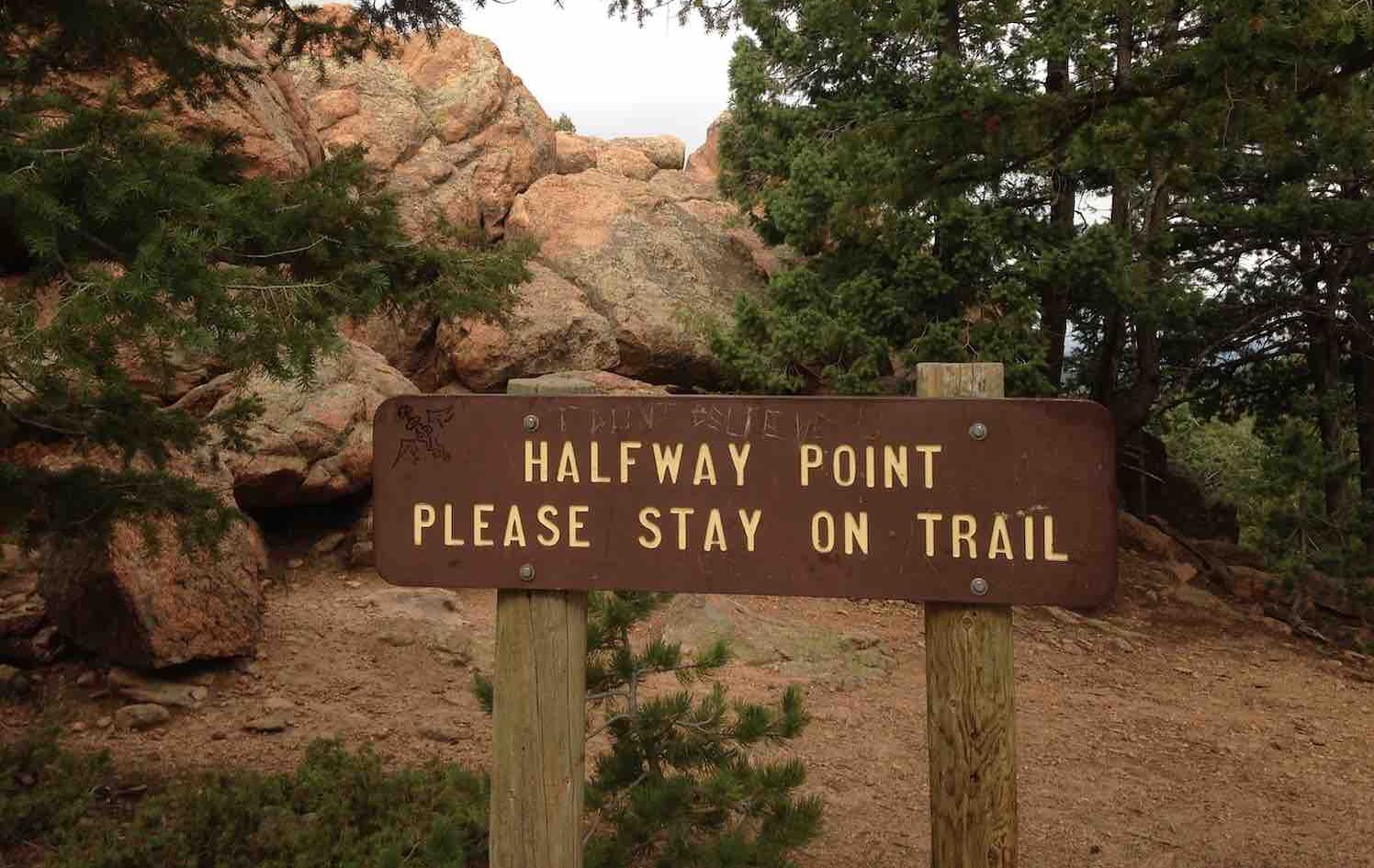

ImpactAlpha, Dec. 19 – Halfway there. When the ball drops in Times Square this year, it will ring in the critical midpoint in the world’s self-set 2030 milestone in the global mobilization to prevent catastrophic global warming.

We have some catching up to do. To zero-out carbon by mid-century, we need to halve greenhouse gas emissions by 2030 (from 2010 levels). That’s just to keep planetary warming to 1.5 degrees Celsius from pre-industrial levels – higher than we have now, with even more catastrophic droughts, storms, and famine than we’ve seen so far.

The Earth has already warmed by at least 1.1 degrees, or 2.7 degrees Fahrenheit. Despite a pandemic-related dip in 2020, global emissions are growing an average .5% per year.

The 2015 Paris agreement, signed by some 200 nations, came just weeks after the adoption of the U.N.’s Sustainable Development Goals, which also committed to 2030 deadlines for improving health, water, gender equity, and livelihoods for populations in both low- and higher income countries. At the midway mark, not a single one of the 17 SDGs is on track to meet the deadline.

What’s different this year is the palpable sense that a dramatic mobilization to make a back-loaded run at meeting climate and development goals remains possible, even at this late date. When historians identify the “inflection point” that shifted the world’s energy supply away from fossil fuels and toward renewable energy, they may find it has already occurred.

Dramatic advances in technology and reductions in costs are driving a global transition on economics alone. Utility-scale solar and onshore wind are already the cheapest forms of new energy in much of the world. The three most important words in the energy transition continue to be deployment, deployment and deployment.

“The energy world is shifting dramatically before our eyes,” Fatih Birol of the International Energy Agency said this fall. “Government responses around the world promise to make this a historic and definitive turning point towards a cleaner, more affordable and more secure energy system.”

In the U.S., the Biden administration and congressional Democrats pushed through historic legislation and policies that are sparking investments in electric vehicle manufacturing, batteries and charging infrastructure and new solar and wind development. Consumer subsidies that kick in on January 1 will prompt a wave of heat pumps, induction stoves, EVs and other green products.

In Europe, a new carbon border tax that will slap levies on polluting products is expected to ripple through global supply chains. Voters in Australia, Brazil and Colombia have defeated climate deniers and swept in leaders who promised climate action.

The narrative has shifted. The goals are within our reach.

Unstoppable S-curves

Not even the global energy crisis sparked by the Russian invasion of Ukraine could stop the inexorable clean energy transition. A scramble to secure energy supplies gave a short-term boost to coal, which hit record levels this year, and oil and gas companies used the turmoil to push their agenda.

But the more decisive impact of the Ukraine crisis is an accelerated shift from fossil fuels to clean energy. The IEA has upped its near-term global renewable energy forecast by 30% since the Ukraine war broke out. Clean energy sources are expected to make up 90% of new energy additions over the next five years, overtaking coal to become the largest source of global electricity by mid-decade. China alone will account for half of those additions. Consider: The IEA has perpetually underestimated the speed and scale of the shift.

The S-curve of technology adoption, and the positive returns to scale in the form of continuously falling costs, are driving adoption of renewables. Solar and lithium-ion battery costs have fallen by more than 90% in the past decade and a half.

Such virtuous cycles make the transition not slow, hard and forced, says Kingsmill Bond of RMI, but “fast, beneficial and inevitable.”

Here are some of the signals we’re watching:

Every building, every neighborhood

The Inflation Reduction Act’s hundreds of billions of dollars in incentives is driving a green, inclusive economic revival across the U.S. – and reframing narratives. EV manufacturing plants and battery gigafactories are rising in Ohio, Tennessee, Michigan, Georgia and other states. Residents in underserved communities of New York and Los Angeles are being trained for good-paying green jobs.

Brooklyn-based BlocPower sees “trillion-dollar opportunities” decarbonizing buildings, transportation and charging infrastructure for the mass market. The company is banding together with other diverse-led tech startups to help cities and municipalities navigate the windfall of federal funding and optimize their impact.

What’s needed: more local project developers to fuel the revival. “The money is there,” says Jigar Shah, a cleantech entrepreneur now running the U.S. Department of Energy’s loan program. “Where the world has not caught up is in creating the projects.”

Shah’s Loan Programs Office has begun doling out billions of dollars in loan guarantees to help commercialize promising climate tech and build first-of-a-kind factores.

Climate solutions represent not a costly sacrifice, but better, cheaper, faster products and healthier communities. Rather than imposing costs, decarbonization can save $5 trillion to $15 trillion over the next few decades, concluded a recent report out of Oxford University.

“We’re not selling doom and gloom here,” as Rachel Kyte of The Fletcher School at Tufts University told ImpactAlpha. “We’re selling what people want.”

Go deeper:

- New narrative of climate action: Unstoppable progress and immense opportunity

- Eight ways the Inflation Reduction Act is resetting the climate table

- Trillions are the talk of Climate Week, as opportunities drive climate action

Catalytic climate capital

Just Energy Transition Partnerships. Debt-for-nature swaps. Carbon markets. With a looming recession and domestic concerns putting many wealthy governments in a Scrooge-like mood, impact investors are getting creative to meet the trillions of dollars of investment in climate mitigation and resilience needed annually to meet the goals of the Paris Agreement.

The low-hanging fruit: wringing the most from what funds are available. For example, ending subsidies to fossil fuels and harmful agriculture practices could free up hundreds of billions of dollars. Reforming how the World Bank, International Monetary Fund and other development finance institutions operate could unleash hundreds of billions more (see Barbados PM Mia Mottley’s Bridgetown Initiative).

Carbon markets, which enable corporations to pay project developers that reduce carbon, are making restoration, conservation and new direct air capture technology economically viable. The key is establishing standards and transparency to ensure their integrity. An “Energy Transition Accelerator” launched by U.S. climate envoy John Kerry with the Rockefeller Foundation and Bezos Earth Fund will use carbon markets to catalyze private capital investment in low- and middle-income countries to aid their energy transitions.

Helping to spot the gaps in climate finance: the Climate Finance Tracker developed by Vibrant Labs with ImpactAlpha.

Go deeper:

- Just Energy Transition Partnerships and other ways to shift climate finance toward low-income countries

- On deadline, COP27 wrangles with loss, damages and fossil fuels

- Creative finance is needed to plug gaps in global climate funding – and to rescue COP27

Climate tech resilience

From carbon capture and more efficient batteries to climate-smart agriculture and emissions accounting, investors piled into climate tech in 2022. More than a quarter of all venture funding went to such investments in 2022, according to PwC. Climate Tech VC counted at least $94 billion in fresh private climate-targeted assets under management amassed this year.

Climate tech has proven resilient even as the broader tech market got pummeled. Startups pursuing battery materials, EVs, home electrification and other solutions poised to benefit from Inflation Reduction Act subsidies saw valuation premiums. Other categories solve long-term problems. Remote monitoring systems are needed to verify all of those emissions reductions claims. Farmers need tools to combat increasingly extreme weather. And new regulations, such as a rule under review by the Securities and Exchange Commission that would mandate climate risk disclosures, are fueling demand for climate accounting software.

Mega funds, such as TPG Rise’s $7.3 billion climate fund and Brookfield’s $15 billion fund, are hunting big game. A crop of smaller climate-focused funds are seeding promising new technologies – and fund managers. Energy Impact Partners, better known for investing in ready-to-deploy technology, launched an early stage climate fund. Chris Sacca doubled down on carbon capture and fusion with new funds this year. VC Include is seeding emerging climate managers in the U.S. and Europe.

Early-stage climate tech investor and accelerator Elemental Excelerator, which has helped launch hot startups such as BlocPower, ChargerHelp and Proterra, is focusing on industrial decarbonization with its latest cohort. It’s not just mitigation. Private investors, long on the sidelines of climate adaptation, are also keying in on the opportunity to build resilience in communities on the frontlines of climate change.

Go deeper:

Nature-positive investment

Biodiversity, long overshadowed by the climate crisis to which it is inextricably linked, is finally getting its due. A U.N. goal seeks to halt and reverse nature loss, from a baseline of 2020, by the end of the decade. (There, too, nations are falling short on progress). After a pandemic-related delay, environmental ministers regrouped in Montreal for COP15 this month to hammer what advocates hope will be a “Paris Agreement for nature.” The summit wrapped up with a far-reaching agreement to preserve 30% of the planet’s habitat by 2030, respect the rights of indigenous communities, channel $200 billion per year to conservation efforts and encourage corporate biodiversity-risk disclosures.

Investors are waking up to the issue as well. About half of global GDP – some $44 trillion – depends on nature. Ecosystem decline could shave 2.3%, or about $2.7 trillion, from global GDP in 2030, warns the World Bank. Companies that move quickly to develop nature-positive, resilient solutions could generate up to $4.5 trillion of new business opportunities annually by 2030, the U.N.-backed Race to Zero alliance estimates.

We’ll be watching for new models that value nature and pay for its protection and restoration to gain traction.

Go deeper: