Down goes another obstacle to the growth of impact investing.

The new Impact Investing Benchmark, from Cambridge Associates and the Global Impact Investing Network (GIIN), showed that a group of more than 50 impact investing funds delivered returns nearly as strong as a set of comparable funds with no measured social impact. Some subsets even outperformed.

“This Impact Investing Benchmark has exhibited market rate returns – and stronger performance in a number of vintage years, sizes and geographies of focus,” said Jessica Matthews, managing director of Cambridge Associates and head of the firm’s Mission-Related Investing Group.

“There’s a view among some investors that impact investing necessarily entails a sacrifice in financial return,” she said. “This data helps to show that is more perception than reality.”

The first comprehensive look at private equity and venture capital impact fund financial performance provides measures by which private investment funds can compare their own performance.

“This benchmark lays the groundwork to generate critical financial performance data for the impact investment industry,” said Amit Bouri, CEO of the Global Impact Investing Network.

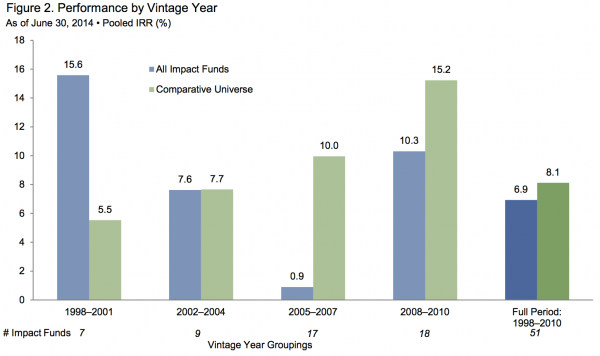

The funds that comprise the Cambridge Associates Impact Investing Benchmark provided an internal rate of return (IRR) of 6.9 percent to investors. A set of comparative funds with no measured social returns returned 8.1 percent. The benchmark includes 51 private investment funds of vintage years 1998 to 2010 that target market-rate returns and that have a specific social impact objective. It does not include those impact funds intentionally seeking below-market rate, ESG funds, or those with only a specific environmental impact objective.

The 51 impact investment funds have combined assets of $6.4 billion. The comparative universe was made up of 705 funds with assets of $293 billion.

While the benchmark on the whole slightly underperformed, more mature, smaller, and emerging market subsets of the benchmark performed inline or outperformed comparative subsets, according to the Cambridge data:

- In aggregate, impact investment funds launched between 1998 and 2004 outperformed comparative funds.

- Emerging market impact funds, in particular, of 1998 to 2004 vintage, significantly outperformed a comparative set of emerging market private equity and venture capital funds.

- Funds focused on Africa performed particularly well, returning 9.7 percent, while the set of emerging market impact funds returned 6.2 percent.

- Smaller impact funds, those with assets under $100 million, with an IRR of 9.5 percent, outperformed similar-sized funds in every vintage-year grouping except 2008 to 2010.

- US-focused impact investing funds returned a 13.1 percent IRR versus a 3.6 percent IRR for comparative US funds under $100 million.

“We are encouraged that impact investing funds have performed so closely with peer funds in the comparative universe,” Bouri said. “It’s also important to note that, beyond the financial performance the Benchmark accounts for, these funds are also generating a positive social impact.”

The report is quick to note the difficulty involved in bench-marketing private markets, let alone emerging ones, as funds are young and data is scarce. Cambridge will report quarterly on the benchmark’s performance to track the sector’s progress. The investment advisor will also update the benchmark as funds mature and share their data.

Still, the benchmark brings added transparency to the impact investing marketplace and clarity to the question of risks and returns. From Monitor Institute’s 2009 landmark report on impact investing to this year’s OECD report on building the sector’s evidence base, experts have cited the lack of data and benchmarks as an obstacle to increased investment. That excuse now carries less weight.