Greetings, Agents of Impact!

Featured: What’s Next Series

Next generation of investment professionals need to be impact-smart. “If impact investors aim to transform the global financial system, the industry must rebuild how it develops talent and builds investment teams,” writes the Global Impact Investing Network’s Amit Bouri. Without revamping entrenched and outdated practices for developing and recruiting finance professionals, “we will never be able to institutionalize impact as a standard part of the investment process,” Bouri argues in latest post in ImpactAlpha’s What’s Next series, produced in partnership with the GIIN.

Bouri makes four calls to action. By valuing experience, not just credentials, investment firms can build teams that reflect a diversity of perspectives and experiences. “Building teams that reflect a breadth of backgrounds, ideas, and experiences will certainly result in stronger deals,” he says. Teaching impact practices to all future investment professionals in undergraduate and graduate programs can build a pipeline of impact-smart investors. “Future investment leaders should learn about impact measurement and management early, so that they can appropriately account for impact when they are sourcing and diligencing deals, managing investments, and navigating exits responsibly,” Bouri writes. Investment firms can take advantage of the huge enthusiasm for high-impact career opportunities by upskilling established investment professionals to close the skills gap with in-house and third-party trainings. Certification bodies for analysts and advisors can signal the importance of impact measurement and management by embedding impact in investment certifications. “For the market to reach the scale that is needed, we need to multiply manyfold the number of investment professionals with an impact mindset,” Bouri concludes.

Read, “Impact-smart investors need new training, broader experiences and higher values,” by Amit Bouri on ImpactAlpha. And take a spin through the full What’s Next series.

- What’s your take? The GIIN and ImpactAlpha want to hear from you. Send quick reactions, short blurbs and longer responses (600-800 words) to [email protected] by Friday, Mar. 8.

- ImpactAlpha offers scholarships and discounts for impact investing and sustainable finance faculty and academic programs. Dozens of profs as well as Harvard, Yale, Tufts and other schools already are on board. Drop us a note at [email protected] for details.

Dealflow: Follow the Money

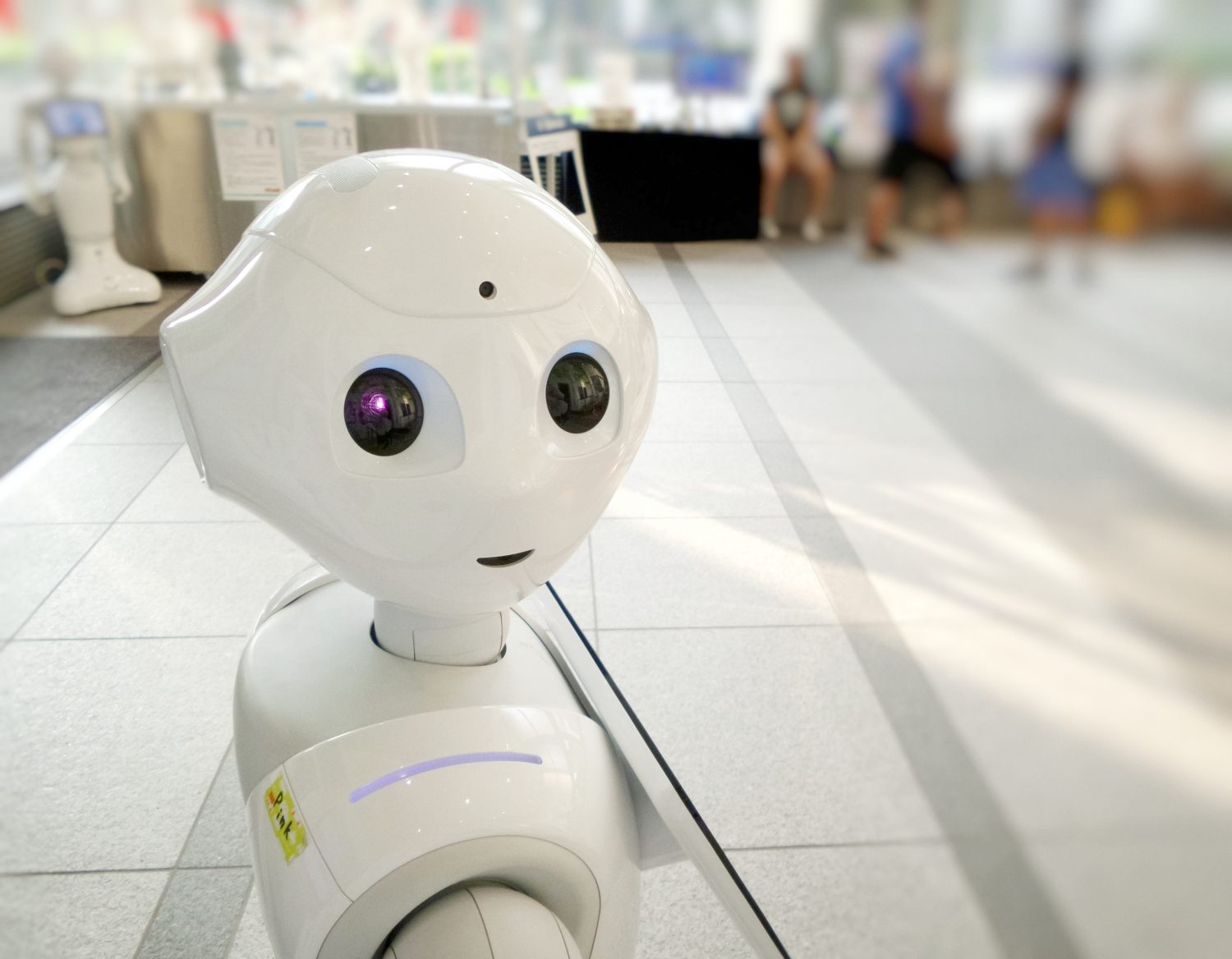

John Hancock rolls out COIN, a “conscious” stock account for retail investors. The idea for COIN, short for “Conscious Investor,” grew out of a 2016 hackathon held by financial services firm John Hancock. The platform uses robo- or algorithmic investing to help individuals invest as little as $50 in portfolios of public equities aligned with the U.N. Sustainable Development Goals. Founder Megan Schleck told ImpactAlpha that she recognizes that “true impact is hard to do in a product that’s accessible for everyone.” COIN’s focus is elevating everyday investors’ decision-making power. “We’re trying to give all people access to make their opinions known as best they can.” COIN is part of an expanding menu of retail impact investing options from Aspiration, CNote, Ellevest, and others. Dig in.

Remix raises $15 million to improve city transit. As urban populations swell, startups have jumped into transportation services traditionally offered by the public sector. Startups like San Francisco-based Remix are trying to help cities manage “the proliferation of private mobility options, including ridesharing, dockless bikes, e-scooters, and eventually autonomous vehicles.” Remix makes a mapping tool that is helping planners in more than 300 cities manage transportation infrastructure and both public and private services. It raised a $15 million Series B round from Energy Impact Partners, a utility-backed investment fund, and Sequoia Capital. Check it out.

Superfood company Kuli Kuli raises $5 million from corporate and impact investors. Oakland, Calif.-based food venture Kuli Kuli makes a range of health products from moringa, a plant founder Lisa Curtis discovered as a Peace Corps volunteer in West Africa. The five-year old company works with more than 1,300 farmers in the region and Kuli Kuli’s products are sold in 7,000 stores in the U.S. With a $5 million Series B round, the company is looking to market moringa ingredients to other food businesses. Investors including Kellogg’s venture fund eighteen94 capital, family-owned Griffith Goods, InvestEco and VilCap Investments backed the round. Here’s more.

- Time machine. Read about Kuli Kuli’s crowdfunding success…in 2014.

Agents of Impact: Follow the Talent

Follow the talent. Sev Vettivetpillai departs LGT Impact as part of a reorganization at the financial services firm owned by the royal family of Liechtenstein… David Bohigian takes the helm as acting president and CEO at the Overseas Private Investment Corp. OPIC’s Ray Washburne stepped down earlier this month… Siobhan Dullea is the new CEO of accelerator network MassChallenge… Marcel Rodgers, ex- of Resonant Energy, joins Sunwealth as a project development manager.

Seize the Opportunity. San Francisco-based Obvious Ventures is recruiting a senior associate… Veris Wealth Partners is hiring a chief operating officer in San Francisco… Tideline is looking for a director in New York… McKnight Foundation seeks an investment analysts in Minneapolis.

Apply, respond, submit. MIT’s Solve seeks solutions for its 2019 global challenges in the circular economy, community-driven innovation, early childhood development and healthy cities… Applications are open for the Women of Ireland Fund.

— March 4, 2019.