Greetings, Agents of Impact!

Featured: Fail Forward

Blowup at Bitwise reveals weaknesses in impact due diligence. Over drinks or on the sidelines of conferences, it’s not uncommon to hear impact investing practitioners wish for a fuller airing of the industry’s flops to go along with celebrations of its successes. Failure is good, they say, insofar as it reflects a willingness to take risks, or at least is educational, with lessons that can help future investors avoid the same mistakes. When the failures occur on their watch, however, investors are less talkative. The exact circumstances of this month’s dramatic blowup of Bitwise Industries, the Fresno, Calif.-based tech job training program and business incubator, are not yet clear. One obvious lesson: Don’t let impact hype blind you to financial due diligence. “We have continued to double-down round after round and the skeptics have been proved wrong round after round,” Mitch Kapor of Kapor Capital, a board member and early investor, told ImpactAlpha in March. The social enterprise darling furloughed its 900 employees and suspended operations on May 31. Co-CEOs Jake Soberal and Irma Olguin Jr. were fired the next day.

- Rapid expansion. Bitwise expanded rapidly to new cities, scooping up buildings and acquiring small software and consulting firms. Warning signs began to surface as early as January 2022, when Bitwise was sued by real estate partners and forced to acquire a building for $22 million in a settlement. The company faces multiple lawsuits from employees, partners and lenders. Mea culpa: ImpactAlpha contributed to Bitwise’s early buzz. Since we first profiled co-founder Olguin back in 2019, we’ve written a half-dozen stories as the company went on to raise at least $157 million over several financing rounds, including $80 million from Kapor Capital, Motley Fool, Citi Impact Fund and Goldman Sachs Asset Management in late February.

- Lax oversight. Mitch and Freada Klein Kapor, the co-founders of Kapor Capital, highlighted the company in their recent book, “Closing the Equity Gap: Creating Wealth and Fostering Justice in Startup Investing.” Three months before Bitwise blew up, Kapor Center completed a 17-page due diligence document, according to The Information. Citing the ongoing investigations and litigation, Kapor and others declined to discuss the company’s meltdown. Klein Kapor did tell The Information, “From where I sit, we were presented not just with a general sentiment that things were okay, but with financials that seemed to [now] not match reality.” She added, “The picture of Jake and Irma that is emerging now… bears no resemblance to how they have presented themselves to me and to others for many, many years.” Another Kapor Capital portfolio company, the LGBTQ+ neobank Daylight, is shutting down this week amid allegations of improprieties.

- Fallout. Some former Bitwise employees have resorted to Gofundme campaigns to make ends meet. “One venture capitalist’s lesson learned is someone else’s eviction notice,” a former Bitwise marketing director wrote in The Fresno Bee. “Maybe to some investors, startup funding is monopoly money. But it’s real to the underdogs who can’t make rent.”

- Keep reading, “Blowup at Bitwise Industries reveals weaknesses in impact due diligence,” by Roodgally Senatus, David Bank and Amy Cortese on ImpactAlpha.

Dealflow: Muni Impact

Impact muni bond: $1 billion in green bonds to reduce the cost of clean energy in Southern California. California utilities are leveraging a bond instrument long used to prepay for natural gas to drive down the costs of procuring clean energy. This month, California Community Choice Financing Authority issued nearly $1 billion in bonded debt to finance the acquisition of clean energy by the Clean Power Alliance of Southern California, the fourth-largest electricity provider in California. ImpactAlpha is featuring the green bond as part of our partnership with HIP Investor to highlight bond issues with social and/or environmental significance. The series has featured bonds in Kansas City, Santa Clara, Calif., Los Angeles, Philadelphia, the Twin Cities, Arizona and North Carolina.

- Prepaid renewable energy. Tax-exempt prepayment bonds have been used in the US since the early 1990s to lock-in the price of energy. First, a municipal bond issuer issues tax-exempt bonds to finance a prepayment of energy; second, a taxable energy supplier uses the proceeds of the bond to provide a discount to a tax exempt public electricity supplier; and finally, the three parties enter a long-term energy supply agreement for clean electricity from solar, wind, geothermal or hydropower.

- Accessible and affordable. The nearly $1 billion bond is expected to lower costs of renewable energy procurement for the Clean Power Alliance by an average of $8.3 million per year during the first eight years of the bond. “This municipal bond is an example of how clean electricity can become more accessible and more affordable,” says Rose Fadjia Joseph of HIP Investor, which gives CPA an above average impact rating of 64 (on a 100 point scale).

Illumen Capital and MassMutual back Supply Change Capital to invest in the future of food. The LA-based early-stage venture firm is gearing up for the final close of its planned $40 million fund to invest in women and diverse tech founders working toward a more resilient and sustainable food system. “Food is also culture,” Supply Change’s Shayna Harris told ImpactAlpha, adding, “Food is responsible for up to a third of our emissions. We can’t address the climate crisis without thinking about it.” Illumen backed Supply Change via its Catalyst Fund; MassMutual invested through its First Fund Initiative, a $150 million commitment to co-invest with Black, Indigenous and Latino fund managers.

- Returns on inclusion. Harris and Supply Change co-founder Noramay Cadena joined other first-time women of color fund managers to form the Ally Capital Collab to coordinate fundraising efforts. Supply Change has received commitments from VC Include, Bank of America, General Mills and other investors. The fund has deployed more than $13 million in 15 companies. The company’s impact report details its impact scoring.

Dealflow overflow. Other news crossing our desks:

- Upaya Social Ventures backed WeVois Labs in India to “improve incomes for sanitation workers while improving overall waste collection efficiency.” (Upaya Social Ventures)

- The Emerging Africa Infrastructure Fund and FMO provided project financing to Africa REN to develop a solar + battery project in Senegal. (PV Magazine)

- Hyfé raised $9 million from The Engine, Refactor Capital, Supply Change Capital (see above) and others to upcycle wastewater from food processing into ingredients for alternative-proteins. (Axios)

Impact Voices: Climate Adaptation

Smallholder farmers need holistic climate solutions, not quick fixes. Climate change could push more than 130 million people into extreme poverty by 2030. People with climate-sensitive livelihoods, like smallholder farmers, are among the most vulnerable. On-farm adaptation practices will be essential to small farmers’ climate resilience, writes Acumen’s Christopher Wayne in a guest post on ImpactAlpha. “They can’t shoulder the financial burden or risk without the assurance of new income streams and increased profits.” What’s needed, he says, is “a systems approach that centers the farmers’ needs and incorporates inputs, services, training, and access to markets.”

- Magic bullets. The idea that a single product, input or tech platform can solve farmers’ climate vulnerabilities is alluring to investors and agribusinesses. Billions of dollars have been invested in such solutions. “In our experience, however, it is not a successful approach,” Wayne warns. Acumen has invested in seven single-product or technology agri-ventures. “All resulted in write-downs or complete write-offs,” he says. “Farmers did not earn enough additional income to pay for the product or adopt it long-term.”

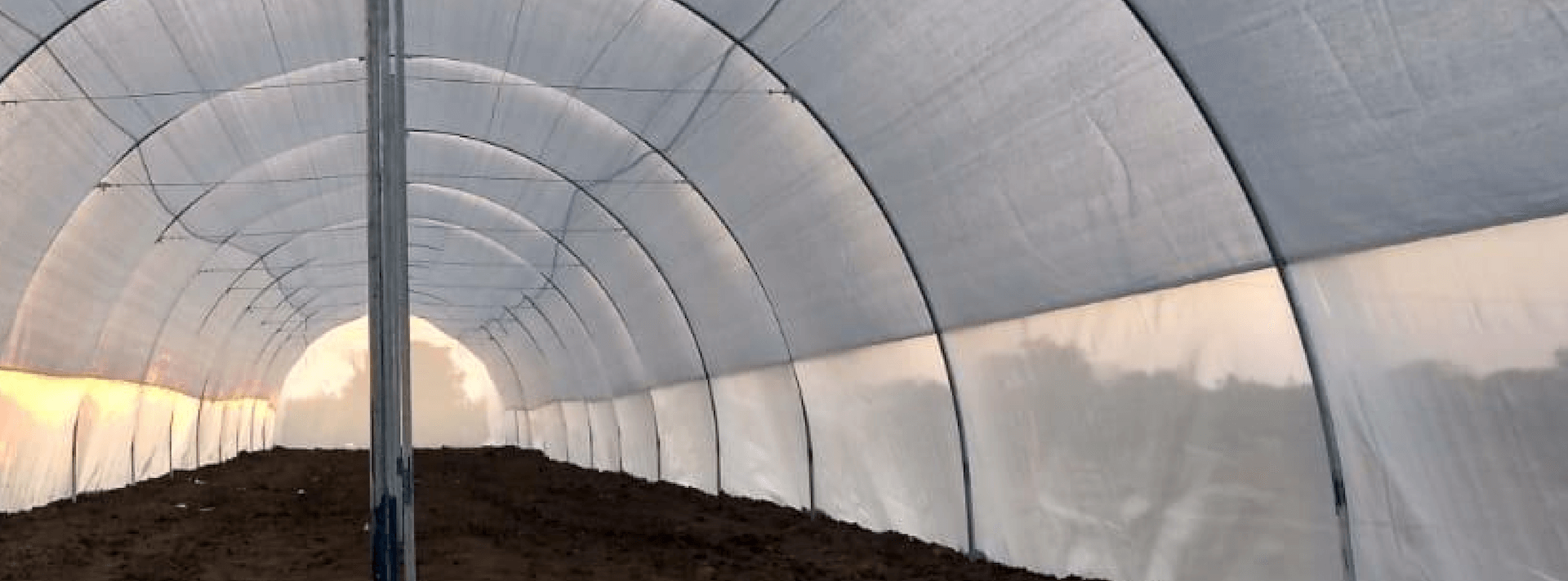

- Comprehensive models. Sierra Leone-based Lizard Earth helps farmers grow more climate-resilient cocoa by providing agricultural training and access to tree nurseries, then buys their cocoa at premium prices. Its farmers have increased incomes by 30% or more. Kheyti in India bundles low-cost greenhouses with input linkages and training on climate resilient farming practices. Its small farmer customers have nearly doubled their incomes. These are examples, Wayne says, of why investors should focus on solutions that “solve both climate variability and income variability.”

- Keep reading, “Smallholder farmers need holistic climate solutions, not quick fixes,“ by Acumen’s Christopher Wayne on ImpactAlpha.

Agents of Impact: Follow the Talent

Vinesh Kapil, ex- of Touchdown Ventures, joins Social Finance as associate director of impact investing… Alexis King Wilson, ex- of Chief, joins Endeavor as senior director of impact and inclusion… Open Road Alliance seeks an investment officer in Washington, DC… Rockefeller Philanthropy Advisors has an opening for a writer and editor in New York… Raise Green is hiring a climate finance project manager in New Haven, Conn… Levoca is recruiting an impact and sustainable finance associate in Miami… Ananda Impact Ventures is on the hunt for a remote investment manager and associate… This year’s Africa Impact Summit will take place July 13-14 in Cape Town.

Thank you for your impact.

– June 27, 2023