MANA Nutrition delivers 500,000 packets of calorie-enriched peanut butter to malnutritioned children every day. Solidarium has equipped 25,000 artisans in Brazil to connect with buyers and corporate distributors. And Mosaic, the solar project financing platform, has raised a whopping $41 million.

Those are some of the highlights of the new impact report from the Unreasonable Institute, a leading early-stage impact accelerator based in Boulder, Colo., detailing the achievements of their portfolio companies over the past five years.

By the numbers: Unreasonable companies have raised a total of $72 million, including $55 million in investment. More than 90 percent of ventures that have gone through the program are still operating. The companies employ 2,900 people part- or full-time. None of the companies have yet provided exits for their investors, via acquisitions or public offerings, but several ventures have received acquisition offers.

Mosaic, based in Oakland, Calif., appears to by the biggest financial win among Unreasonable companies, by a long shot. The company, which allows large and small investors to loan money to pre-qualified solar projects, raised $41 million of the $72 million in total financing. Mosaic has been hiring briskly and last October received another $650,000 award from the U.S. Department of Energy (on top of $2 million in 2012) to expand its Home Solar Loan Program.

Following Mosaic, “MANA Nutrition is a leader in terms of both funding raised and revenue earned,” said Leigh Fisk, one of the organizers of the report.

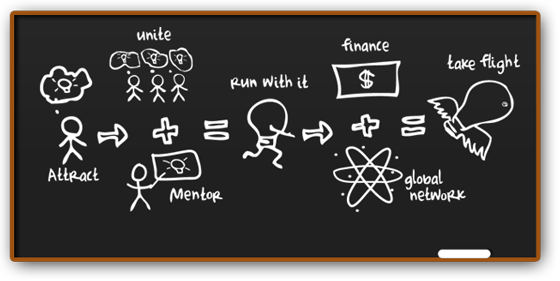

Entrepreneurs who have participated in Unreasonable’s program report that the experience has been useful in building their business. Nearly all (97 percent) of the entrepreneurs would recommend the program to a friend. Three out of four are still in touch with mentors from the program. One question that was not asked — “Did the experience contribute to the growth of their business?” — would be the primary focus of a tech incubator such as 500 Startups or Y-Combinator.

Reports such as Unreasonable’s are becoming more common as impact accelerators seek to demonstrate their, well, impact. Village Capital issued its own last year. And accelerators such as Global Social Benefit Incubator, Better Ventures (formerly Hub Ventures), Mentor Capital Network, Echoing Green, Impact Engine and many others are sharing knowledge via efforts such as Accelerating the Accelerators.