ImpactAlpha, Sept. 28 – “We’re the government and we’re here to help.”

The Department of Energy is trying to turn the old punchline into reality. Armed with hundreds of billions of dollars from a trio of historic laws, the agency is stepping into the role of convener, funder and cheerleader for what it calls a “private sector-led, government-enabled” clean energy transition that will touch every sector of the economy.

The government “is ready to bet big, and bet smart,” Energy Secretary Jennifer Granholm told the 600 entrepreneurs and investors assembled for the DOE’s first-ever “Demonstrate Deploy Decarbonize” conference in Washington, DC, co-hosted by the Cleantech Leaders Climate Forum.

Energy officials are looking to mobilize private sector investment many times the $1 trillion the department has in grants, loans and tax incentives.

“The goal for all of these technologies is to rapidly scale them across the bridge to bankability, because we absolutely need them to thrive,” said Jigar Shah, the head of the DOE’s $400 billion Loan Programs Office, who presided over the gathering (listen to ImpactAlpha’s podcast conversation with Shah on building that ‘bridge to bankability.’)

On cue, the office today announced a $3 billion loan guarantee for Sunnova Energy, which will support the Houston company’s plans to bring its virtual power plants and energy-as-a-service to disadvantaged communities. It is the first commitment from the loan office for a VPP, which adds grid capacity by managing demand from distributed energy assets.

The Loan Programs Office has committed $14 billion in loans and guarantees, subject to meeting certain conditions, since the IRA was passed.

Scaling up

There was a palpable sense of urgency. The International Energy Agency’s latest Net Zero Roadmap insists that keeping warming to 1.5 °C is still possible, but “the path has narrowed.” At the same time, Republicans have threatened to roll back funding and subsidies greenlighted by the Inflation Reduction Act should they retake the presidency in 2024.

“This might be our last great opportunity to bend the curve on climate change while providing safe, affordable and reliable energy to the American public,” said David Crane, the DOE’s under secretary for infrastructure.

The conference drew entrepreneurs working in direct air capture, green cement, micro-grids and advanced nuclear, who are seizing the historic moment.

“We’re fired up and we’re trying to think about how we can move faster, how we can think bigger,” said Tim Hade, cofounder of Scale Microgrids, a New Jersey-based builder and operator of distributed energy. Scale Microgrids is hoping to provide 1% of the 160 gigawatts of virtual power plant capacity needed by 2030 – a goal that would have seemed impossible a few years ago, added Hade.

“Most of the problems today are focused on problems of scale,” noted JB Straubel of lithium ion recycler Redwood Materials. “How do we achieve that 7x, 10x scale?”

Industrial decarbonization

Chemicals, refining, iron and steel, food and beverage, pulp and paper, cement, aluminum, and glass – these eight sectors account for some 14% of US emissions, and are considered “hard to abate.”

Despite the characterization, “not everything is hard to decarbonize in the US industrial sector,” said Katherine Scott, with DOE’s office of technology transitions. “There are opportunities today to make money and to deploy in 2023.”

A recently published “Liftoff” report by DOE suggests that IRA incentives that boost the economics of industrial electrification, new materials and feedstocks, electrolytic hydrogen carbon capture and storage, and other technologies could reduce industrial emissions by 40% by 2030.

The agency is expected to announce its regional hydrogen hubs, along with $8 billion in funding, as early as next week.

Political risk mitigation

The elephant in the room is a looming government shutdown and the possibility of Republican wins in the 2024 election that could reverse climate policies.

“That’s not the type of stuff that tends to deter us,” said Jacob Susman of hydrogen startup Ambient Fuels. “Our industry has a lot of purpose-driven professionals who are here trying to solve the climate crisis.”

“They’re going to make it so that we have to drag our boulder up the hill at slightly slower pace,” he added, “but we’ll get there.”

There was also skepticism that Republicans could follow through on their threats – especially when the programs are creating a surge of new battery and EV plants in Republican-leaning states and municipalities.

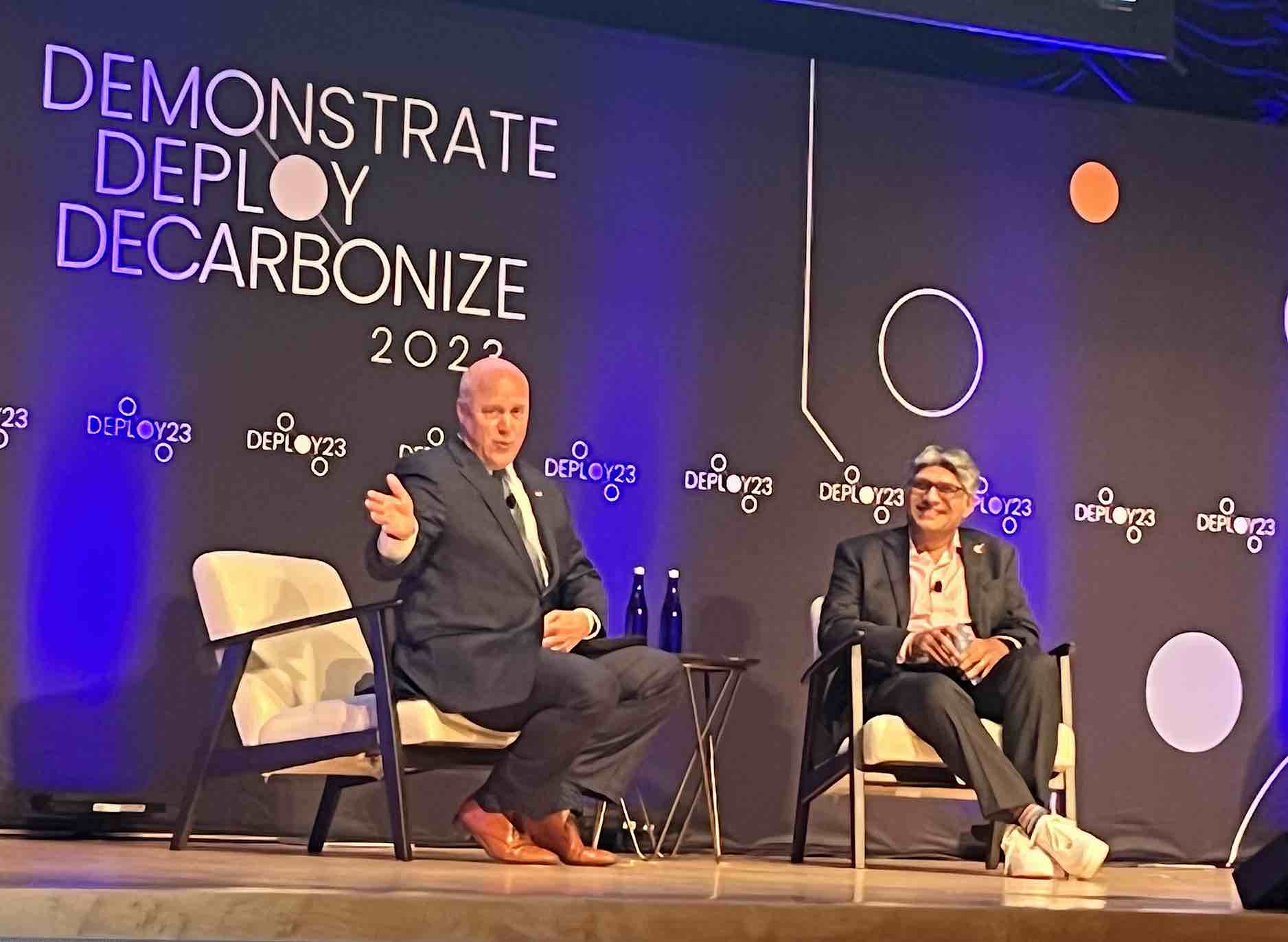

“I have not heard one politician who voted against the bill or is trying to repeal it say, ‘I don’t want clean water for my constituents,” or ‘No, I don’t want the battery plant,” Mitch Landrieu, former mayor of New Orleans and an advisor to the White House on infrastructure, said in conversation with Shah. “Once there’s this kind of money out there, and people actually using it, it’s really hard to take it back.”

Ramping up

Energy Department officials blanketed the Ronald Reagan building near Capitol Hill where the “Deploy23” conference took place (ironically, Reagan gutted renewable energy R&D budgets as well as solar and wind incentives during his administration). Many of the officials were in newly created roles and have been with the agency for just a few weeks or months. The IRA boosted the loan authority of the Loan Programs Office from $40 billion to $400 billion. If a private equity firm had $40 billion to invest, “they’d have a staff of 500,” said LPO’s Shah. “So we need to grow.”

The new energy at Energy has lured experienced professionals from the private sector. Shah, who cofounded sustainable infrastructure investor Generate Capital, is a well known pioneer in financing clean energy projects. Krane was the chief of energy company NRG. Giulia Siccardo was counseling corporations on low-carbon transitions at McKinsey before joining DOE’s Manufacturing and Energy Supply Chains office in June.

“We have a bunch of disruptors that want to activate the private sector, and we’re bringing that private sector thinking into the federal government,” said Vanessa Chan, another former McKinsey partner and engineering professor who is now Chief Commercialization Officer for the Department of Energy and Director of the Office of Technology Transitions.

Lynn Nguyen joined the Loan Programs Office in December to help manage the group’s growing portfolio after a career in development finance, including at the US International Development Finance Corp.

“It’s the place to be for climate finance right now,” she said. “It’s happening right here.”

Net Zero transition

The IEA’s 2023 update of its Net Zero Roadmap: A Global Pathway to Keep the 1.5 °C Goal in Reach zeroes in on four strategies to reach that goal: tripling renewable energy capacity, doubling efficiency, slashing methane emissions by 75% and boosting penetration of EVs and heat pumps.

As a result of the progress of renewable energy, electrification and efficiency, the IEA reduces the role of carbon capture and storage in its models by 40% in 2030 compared to the 2021 estimates. As in 2021, the updated roadmap reiterates that there is no room for new investments in coal, oil and natural gas.