Greetings, Agents of Impact!

In today’s Brief:

- Justice40’s accelerating impact

- European battery recycling

- Infrastructure in Africa’s underserved markets

- New record for new businesses

👋 Hop on today’s Call: Compensating impact fund managers for… impact. Join Aunnie Patton Power of The ImPact, Uli Grabenwarter of the European Investment Fund, Gilberto Ribeiro of Vox Capital, Santiago Alvarez of ALIVE Ventures, Bjoern Struewer of Roots of Impact, and other Agents of Impact, in conversation with David Bank and Jessica Pothering, today at 10am PT / 1pm ET / 6pm London. There’s still time to RSVP.

- Background reading: “From funds to managers to enterprises, some investors are aligning incentives for impact,” and “Navigating the metrics and management of impact incentives.”

Featured: Policy Corner

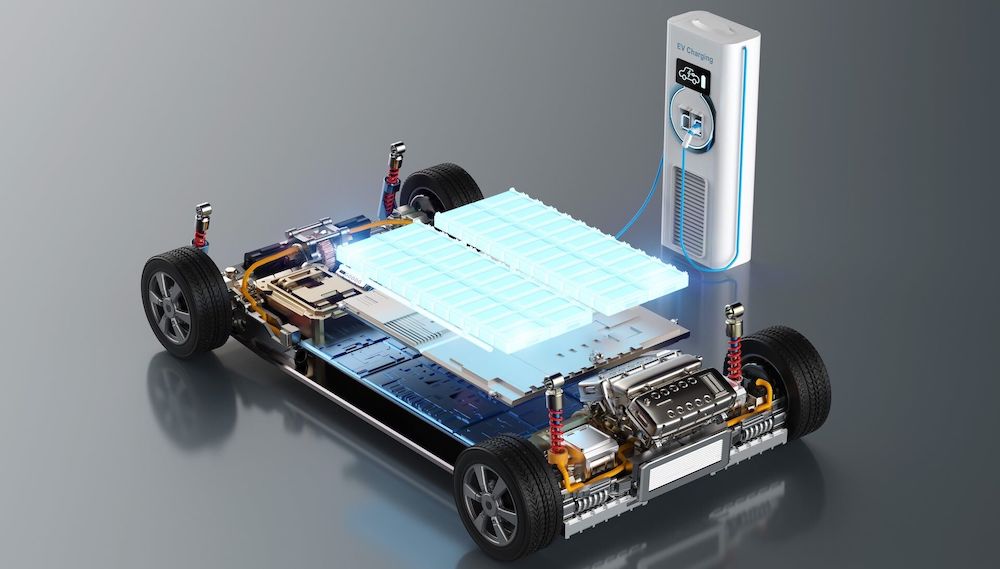

Justice40: Frontline communities step up to deploy historic federal climate funding. When the US Federal Highway Administration last week announced $623 million in grants to install public charging stations for electric vehicles across the country, more than half of the funds went to community-driven projects in underserved neighborhoods. Three years after President Biden launched the Justice40 initiative with an executive order prioritizing underserved communities in an ambitious reimagining of federal spending, those communities are stepping up to jumpstart projects that can create good jobs, reduce pollution and build economic and climate resilience. The once-in-a-generation opportunity won’t last forever. “We have a short amount of time to really maximize this historic federal investment in American cities,” Cleveland Mayor Justin Bibb tells ImpactAlpha.

- Frontline communities. The Justice40 initiative calls for 40% of key federal funding to flow to historically marginalized communities. Cleveland has used federal funds to train residents for jobs installing solar panels, weatherizing homes and laying broadband, says Bibb. Via a partnership with a local nonprofit, the city was awarded $500 million from the American Rescue Plan to redevelop brownfield sites, attract employers and create quality jobs. Says Bibb: “We couldn’t have made that investment without a direct stimulus going to us from the federal government.”

- Capacity building. Given the complexity of navigating the laws, nonprofits are standing up intermediaries to help frontline communities access the historic funding. The Solutions Project in Oakland, Calif., joined up with the Partnership for Southern Equity in Atlanta and Chicago-based Elevate to create the Justice40 Accelerator, which provides technical assistance and $25,000 grants to help local groups apply for federal funds. The accelerator has helped dozens of community-led projects secure a total of $43 million, including a $10 million grant to the Chicago nonprofit Blacks in Green so Midwestern communities can develop green infrastructure projects. The West Georgia Farmers Cooperative won $1.1 million from the US Department of Agriculture. The accelerator’s revolving loan fund helps cover project developers until they are reimbursed by the government.

- Tracking progress. A November report by the Clean Investment Monitor analyzing the first 12 months of the Inflation Reduction Act found that 40.5% of overall clean investment went to low-income communities. Manufacturing investments spurred by the IRA’s 45X Advanced Manufacturing Production Credit have primarily gone to economically disadvantaged counties, according to a Treasury Department analysis. “Justice40 has been instrumental in focusing entrepreneurs and developers on working with frontline communities,” said Dawn Lippert of Elemental Excelerator, which received $1 million from the Rockefeller Foundation to work with community projects to unlock federal funds. “We need much more capacity at the local level in order to accelerate implementation.”

- Keep reading, “Justice40: Frontline communities step up to deploy historic federal climate funding,” by Amy Cortese and Andrea Riquier on ImpactAlpha.

Dealflow: Green Infrastructure

Swedish battery maker Northvolt raises $5 billion for battery recycling. Stockholm-based Northvolt isn’t just looking to lead the green battery race in Europe – it’s plotting world domination. Since 2016, the company has secured over $55 billion in contracts for lithium-ion batteries from BMW, Scania, Volvo, Volkswagen and other global customers. Northvolt is rolling out batteries from its flagship gigafactory in Sweden. The new $5 billion debt financing package, backed by nearly two dozen commercial banks including the European and Nordic investment banks, brings the company’s total funding to $13 billion. The fresh funds will help Northvolt expand its battery recycling plant. Northvolt aims to source half of its raw materials for new batteries from recycled batteries over the next decade. “I’m proud to see how our ambition to mass produce the world’s greenest battery attracts top-tier financial partners,” said Northvolt’s Emma Nehrenheim.

- Charged up. Battery investments rose from $979 million in 2020 to $6.2 billion in 2023, even as overall EV investment declined (see, “Battery innovation speeds the energy transition”). Northvolt is seeking to build gigafactories with 150 gigawatt-hours of annual capacity for the projected 145 million electric vehicles that could hit the road by 2030.

- Check it out.

EAIF locks in $294 million in debt for infrastructure in Africa. The $100 billion gap in Africa’s annual infrastructure financing needs isn’t evenly spread. The Emerging Africa Infrastructure Fund is known for backing projects in Chad, Côte d’Ivoire and Africa’s other underdeveloped markets (see, “Building investment pathways in the world’s most neglected markets“). It often provides first-in senior debt to catalyze other private investors, and scales back its commitments for projects with sufficient private market interest. EAIF’s Martijn Proos said the fund’s latest debt round is “a sign of private investor confidence that strengthens our ability to pioneer new models for infrastructure development.”

- Catalytic capital. EAIF is part of the Private Infrastructure Development Group, an investment organization backed by European donor countries to catalyze infrastructure investments in Africa and Asia with vehicles for lending and derisking. EAIF has financed 96 projects in 20 African countries, including a $30 million investment for AXIAN Energy’s solar pipeline. It plans to expand to Asia this year.

- Institutional investors. Allianz Global Investors and German development bank KfW topped up previous investments in EAIF. South Africa-based Standard Bank provided $100 million in sustainability linked credit and term-debt.

- Share this post.

Dealflow overflow. Investment news crossing our desks:

- HCAP Partners will apply its “gainful jobs approach” to its newest portfolio company Apprio, a Black-led health tech company that connects uninsured patients to affordable medical coverage (see, “HCAP Partners raises $353 million to take its good jobs strategy nationwide”). (HCAP)

- UK-based Tokamak Energy, which is looking to commercialize its nuclear fusion process that uses high-temperature superconducting magnets, secured $50 million in an ongoing Series C round. (Sifted)

- Cactos, a Finnish smart energy storage systems developer, scored over €26 million ($28.3 million) from OP Finland Infrastructure, Finnish Climate Fund and other investors. (FinSMEs)

- Furbnow snagged £950,000 ($1.2 million) in a round backed by Norrsken Accelerator and other investors to provide energy retrofits for homes in the UK. (BusinessCloud)

Short Signals: What We’re Reading

📈 New record for new businesses. Roughly 5.5 million Americans filed applications to start new businesses in 2023 – a new high, according to data from the US Census Bureau’s Business Formation Statistics. The startup surge has been led by states in the Mountain West and Southeast. (Economic Innovation Group)

⚡ Climate-centric consumer tech. ImpactAlpha has been calling the sustainability shift in consumer electronics for years. At the Consumer Electronics Show in Las Vegas last week, a climate-centric future was on full display, from home batteries to hydrogen, electric grills to EVs. Two years ago, “there were companies mentioning it, but now everyone is talking about it,” LG Nova’s Limor Schafman told Bloomberg. (Bloomberg)

🌱 Global cleantech 100. Which 100 private companies today are most likely to make significant market impact over the next 10 years? This year’s list from Cleantech Group features solar leaders (Omnidian, Raptor), storage and batteries (Rondo Energy, Energy Dome), critical minerals (Lilac Solutions, Nth Power), shipping (Amogy) and aviation (OXCCU). (Cleantech Group)

♿ Accelerating disability tech. I2Gether-International, a startup accelerator run by and for entrepreneurs with disabilities, has partnered with tech company BuildWithin and the US Department of Labor Apprenticeship Intermediary to create the first-ever apprenticeship program for aspiring founders with disabilities. (I2Gether-International)

- Bonus. AI’s next billion-person market: People who live with disabilities. (Axios)

💲 Black wealth is increasing. So is the racial wealth gap. Housing equity has driven increases in Black wealth in recent years. That growth has paled compared to gains white households made from investment returns. “Wealth begets wealth,” write researchers at Brookings Institution. Growth in Black ownership is positive, they say. “It is not enough to combat the compounding effect of wealth.” (Brookings Institution)

⏳ Social progress, stagnating. The annual release of the Social Progress Index provides one of the most comprehensive views into the social and environmental state of society. The outlook: not good. In total, only 32 countries saw an increase in their social progress. Sixty-one countries saw a significant decline, while 77 more stagnated. “The downturn marks the world’s first social progress recession in the past decade,” according to Social Progress Imperative. (Social Progress Imperative)

Agents of Impact: Follow the Talent

US SIF names Envestnet’s Kiley Miller and Elizabeth Levy of Trillium Asset Management to its board of directors… PayPal is hiring a director of ESG reporting and operations… Starbucks seeks a senior manager of global responsibility and social impact… The Pivot Fund is looking for a staff associate… The European Network Against Racism Foundation has an opening for a fund coordinator in Brussels… Accion is recruiting a vice president of practice area program management… Rockefeller Foundation seeks summer associates for its Economic Equity initiative and its Health Initiative team… VC Include has opened applications for its fellowship for emerging impact fund managers.

👉 View (or post) impact investing jobs on ImpactAlpha’s new Career Hub.

Thank you for your impact!

– Jan. 17, 2024