ImpactAlpha, Nov. 10 – The foreign minister of Tuvalu addressing world leaders while knee deep in coastal waters will be one of the enduring images of COP26.

For island nations like Tuvalu that contribute little to global warming, climate change is an immediate existential threat. “No matter if we feel the impacts today, like in Tuvalu, or in 100 years, we will all feel the dire effects of this global crisis one day,” said the minister, Simon Kofe.

Developing countries on the front lines of climate change have criticized wealthy nations for not backing up their rhetoric with clear plans and funding, such as a minimum $100 billion a year promised to help them mitigate and adapt to climate change.

Another mechanism may ultimately unlock much more than that by establishing a realistic price on the carbon and other greenhouse gases responsible for the global warming that is causing sea levels to rise. A price of $100 or even $150 per ton of carbon averted or removed would send a market signal that could thunder through the global economy.

“Pricing carbon is perhaps the single most effective thing we can do,” said Emergent’s Eron Bloomgarden, with “systemic effects throughout the economy: it changes pricing and changes incentives and so it changes behavior.”

Conservation projects and mitigation investments that currently do not pencil out may suddenly look attractive when the price of a ton of carbon averted reaches $100 or more. Farmers practicing regenerative agriculture have been able to generate extra revenue for sequestering carbon in soil.

Market design

Governments have long talked of directly taxing carbon emissions – the idea has new life in U.S. policy discussions. But today, the practicalities of putting a price largely takes place via the global checkerboard of carbon trading marketplaces, including in Europe, California and, most recently, China.

Countries working to reduce their emissions and meet their commitments under the Paris Agreement can purchase credits from other countries who are further down the path. Similarly, corporations can buy carbon credits to offset hard-to-abate emissions and help meet their net zero goals.

Such arrangements were a flashpoint at COP26, the global climate summit wrapping up this week in Glasgow. Climate activists, including Greta Thunberg, dismissed carbon credits as a greenwashing scheme that allows corporations and governments to continue to pollute. Carbon credits are not a substitute for absolute emission cuts. Yet, if structured well, they have the potential to shift huge sums of money towards decarbonization.

Negotiators at COP26 are hammering out rules this week for a global climate market that would turn carbon offsets and allowances into fungible assets that can be traded across geographies the way barrels of oil or bushels of wheat are today.

Among the thorny issues to be resolved: how to prevent double-counting of emissions reductions, whether offsets issued under older, less stringent systems can be carried forward, and how transaction fees might channel money to countries such as Tuvalu that are struggling to adapt to climate change.

The rules would help bring transparency and interoperability to a patchwork of carbon markets in use today, from regulated markets, such as the European Emissions Trading System, regional trading schemes in the U.S., and China’s newly launched carbon market, to a proliferation of voluntary markets used mostly by corporations scrambling to meet net zero pledges.

A failure would seriously undermine the goals of the Paris accord.

Rising prices

Even with a lack of standards, prices for carbon and other greenhouse gasses have risen steeply. Prices on Europe’s emissions trading schemes have more than doubled since February, and California’s prices are up by more than 50%.

Experts expect investors will eventually be able to trade between the disparate national and sub-national markets, and that voluntary and mandatory compliance markets will gradually converge. Even before that happens, the rising price of carbon is already shifting decision making and capital flows.

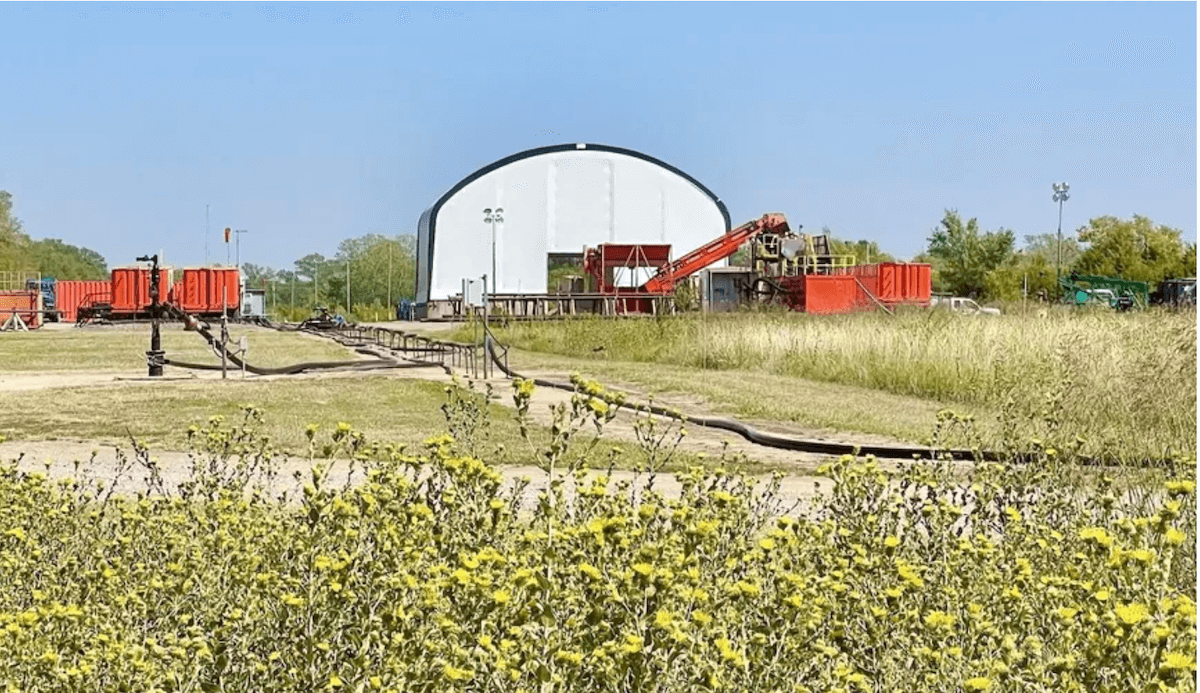

Equilibrium Capital is generating revenues of about $25 million a year with credits under California’s Low-Carbon Fuel Standards and federal renewable fuel standards, via methane-capturing infrastructure projects such as dairy-waste biogas plants that produce renewable natural gas. A ton of methane has at least 80 times the warming power of carbon dioxide in its first 20 years (see, “The sky-high value of cutting methane emissions is attracting policymakers – and investors”).

“We may sell our methane for $5 and our environmental credits associated with that could be $80,” Equilibrium’s Dave Chen tells ImpactAlpha.

The accelerated phaseout of coal across parts of Europe is in part a function of rising carbon prices, says Pedro Martins Barata of the Environmental Defense Fund. As carbon prices under Europe’s Emissions Trading System rose from single digits in 2017 to more than €60 this year, coal became less competitive with low-cost renewable energy and lower-carbon natural gas.

A higher carbon price, he said, “is leading to significant short-term reductions in energy-related emissions in Europe.”

An analysis by Columbia Business School’s Shivaram Rajgopal and Saïd Business School’s Bob Eccles conclude that $100 a ton carbon for direct emissions would cost Exxon Mobil more than $9 billion a year. If emissions from the end use of its products, like tailpipe emissions, were taxed at just $18 a ton, the company “would be rendered bankrupt,” they say.

The Organization for Economic Cooperation and Development estimates that a price of $147 a ton is needed by 2030 to reach net zero carbon emissions by 2050. Others peg the number at $200 a ton.

Real money

The rules negotiated at COP26 could throw er, gas, on an already hot market. Market infrastructure is emerging. The London Stock Exchange this week announced a plan to enable investors to put money into designated carbon funds traded on the exchange, with the aim of bringing transparency and scale to a fragmented system. Exchange-traded funds are tracking carbon prices.

The LEAF Coalition, coordinated by the non-profit intermediary Emergent and backed by the governments of Norway, the U.K, and the U.S., is bringing together forest countries that can sequester carbon and corporate buyers such as Delta Airlines and Unilever looking to offset their emissions.

“These are real commitments that will be legally binding commitments from the corporate and from the donor governments to pay once these emission reduction credits are generated,” Bloomgarden told ImpactAlpha. “This is real money that’s being committed.”

The trend is clear. As carbon becomes less invisible, companies are being asked, or required, to measure their emissions across their supply chains and portfolios.

“You need to put a price on it,” said Rachel Kyte of Tufts University’s Fletcher School, who co-chairs a task force on voluntary carbon markets. “To not put a price on the pollutant that we are trying to wean ourselves off it just means that everything else is much harder to work around.”