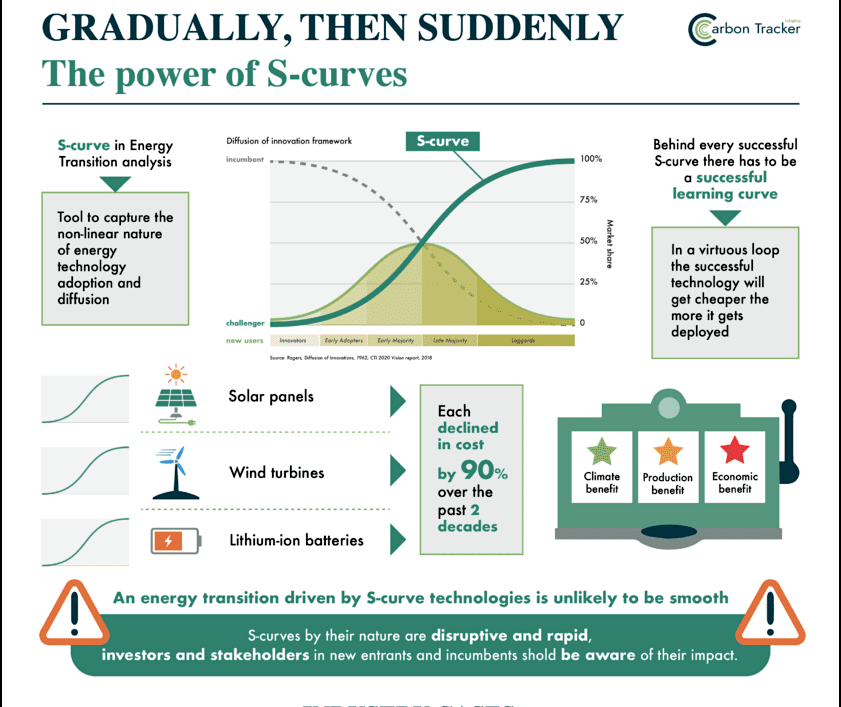

ImpactAlpha, Feb. 1 – The future of energy is S-shaped. Adoption of technological innovations is typically slow until they hit a tipping point, typically at 5-10% market share, after which they grow like gangbusters until they become mainstream.

“S-Curves by their nature are disruptive and rapid,” writes CarbonTracker’s Harry Benham.

In a research note exploring growth patterns in the energy transition, Benham explains that manufacturing technologies (think EVs, batteries, solar and wind systems and heat pumps) benefit from declining costs as knowledge and expertise grow with scale. Extraction projects like fossil fuels, says Benham, “are almost the opposite: one-off large scale complex efforts that are difficult, potentially impossible, to replicate and improve.”

Proof points

In the UK, EV sales have surged from one in 100 cars sold in 2016 to what CarbonTracker projects will be one in every three cars sold this year. Global EV sales could hit 14 million, or 20% of auto sales, in 2023. Wind and solar now account for more than 75% of all annual growth in the power sector.

Next could be “green” hydrogen, as innovation and falling prices kick in for electrolyser technologies, and heat pumps, which Benham says are poised to scale. Even oil major BP in its latest energy outlook declared the renewables surge “quicker than any previous fuel in history.”

Trillion-dollar tipping point

Investors are riding the curve. The amount invested globally in renewable energy and other transition technologies last year surpassed $1 trillion for the first time (and that doesn’t include equity investments in climate tech startups). What’s more, clean energy investments matched the amount invested in coal, gas and oil for the first time, according to “Energy Transition Investment Trends 2023” report.

The data should “put to bed any debate about how the energy crisis will impact clean energy deployment,” said BloombergNEF’s Albert Cheung. “Investment in clean energy technologies is on the brink of overtaking fossil fuel investments, and won’t look back.”