ImpactAlpha, March 6 – JPMorgan Chase will cease lending to private operators of prisons and immigrant detention centers.

“We will no longer bank the private prison industry,” a spokesman for the U.S.’ largest bank told Reuters. In the end, the risks of sticking by private prison operators outweighed the benefits.

Activists teamed with activist investors to raise those risks. “Banks like Chase are seeing it’s time to get ahead of these issues,” Candide Group’s Morgan Simon told ImpactAlpha.

Candide’s Real Money Moves initiative is part of the Families Belong Together coalition, which on Valentine’s Day organized actions at more than 100 JPMorgan Chase and Wells Fargo branches and collected 150,000 signatures calling on the banks to “break up” with private prisons. Other protesters have dogged JPMorgan Chase CEO Jamie Dimon and staged rallies at Chase’s Manhattan Private Client offices.

“Public sentiment towards value-aligned business does not bode well for companies who are not proactively addressing their social footprint,” Simon said (see Simon’s post on Forbes for her full take).

JPMorgan Chase is the latest financial institution to break from the business of private prisons. In January, Wells Fargo, another big prison industry lender, said it would reduce its lending to private prisons as part of its “environmental and social risk management” process. Last June, New York City’s pension funds divested almost $50 million in stocks and bonds from private prison companies. Other banks, including Bank of America, Citizens Bank, US Bancorp and BNP Paribas are likely to face pressure from activists as well.

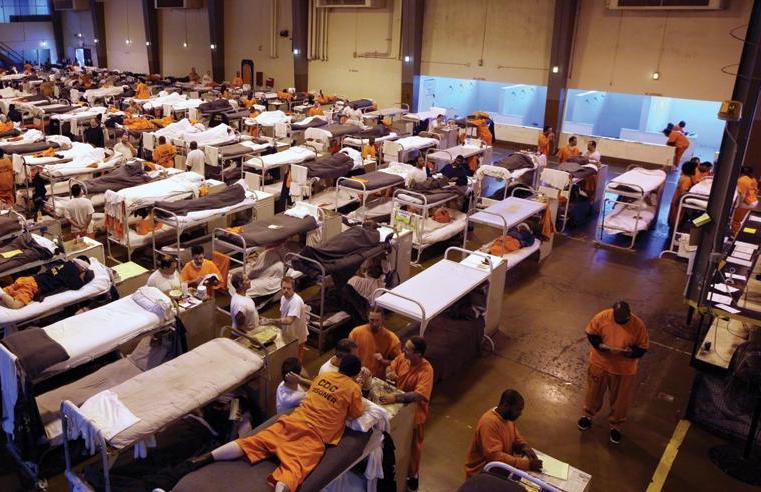

JPMorgan Chase and Wells Fargo have been lenders to CoreCivic Inc and GEO Group Inc, the two big U.S. private prison operators. The Trump administration’s immigration policies have heightened scrutiny of the companies’ practices and possible human rights violations, particularly around undocumented minors being separated from their parents.

In a statement, a Geo Group representative denounced the the divestment efforts as “politically motivated and based on a deliberate mischaracterization of our role as a long-standing service provider to the government.”

Bottom up… and top down

The banks have been under pressure from shareholder advocacy group Interfaith Center on Corporate Responsibility, which represents 300 global institutional investors managing more than $400 billion in assets. JPMorgan Chase “was benefiting financially from harm caused to detainees and immigrant communities,” Mary Beth Gallagher of the Tri-State Coalition for Responsible Investment, one of the lead investors pressuring the bank, said in a statement.

“Our ongoing engagement has called for the bank to conduct enhanced human rights due diligence, to assess the human rights risks and use its leverage to influence the companies it is lending to.”

In Oct. 2017, the coalition sent a letter to JPMorgan Chase CEO Jamie Dimon on behalf of 100 institutional investors holding $27 billion in shares. The investors were concerned that ongoing lending to CoreCivic and GEO Group, “may expose the bank to reputational risk and result in its losing clients who are opposed to the current immigrant policy and/or have concerns with private prisons more generally.”

Social risk

The pressure on JPMorgan Chase is an example of how social risks related to human rights are increasingly treated as a “material” risk.

An analysis last year of the events surrounding the Dakota Access Pipeline, the oil pipeline built on indigenous lands, found that poor social risk management cost the owners and financiers of the pipeline tens of billions of dollars. Social pressure associated with opposing the pipeline cost Energy Transfer Partners, the pipeline’s parent company, and other owners at least $7.5 billion. The banks that financed the pipeline incurred costs of $4.4 billion just in closed accounts. Costs to local taxpayers and stakeholders ran north of $38 billion.

Over a two year period beginning in August 2016, Energy Transfer Partners stock declined in value by about 20%; during that period, the S&P 500 increased in value by nearly 35%.

In the case of JP Morgan’s split from private prisons, protests helped raise awareness about the underlying business models and conditions at Core Civic and GEO. Activism from investors highlighted the risks – and associated costs – to the bank of causing or contributing to human rights abuses.

The Tri-State Coalition’s Gallagher said JPMorgan Chase was forced to ask itself whether the risks associated with Core Civic and GEO could be mitigated. “It’s clear JPMorgan Chase found they could not,” she said.