Greetings, Agents of Impact!

👋 Join us on LinkedIn Live: Unlocking social returns on investments in HBCUs. With their massive contribution to educational opportunity and economic mobility, historically Black colleges and universities may represent the ultimate social impact investment. ImpactAlpha contributing editor Sherrell Dorsey, founder of The Plug, and David Bank will explore how investors, employers and policymakers are generating social returns on investments in HBCUs, with Carla Whitlock of Tuskegee University, JFF’s Taj Eldridge, Milken Institute’s Troy Duffie, and other special guests, Wednesday, July 26 at 10 am PT / 1pm ET / 6pm London. RSVP today.

Featured: Ownership Economy

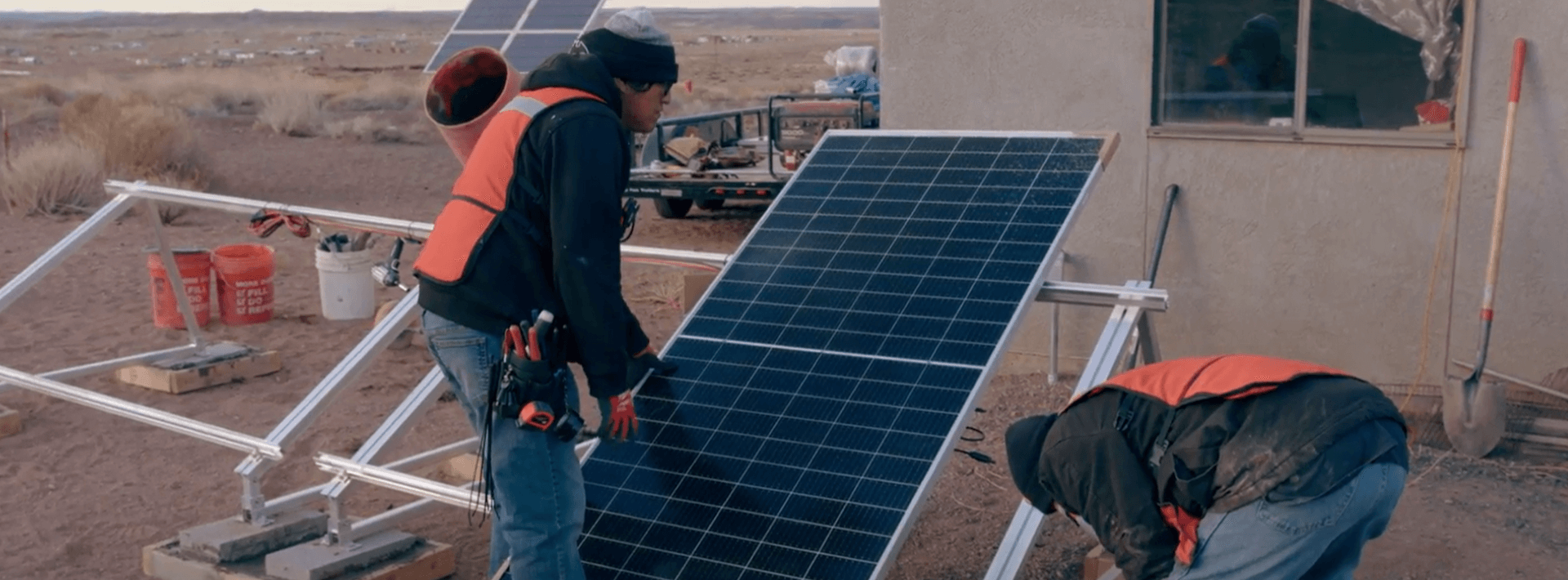

Native-led Navajo Power leans into the just transition with community benefits and local jobs. Rapid development of clean energy capacity and a just transition are needed to confront the increasingly urgent climate crisis. Navajo Power is out to prove that it’s possible to profitably decarbonize the economy and strengthen and build wealth in Indigenous communities. In five years, the solar developer has established a three-gigawatt pipeline of solar-plus-storage projects in tribal communities across the United States, including a 750-megawatt facility near a now defunct 2.3-gigawatt coal-fired power plant on Navajo Nation. When the company’s projects come online, local communities will get a cut of the profits to use as they see fit. “It’s a way for us to reinvest in communities beyond traditional land leases and taxes,” Navajo Power’s Brett Isaac tells ImpactAlpha, adding, “We’re able to utilize the benefit of working with communities to build our company.”

Isaac launched Navajo Power in 2018 to flip the traditionally extractive energy industry on its head. Coal mining was until recently the main source of jobs on the Navajo Nation, the largest tribal reservation in the US. The power was exported; many residents on the reservation are not connected to the electricity grid. “Everyone asks when we come out to start these projects, ‘What are you going to do for us?’” says Isaac. A trust controlled by Navajo CDFI holds 10% of Navajo Power, a public benefit corporation. Loan repayment savings from below-market-rate debt are being reinvested in communities where Navajo Power’s projects are based. A joint venture with off-grid solar provider Ilumexico is providing solar home systems for energy-poor Indigenous households. Phrases like “community benefits,” “stakeholder engagement,” and “transparency” dot discussions of the just transition, Isaac says in a Q&A with ImpactAlpha. “We’re not just trying to execute on theory, we’re stretching it.”

- Keep reading Jessica Pothering’s Q&A with Navajo Power’s Brett Isaac and Michael Cox on ImpactAlpha.

Dealflow: Catalytic Capital

BII anchors SDG Outcomes Fund with $10 million for development impact bonds. The fund is seeking $100 million to seed approximately 15 to 20 “development impact bonds” that target positive health, education, employment and environmental outcomes in West Africa and South Asia. British International Investment’s commitment marks its first investment in development impact bonds, contracts that are repaid when social and environmental outcomes are achieved. The UK’s development finance institution joins the Development Finance Corp. as an anchor investor in the fund. Other investors include Dubai-based Legatum, the Tsao Family Office and high-net-worth individuals. UBS Optimus Foundation and Bridges Outcomes Partnerships, a nonprofit subsidiary of Bridges Fund Management, launched the fund “to improve lives at scale and, over time, to transform the way in which development projects are designed and delivered,” said Bridges’ Mila Lukic.

- Strategic partners. In Ghana and Sierra Leone, the SDG Outcomes fund backed government programs to improve education outcomes for young children. In Nigeria, the fund backed Wecycler, a plastic-waste recycling social enterprise that aims to collect over 33,000 tons of plastic waste over five years and create more than 700 jobs. Tsao’s Bryan Goh said the family office joined both philanthropic and investment tranches in the fund “to fully participate in the blended finance structure.” Donations from over 30 UBS clients provide a 20% first-loss layer to catalyze private investments.

- Check it out.

Terabase and PVcase raise capital for solar design and construction. More than 50 terawatts of solar capacity are needed globally by 2050 to stave off catastrophic global warming. Investors are keying in on startups to speed solar development and lower costs. Berkeley, Calif.-based Terabase raised $25 million from Fifth Wall, EDP Ventures and existing investors to roll out its construction automation software for large-scale solar power plants. The company’s Terafab “factory to make factories” in Woodland, Calif. uses digital twin modeling, robotics and supply chain and inventory software to speed up solar plant construction. The factory is expected to begin commercial operations later this year. The fundraise follows Terabase’s $44 million Series B round last August, backed by Breakthrough Energy Ventures and Prelude Ventures.

- Solar design. Lithuania’s PVcase (short for PhotoVoltaic Computer Aided Solar Engineering) is tackling a related challenge: taming the multiple data sources that solar engineers need to design projects. Utility-scale solar is poised for explosive growth, “yet it currently lacks the digital tools needed to meet the demand of the market,” said John Tough of Energize Ventures, which invested in PVcase’s $100 million Series B round along with Highland Capital and venture firm Elephant. “Software solutions aimed at automating solar workflows and increasing data integrity are required for the market to become profitable and scalable.”

- Share this.

Dealflow overflow. Other news crossing our desks:

- Denver-based Koloma raked in $91 million from Breakthrough Energy Ventures, Energy Impact Partners and others to drill for hydrogen stored underground. (Carboncredits)

- Nevada-based lithium-ion battery recycler Redwood Materials is in talks to raise $700 million, at an estimated $5 billion valuation. The company secured a $2 billion loan from the US Department of Energy for a local EV battery plant in February (see, “Redwood Materials arranges $2 billion Energy Department loan for EV battery facility”).

- Rwanda’s Kasha Global raised $21 million in Series B financing to expand its last-mile delivery service for contraceptives and women’s menstrual care and hygiene products. (TechCrunch)

Six Short Signals: What We’re Reading

🍻 Brewing employee ownership. The unionized workers of Anchor Brewing, the historic San Francisco brewery that announced it will shutter, have launched an effort to purchase the brewery and run it as a worker co-op. (Vinepair)

📐 Get impact ready. Tools. Standards. Data. IMM nerds unite! The UK Impact Investing Institute’s learning hub has compiled resources to bring you up to speed on impact measurement, management and reporting. (Impact Investing Institute)

💼 Corporate impact VC. Impact-driven corporate venture capital funds like those from Salesforce and Telus can provide portfolio companies with patient financial capital, mission alignment, in-house technical expertise, and access to new markets. (RBC Capital Markets)

☀️ Greening the Gulf. The push from Saudi Arabia, the UAE and Qatar into clean energy is cause for cautious optimism. The Gulf States may be willing to invest in places Western countries will not. (Foreign Affairs)

⚖️ Missy’s climate mission. Missy Sims, an Armani-and-Rolex wearing observant Catholic from a small Midwestern town, is the singular force behind a creative legal gambit to make oil and gas companies pay for the devastation wrought by climate change in Puerto Rico. (The New York Times)

🌾 Agtech in India. Seven of 10 smallholder farmers in India have lost more than half their crops in the past three years due to climate-related challenges, according to a new study. The upside: Farmers are spending less time on farming thanks to technology advances. (Rockefeller Foundation)

Agents of Impact: Follow the Talent

Sherry Madera, senior vice president of public policy at Mastercard, will step into a new role as CEO of CDP (formerly the Carbon Disclosure Project)… Eric Nee is retiring in January after 17 years as editor of the Stanford Social Innovation Review. The magazine is on the hunt for a replacement… Skoll Foundation seeks a program manager in Palo Alto.

Maycomb Capital is looking for an analyst in New York… In Washington, DC, Open Road Alliance is hiring an investment officer… Also in DC, Invest in Our Future, a philanthropic initiative focused on the energy transition, is looking for an executive director… Health Forward Foundation is recruiting a principal impact strategist in Kansas City.

Northern Arc Capital has an opening for a senior associate in Mumbai… Also in Mumbai, GreenArc Capital is on the hunt for a vice president of engineering… Investing in Women is looking for an impact investing technical lead in Manila… Global Fund for Women seeks a US-based senior director of participatory approaches… VentureESG is hiring a London-based research fellow to focus on materiality for venture capital.

Thank you for your impact.

– July 24, 2023