential responsibility for the ESOP trustee to consider sale offers means that ESOPs are not always durable structures.

ESOPs are also not democratically managed, unless structured as an ESOPerative (Once Again Nut Butter, Carris Reels), and therefore the gains for workers are constrained to the economic realm.

Worker Cooperatives are a type of cooperative enterprise where the membership consists of the workers of the company who own and govern the enterprise on a one worker, one vote principle (Cooperative Home Care Associates, Drivers Cooperative, Equal Exchange). They have historically built less wealth for workers than ESOPs due to their relatively small sizes, but they still provide real wealth building through patronage dividends, and any excess profit goes back into the cooperative or to workers.

Co-ops are best structured to create deeply democratic workplaces and good, higher paid jobs for many, including people who are often excluded, such as returning citizens or others who experience barriers to employment. Worker cooperatives are designed to be permanent ownership structures and are rarely sold.

Employee Ownership Trusts (EOTs) in the US are a type of Perpetual Purpose Trust (see above) that typically holds a majority of the voting shares of a company on behalf of employees and includes a profit sharing mechanism, elements of worker governance, and a charter protecting the company from a potential sale (Codeweavers, Mētis Construction).

As with Worker Cooperatives, EOTs share their economic surplus with employees. EOTs are also designed to benefit both current and future workers and to limit decisions that could be detrimental to future workers.

Note: Wealth created is through a profit sharing mechanism, rather than ownership of the company value itself, which some critics argue will create less wealth for workers than through an ESOP. EOTs are appealing because they can be tailored to the needs of the stakeholders involved and can include other purposes in the trust documents.

Models centering other stakeholders

Consumer, Producer, and Shared Services Cooperatives are enterprises owned and democratically controlled by their members on a one member, one vote basis. Members may be individuals (e.g., a consumer cooperative), or entities (e.g., farms, businesses, or nonprofits). They are the most-widespread form of Alternative Ownership Enterprise (Organic Valley, Blackstar Coop, ACE Hardware).

They are all around us—from credit unions to rural electric cooperatives—and we often don’t realize it. Such cooperatives allow individuals or small businesses to work together to access products and services more cheaply or effectively than they otherwise would separately.

Multi-Stakeholder Cooperatives are owned and controlled by members with different roles and interests (Fifth Season Cooperative). They can enable cooperation across a value chain to the greater benefit of all stakeholders, but they can be complex to set up and administer.

While some Alternative Ownership Enterprise models have been around for decades and are poised to scale further, other promising forms are still nascent. Now is a critical time for impact investors to get engaged and provide capital to accelerate growth at each stage: from providing catalytic capital for innovative approaches to powering the growth of proven solutions while maintaining the integrity of their impact.

We can transition to a new kind of economy: An economy that centers the needs of marginalized people. An economy that is interconnected and mission-oriented. An economy that creates solidarity among producers, suppliers, workers, and customers.

Julie Menter is program director and Curt Lyon is executive director at Transform Finance, which works to catalyze capital toward alternative ownership enterprises.