Zero: the number of questions about global warming and climate change asked of presidential candidates during the 2016 campaign debates.

Yet, as such august analysts as the writers of Saturday Night Live understand, the future of fossil fuels has emerged as the incoming Trump administration’s biggest preoccupation, and likely a major driver of Russia’s intervention in the U.S. election as well.

Yet, as such august analysts as the writers of Saturday Night Live understand, the future of fossil fuels has emerged as the incoming Trump administration’s biggest preoccupation, and likely a major driver of Russia’s intervention in the U.S. election as well.

From his selection of ExxonMobil CEO Rex Tillerson as secretary of state to his pick of Oklahoma Attorney General Scott Pruitt to run the Environmental Protection Agency, President-elect Trump has filled his administration with climate deniers, climate skeptics and fossil-fuel champions. In our latest episode, the Returns on Investment podcast crew takes up the challenge of climate action in the Age of Trump.

Listen to the latest Returns on Investment podcasts

David Bank, editor of Impact Alpha, said the most likely scenario remains, as one headline had it, “Trump, Putin, and ExxonMobil team up to destroy the planet.” (See “Battle for the Arctic: Yesterday’s Energy War?“)

In the podcast, however, he discussed an alternative reading of the tea leaves. As he laid out in a recent post, there may be reason to believe that the Trump administration could in fact wind up a proponent of a carbon tax – yes a tax. Tillerson, as well as other oil company executives, have lobbied for a carbon tax as the most market-friendly way to make the low-carbon transition which even they acknowledge is necessary.

In the podcast, however, he discussed an alternative reading of the tea leaves. As he laid out in a recent post, there may be reason to believe that the Trump administration could in fact wind up a proponent of a carbon tax – yes a tax. Tillerson, as well as other oil company executives, have lobbied for a carbon tax as the most market-friendly way to make the low-carbon transition which even they acknowledge is necessary.

It would be a Nixon-to-China move. “The notion,” according to David, “is that only a Republican could get a carbon tax through congress, and only an oil man could bring the fossil fuel industry along.”

Indeed, such a tax could be good for energy companies and exporters who have large holdings in natural gas. The market is already moving from coal to natural gas, and a price on carbon accelerate that movement. Russia and Exxon happen to have large gas holdings.

Imogen Rose-Smith, senior writer at Institutional Investor, says she found David’s proposition “insane.”

Listen to the latest Returns on Investment podcasts

“I don’t see Rex Tillerson being anyone’s climate hero,” she says, explaining that Tillerson’s views as secretary of state need not track positions he states as CEO of ExxonMobil, which has been under legal and regulatory pressure to recognize the reality of climate change.

“And in fact what I think you’re going got to see is a buildup of the high carbon assets in the US, which is going to cause massive investment risk as a result of the policies coming out of the administration.”

Still, Imogen said climate economics will drive other players to action, regardless of U.S. government policy. There’s an even greater need for dedicated action from the global community, business leaders, cities and states, and citizens. (See, “Clean Energy Revolution Trumps Climate Skepticism at Global Climate Talks.”)

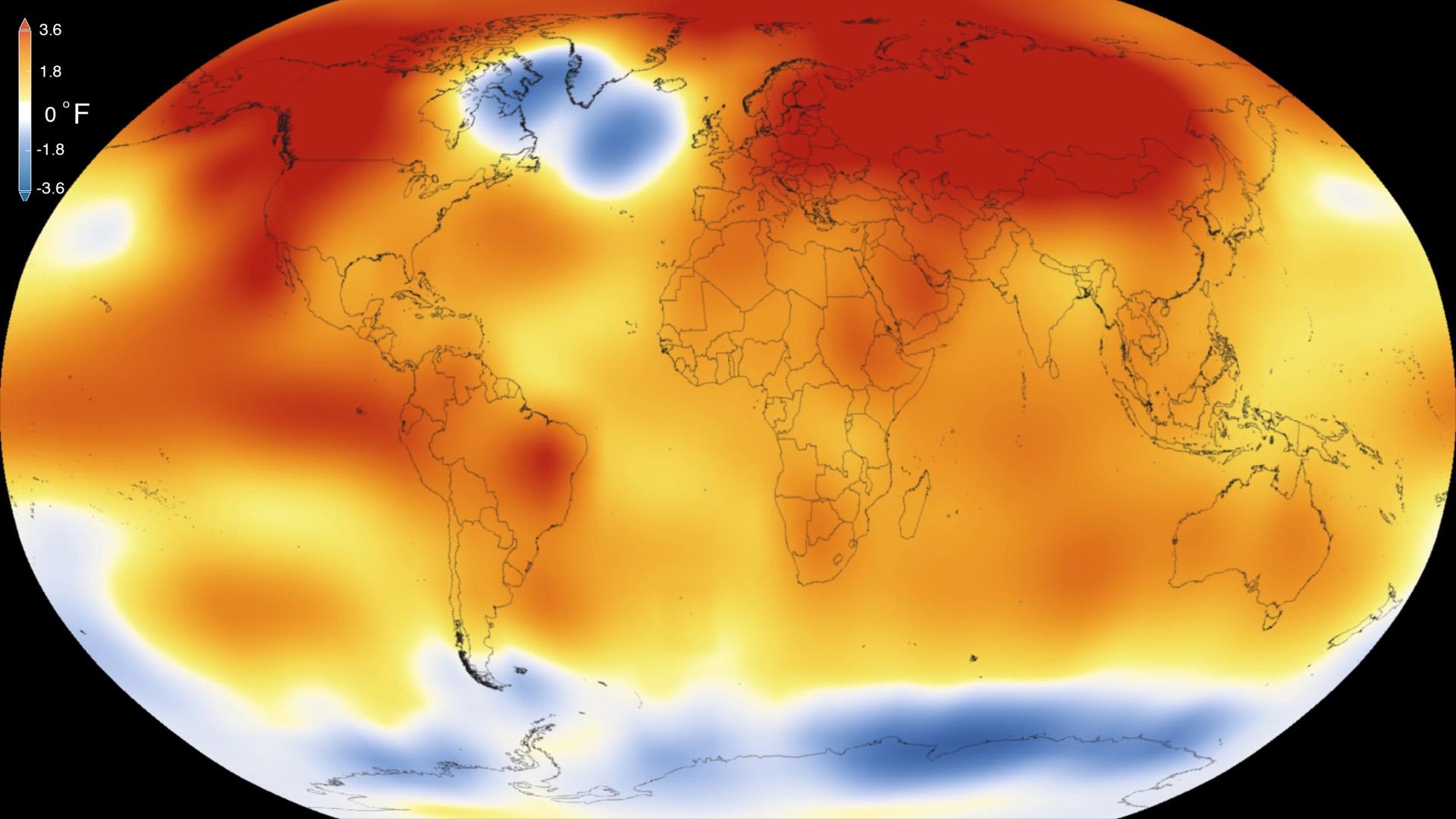

“Climate change is still a problem,” she says. The risks of rising sea levels, water and food insecurity, and extreme weather events are increasing. “It’s still a huge risk for businesses, it’s still a huge risk for investors, that hasn’t gone away.”

[seperator style=”style1″]Disclosure[/seperator]

Subscribe to Returns on Investment on iTunes, Stitcher, or SoundCloud.