ImpactAlpha, May 22 – Climate risk. Worker safety. Executive pay. The stalwart shareholder advocacy group has a resolution for that.

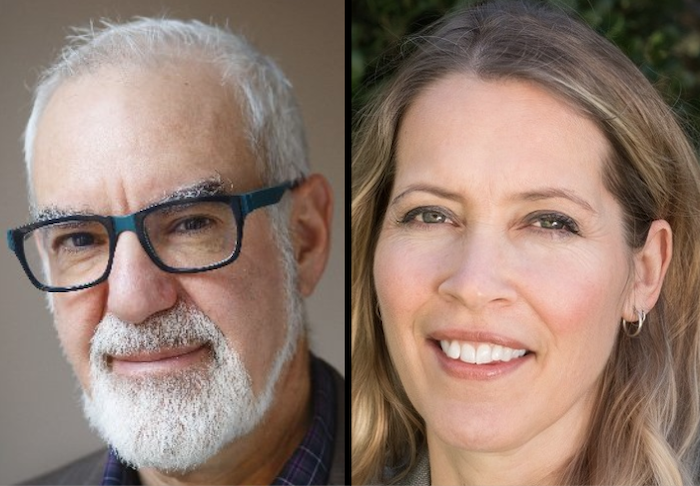

Corporations holding annual general meetings this month are well familiar with two particularly attentive shareholders: Andrew Behar and Danielle Fugere of As You Sow. Along with groups like CERES and the Interfaith Center for Corporate Responsibility, the Berkeley, Calif., nonprofit has taken the lead in engaging corporations on issues from carbon footprints to workforce treatment.

When engagement fails, resolutions often follow. The nonbinding shareholder requests “are about bringing new ideas to the public forum,” says Behar. Even a low vote can seed change. The prescience of the approach came into focus this week as floodwaters overtook a Dow chemical facility in Midland, Michigan, threatening to leach toxic chemicals. Dow executives had ignored a resolution on the issue filed last year by As You Sow.

The group scored at least a symbolic victory this week when holders of half of JPMorgan Chase’s shares voted in favor of As You Sow’s proposal asking the world’s largest financier of fossil fuels to address the climate impact of its lending activities. Shareholders sent the message “that it is past time for Chase to catch up with its peers, implement a strategy to decarbonize and de-risk its lending portfolio,” said Fugere, As You Sow’s president and chief counsel.

Behar, who started a fuel cell venture before becoming As You Sow’s CEO in 2010, took on the “cognitive dissonance” between BlackRock’s public embrace of stakeholder capitalism and its votes “for nearly every egregious CEO pay package, and against nearly every climate resolution.”

Over three decades, the group has notched dozens of wins, getting Revlon to remove toxins from its nailpolish, cajoling McDonalds and Target to ban foam packaging and persuading Disney to stop showing images of smoking in youth-rated films.

In this shareholder meeting season, As You Sow is just getting started. Next up: A face off with Exxon and Chevron.