In a world in which the UN SDG financing gap continues to grow, we face a double hurdle: blended finance is still struggling to take off, and little is known about what ‘works’ and what ‘doesn’t’ in getting large blended deals off the ground.

With this in mind, we set out to answer a fundamental question – what can we learn from large-scale transactions that have managed to achieve their target impact goals?

First comes a recognition that large blended deals are few and far between. While recent developments like Allianz Global Investors’ SDG Loan Fund – a $1.1 billion blended finance fund with a 10% catalytic equity tranche from FMO and a $25 million guarantee from the MacArthur Foundation – continue to encourage growth in the space, transactions above $1 billion total are under three percent of the 1100+ deals recorded in Convergence’s historical deals database (HDD).

Utilizing publicly available data, we analyzed the status of each of these 39 substantial deals. We sought answers to three questions: firstly, whether the financing for these transactions was fully raised and utilized as planned; secondly, whether the deal listed a specific impact target or not; and thirdly, whether there was publicly verifiable evidence or data confirming that the specific impact targets set by these transactions (such as ‘creating 400 thousand jobs by 2014’ or ‘reducing greenhouse gas emissions by 1.6 million metric tons annually‘) had been met.

This analysis yielded several fascinating observations, which are detailed sequentially below.

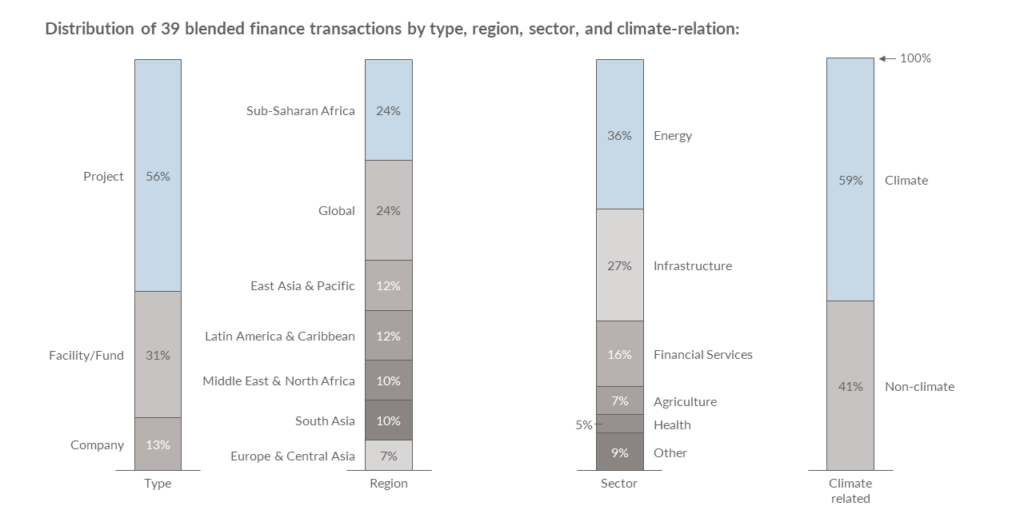

Observation 1: The sample is very diverse across geographies and asset classes, but climate objectives remain a core focus

It was somewhat expected to find that over half of these transactions were related to the energy and infrastructure sectors, given the substantial financing these projects typically require. Additionally, it was anticipated that the largest transactions would tend to be structured as projects, such as the Trans-Sumatra Toll Road in Indonesia, which used subordinated debt from the government mixed with senior debt and equity investments from international investors, or the Panama Metro Line One Project, which included a CAF-funded technical assistance facility alongside a range of international debt and guarantee providers.

What came as a surprise, however, was discovering that Sub-Saharan Africa, which at 24% had the greatest number of transactions by a narrow margin, considering it is often the region most targeted for blended finance.

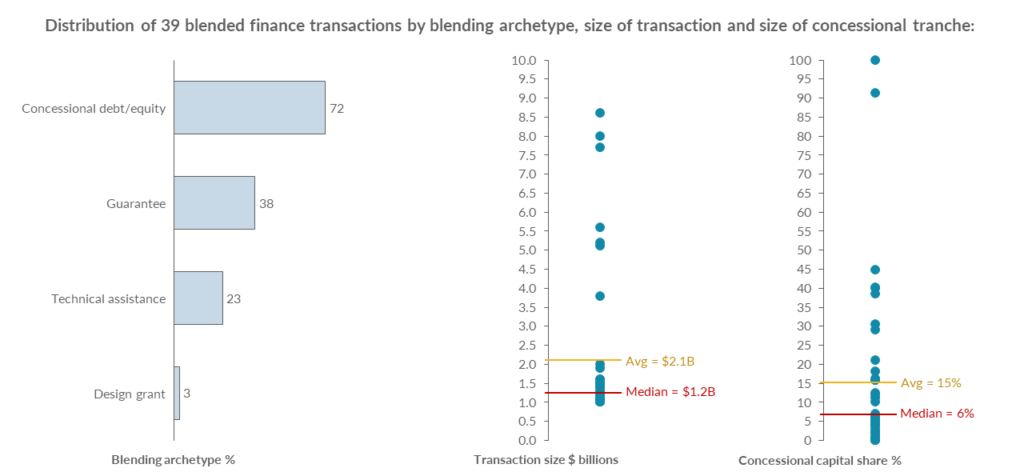

Observation 2: Concessional debt/equity is the most common blending archetype, and represents on average ~15% of the capital stack for large-scale transactions

Convergence delineates four types of blended finance archetypes: concessional debt / equity, guarantees, technical assistance (TA), and design-stage grants. (For further details on these, click here). Upon reviewing the 39 large-scale blended transactions, it was unsurprising to find that concessional debt / equity was the most common element.

Specifically, 28 of these transactions included some form of concessional debt / equity; almost half utilized concessional debt, with the remainder split between junior equity and grants. The predominant providers of this catalytic financing were specialized entities like the Emerging Africa Infrastructure Fund (EAIF) and development finance institutions like IFC, FMO, and EBRD.

What was most intriguing was that despite the large amount of cumulative financing across the 39 large-scale transactions – $86 billion in total, with an average deal size of $2.1 billion – the relative proportion of concessional capital remains low. Convergence has previously found that larger blended transactions leverage higher amounts of commercial capital per dollar of concessional funding.

In fact, it found the average leverage ratios almost perfectly increase with transaction size through to the $1 billion+ range, where average leverage ratios reach 7.6. Within the 28 deals incorporating concessional debt / equity, the average proportion of concessional capital was 15 percent of the total financing, significantly lower than what many may consider necessary to catalyze large-scale blended transactions.

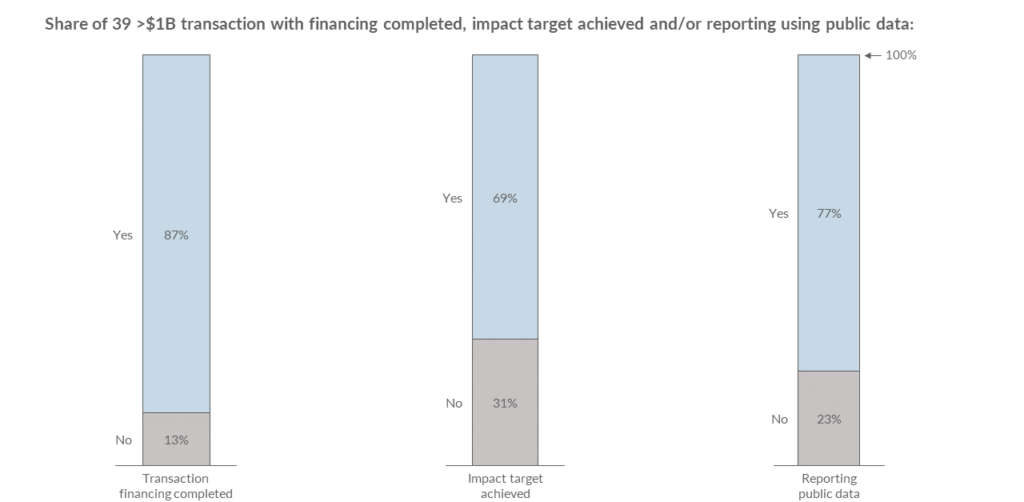

Observation 3: Big deals are more likely to achieve financial close than their impact targets

The biggest insight from my desk research was that while most (87%) of the 39 large, blended transactions have successfully raised and deployed the capital, not as many (just 69%) have successfully achieved their reported impact targets.

This could partially be because there wasn’t always easy to find publicly available information about the deals. In fact, a whopping 23% of deals were not reporting public data. It could also be because some of the deals in the dataset are more recent – including three from 2023, suggesting that more time would be required to see the impact targets achieved.

Observation 4: Transactions structured with concessional debt / equity and TA were likelier to achieve their impact targets than those with guarantees, while companies and facilities / funds were likelier to achieve their impact targets than projects

Reflecting on the suboptimal impact targets achieved according to the publicly available data, we sought to delve deeper into the performance variations. It was found that transactions employing concessional debt/equity and TA as blending archetypes were likelier to meet their impact targets compared to those backed by guarantees.

Furthermore, it was observed that facilities, funds, or companies had a higher likelihood of achieving impact targets than projects. While these findings do not warrant conclusive interpretations, and further research is necessary, they suggest that directing concessional debt/equity and technical assistance into funds, facilities, or companies might be a more effective pathway toward achieving impact goals.

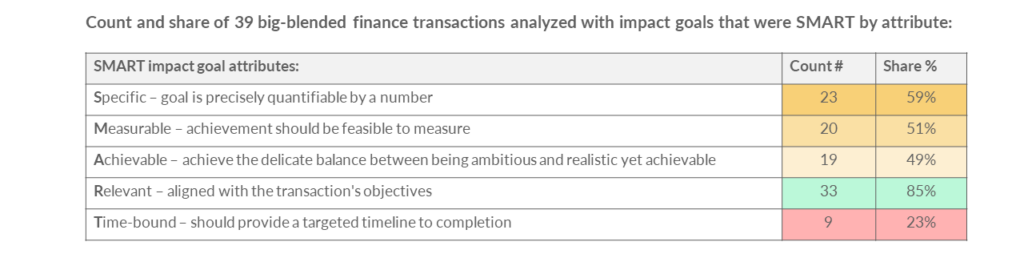

Observation 5: Impact targets are diverse and inconsistent in level of ambition, specificity, and time-bound measurability of the expected outcomes

Upon reviewing the impact targets within the 39 large blended finance deals, we were struck by the wide-ranging objectives, which varied greatly in their level of ambition, specificity, and types. For instance, the Sarulla Geothermal Power Project set a precise and quantifiable environmental goal: “Deliver 320MW of clean electricity; Reduce CO2 by 1.3 million tonnes per year.” In contrast, the Africa Energy Guarantee Facility (AEGF) articulated a less defined target to “support new private sector investment in eligible renewable energy, energy efficiency, and energy access projects.”

Similarly, the range of job-related targets was broad, with the Telkom Kenya (TKL) transaction aiming for an increase in Foreign Direct Investment (FDI) flow, while the Ethiopian Airlines transaction established a more exact target of “Increasing employment from a current staff of 7,200 to 16,899, which equates to 9,699 new jobs over a 12-year period.”

Upon deeper analysis we looked at whether the impact goals of the 39 projects were SMART –specific, measurable, achievable, relevant, and time-bound – and found that only 23 percent of the impact goals reviewed were SMART across all five attributes. See table above for more details. There is a clear need for greater consistency in the impact targets set by these transactions.

Assuming the impact reported by these transactions is authentic and additional, the imperative remains clear – we should continue to double-down on efforts to get more of these ‘needle-movers’ off the ground.

Such scale can not only draw substantial institutional investments but also demonstrate that the deployment of concessional financing can be done with greater efficiency than previously understood. Evidence from the past shows that these mechanisms need not be as expansive as once thought, with the concessional layer representing an average of only 15% in large-scale transactions containing concessional debt/equity in the capital stack This revelation calls for a strategic increase in the utilization of concessional finance instruments in large transactions, aligning financial viability with impactful sustainability goals.

However, money alone is not the measure of success. The ambition and clarity of impact targets must be elevated and standardized. Transactions must move beyond varying and often vague aspirations towards setting unified, rigorous, and ambitious goals. Moreover, there is an urgent need to improve the tracking and reporting of outcomes from large, blended finance transactions.

Only with robust data and transparent sharing of results can we understand the true effectiveness of these investments and encourage broader participation from the private sector. It’s time for all stakeholders to commit, not just to the amount of capital, but to the value this capital can raise. Let us aim not just for billions, but for meaningful transformation that can be seen, measured, and replicated.

This call to action is not just a recommendation; it is a blueprint for the future of financing for development. By taking these steps, we can open the door to not only more significant investment but also to greater impact, accountability, and innovation in the field of sustainable development finance. Let’s harness the power of finance to not only build wealth but to create value and build a better world for all.

Kusi Hornberger and Marcos Paya are co-Leads of Dalberg’s Finance & Investment Practice. Grace Long at the University of Michigan provided research assistant support. Andrew Apampa from Convergence reviewed and validated the insights using Convergence’s proprietary data.