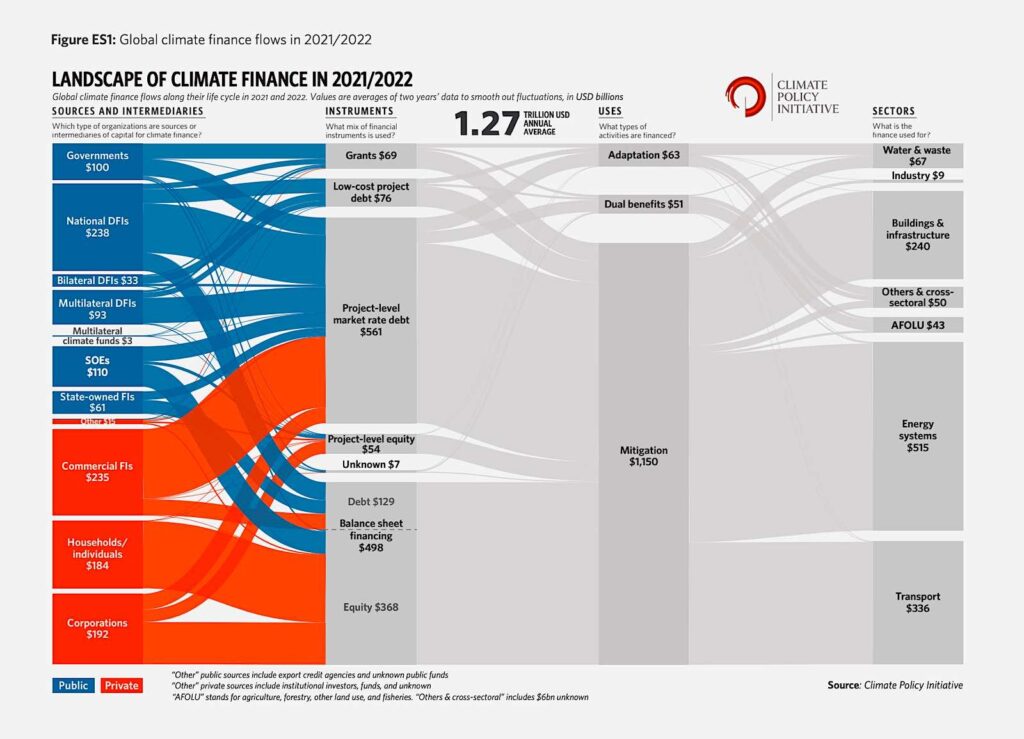

ImpactAlpha, Nov. 10 – Global climate finance flows reached an annual average of $1.3 trillion in 2021 and 2022. That’s double the amount of climate funding in 2019 and 2020. Still, the investments in climate mitigation and adaptation are a fifth of what is needed to stave off the worst effects of a warming planet, and just 1% of global GDP.

The latest biannual tally of global climate funding from research and advisory firm Climate Policy Initiative comes just weeks before world leaders gather in Dubai for the COP28 climate talks. “Our findings indicate the urgent need to work towards mobilizing finance” in regions and sectors where capital is lacking, CPI’s Barbara Buchner said on a briefing call.

The Global Landscape of Climate Finance, a comprehensive accounting of global climate finance flows, uses two-year averages to smooth out idiosyncrasies. The funding gains were propelled by strong investment in solar and wind power and electric vehicles. One country, China, accounted for just over half of all climate finance investment. Of the $1.3 trillion, just $30 billion, or less than 3% of annual investment, went to the least developed countries. Additional takeaways:

Billion-dollar babies

Multi-billion energy transition and climate tech funds have become the norm in venture capital and private equity. Brookfield Asset Management raised a fresh $6 billion green infrastructure debt fund, and TPG this week said it has committed 65% of its $7 billion Rise Climate fund and is eyeing a follow-on. As large as they are, private funds are just a tiny sliver of overall climate finance, which is dominated by development finance agencies on the public side and banks, corporations and households in the private sector.

Consumer power

Spurred by domestic policy incentives, households spent big on EVs, solar panels, heat pumps and other low carbon technologies.

Consumer spending drove most of the gains in private sector climate finance, accounting for almost a third of private funding flows – the largest share since CPI began collecting the data a decade ago. Sales of EVs, in particular, surged in China, Europe and the US.

Adaptation still lags

This year is likely to be the hottest on record, fueling more extreme weather and social and economic disruption. Finance aimed at helping people adapt to the changing climate rose 28%, to $63 billion on average, in 2021 and 2022.

That’s a fraction of the money invested in climate mitigation, and far short of the more than $200 billion a year in adaptation funds needed by developing countries by the end of the decade.

“Mainstreaming adaptation and resilience is going to be really important,” said CPI’s Baysa Naran.

Public finance

Climate funding by government-led institutions rose across the board, with national DFIs, in particular, upping their investment by 37%. The downside: most of the funding for already burdened developing nations continues to be market-rate debt.

Governments and DFIs doled out $561 billion in market rate debt, compared to $69 billion in grants. Reforming development finance institutions so they can take more risk and catalyze private sector investment – via loan guarantees, blended finance and other mechanisms – will be a key topic at COP28.

Bilateral DFIs make up a small portion of public finance, but two-thirds of their funding was in the form of low-cost project debt, which, CPI points out, “demonstrates their role in scaling concessional finance for low-carbon and climate-resilient development.”