TGIF, Agents of Impact!

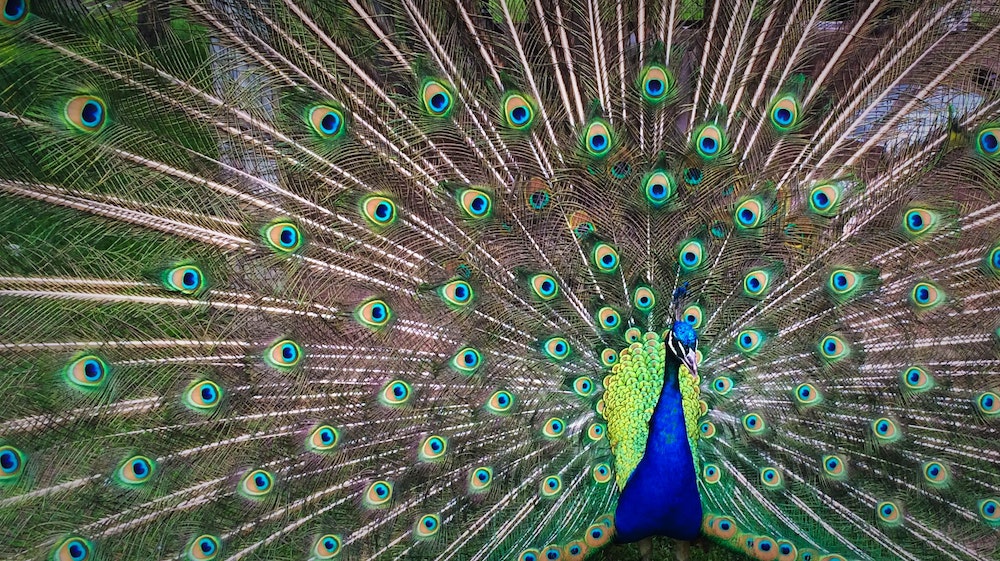

True colors, shining through. A handful of investors have risen to the triple challenge of COVID, climate and systematic racism. But it’s clear too few are meeting the moment with transformative strategies. “I do feel like the high-net-worths haven’t really stepped up,” says Ceniarth’s Diane Isenberg, this week’s Agent of Impact. Development finance institutions have been generally loath to take on the additional risk required for impact in a dramatically riskier environment (see No. 3, below). Asset managers, led by BlackRock, have yet to truly hold corporations accountable for their contributions to systemic risks like climate change and income inequality (No. 2). And the Trump administration has arguably itself become a systemic risk, not least because of its opposition to investment decision-making that considers environmental, social and governance, or ESG, factors aimed at identifying and mitigating just such risks (No 1).

As it becomes clear that we’re in for a long siege, impact investors will have plenty of opportunities to recoup (see surge in gender-lens funds, No. 4, equitable media opportunities, No. 5, and growth in capital India’s social ventures, No. 7). “This world makes you crazy, and you’ve taken all you can bear,” as Cyndi Lauper sings on this week’s Impact Briefing podcast. “So don’t be afraid to let them show, your true colors…”

– David Bank

The Week’s Impact Briefing (podcast)

Impact Briefing. On this week’s podcast, Brian Walsh chats with Amy Cortese about Blackrock’s proxy votes, the Trump administration’s pushback on ESG and how the crisis is pushing investors to show their true colors. We hear from Ceniarth’s Diane Isenberg, who lays down a “1/10th Challenge” for high-net-worth families. Plus, the headlines. Tune in, share, and follow ImpactAlpha’s podcasts on Apple, Spotify or wherever you listen.

The Week’s Big 7

1. Trump’s ESG blindspot. A new rule proposed by the U.S. Department of Labor would make it harder for retirement funds to invest in environmental, social and governance, or ESG, funds. Investors might blow through any new obstacles: Sustainable and ESG funds appear to have mitigated risk and even outperformed in the recent market volatility. More than $15 billion flowed to such funds in the first six months of this year. The skinny.

- Onward. Responding to the DOL proposal is the topic of today’s discussion hosted by The Predistribution Initiative and The Shareholder Commons. The comment period ends July 30. The ESG Advantage Benchmarking Platform from the Conference Board and ESUAGE aims to help U.S. companies compare executive pay, shareholder voting, board practices and other ESG factors.

2. BlackRock’s climate stewardship report falls flat. A few years ago, the $7 trillion asset manager might have gotten credit simply for its transparency around its proxy voting record. But after CEO Larry Fink in January pledged to take a tougher stand on climate action, BlackRock voted against management at just one in five companies it deemed as falling short. Said ShareAction’s Catherine Howarth, “BlackRock is complicit in slowing down climate action in the corporate sector.” Fuzzy math.

3. CDC’s Nick O’Donohoe: Risky times for development finance (podcast). When the coronavirus pandemic took hold in March, development finance institutions were virtually the only emerging-markets investors to stick it out. “Somebody has to do it,” CDC’s Nick O’Donohoe says on ImpactAlpha’s Agents of Impact podcast. Without liquidity, companies will fail and jobs will disappear, he says. “But clearly there’s significant risk involved.” Tune in.

4. Gender-lens investing surges. In its latest report, Project Sage tallied 138 “gender-lens” funds managing some $4.8 billion—up from 87 funds with $2.2 billion in assets last year. “This marks a shift in who has power to make investments,” write the authors. By the numbers.

- Also check out Criterion Institute’s new guide for investors, asset managers and philanthropists on how lesbian, gay, bisexual, transgender, queer, and intersex considerations are material to investment decision-making. More.

5. Equitable news is an investable opportunity. A new crop of Black press outlets, including Blavity, The TriiBE, The Root and The Plug, is “changing the lenses of victimization and dysfunction into lenses of empowerment and agency,” writes Neiman Reports’ Deborah Douglas. In a new report, Transform Finance and Ford Foundation unpack the challenges and opportunities to mobilize capital to help them grow. Dive in.

6. Centering on the needs of small businesses. Many impact investors define success based on their own goals. To build the diverse local economies we need, they should instead define and measure success by what local businesses need, argues John Hamilton of the New Hampshire Community Loan Fund, a community development financial institution. Hear him out.

7. Catalyzing impact capital in India. In the past decade, almost $10.8 billion in equity capital has been invested in Indian companies with a social mission. Social ventures have impact investors to thank for ushering in commercial capital. Dig in.

The Week’s Agent of Impact

Diane Isenberg, Ceniarth. For 35 years, Isenberg has been a working partner on her family’s 350-acre sheep farm in rural Wales. She also has worked as a teacher, a community organizer and on maternal health care in Bangladesh. So, when she became the custodian in 2013 of the fortune her father built, primarily as CEO of Nabors Industries, she knew what she wanted to do: deploy capital into marginal and vulnerable communities. Last year, Ceniarth made commitments to Blue Orchard’s InsuResilience Fund, SunFunder’s Solar Energy Transformation Fund and Global Partnerships’ Impact-First Development Fund, among at least 30 transactions. When the COVID crisis hit, Ceniarth quickly put up $3 million to backstop rural and Native community development financial institutions, or CDFIs, making small business loans under the federal Paycheck Protection Program. Over 10 years, Ceniarth is moving its entire $400 million portfolio into “impact-first capital preservation,” including rural agricultural loan funds in Africa, CDFIs in the U.S. and other low-return but high-impact investments.

Isenberg is the rare wealthy individual who is unafraid to call out other wealthy families, as well as the shibboleths of impact investing. “I do feel like the high-net-worths haven’t really stepped up,” Isenberg said on ImpactAlpha’s Agents of Impact podcast. And she is skeptical that the COVID crisis will usher in radically new approaches to investing. In response to ImpactAlpha’s 10x Challenge, Ceniarth is proposing a “1/10th Challenge,” calling on other high-net-worth family offices to allocate just 10% of their portfolios to impact-first opportunities in racial justice, gender equality, climate action and other areas. “You don’t need to go 100%, all-in with this, as we have, for this to be meaningful,” she says. “If everybody did a little bit, it would be hugely transformative.” If the strategy fails, we’re likely to hear about it. “I would welcome having a lot more discussion around failure” in impact investing, she says, “and a lot less discussion of how great we are, which I feel there is far too much of.”

- Share Diane Isenberg’s Agent of Impact story and like it on Instagram.

- Listen in to the full interview with Isenberg on ImpactAlpha’s Agents of Impact podcast.

The Week’s Dealflow

Fund news. Actis raises $3 billion for renewable energy in emerging markets… NEI launches an impact bond fund for Canadian investors… Rally Assets to invest for impact in public and private markets… Chelsea Clinton mulls ‘values conscious’ health- and ed-tech venture fund.

Agrifood investing. Blackstone leads alt-dairy maker Oatly’s $200 million funding round… Lightship Capital backs food tech startup FreshFry… Soplaya raises €3.5 million to streamline food logistics in Italy… Austin-based Vital Farms plans initial public offering… Animal-free proteins are growing revenues and raising capital.

Returns on inclusion. Meyer Memorial Trust commits $25 million to racial justice in Oregon… Open Society Foundations backs racial justice groups with $220 million… Beyoncé and NAACP team up on grants for Black-owned small businesses… Female investors power Rethink Impact’s $182 million gender-lens fund.

Conservation finance. Komaza secures $28 million for sustainable forestry in Africa… KKR’s Global Impact Fund backs GreenCollar’s environmental marketplace.

Health and wellbeing. India’s HealthQuad raises $68 million for its second healthcare fund… Doctor On Demand raises $75 million to expand telehealth in the U.S.

COVID relief. Open Road Alliance disburses $5.5 million in COVID-related bridge loans and grants to 40 enterprises.

Low-carbon future. Electric truck maker Rivian hauls in $2.5 billion.

The Week’s Talent

Sylvain Carle, ex- of Real Ventures, joins SecondMuse Capital as a senior director… Nithio CEO Hela Cheikhrouhou joins the board of the Global Impact Investing Network… Chuka Umunna, formerly of the U.K. parliament and Labour party, is Edelman’s new executive director and head of environmental, social and governance consulting… Purpose Built Communities’ CEO David Edwards steps down. The organization’s president, Carol Naughton, will serve as interim CEO.

The Week’s Jobs

Notley is hiring a program manager for its HomeFront Fund in Austin… AARP Foundation seeks a senior advisor of impact investing in Washington, D.C… The ImPact is hiring a manager of education and insight in the U.K… MCE Social Capital seeks a CEO, preferably in San Francisco or Denver… LeapFrog Investments seeks an associate director of investments in Singapore.

FMO is looking for a senior environmental and social officer in The Hague… PGGM is hiring a responsible investment advisor in Zeist, Netherlands… Santa Clara University’s Miller Center is recruiting a program manager for its GSBI accelerator… ImpactAssets seeks a business development associate in San Francisco.

Pacific Community Ventures is looking for an associate director or director for its research and consulting team in Oakland… City Light Capital seeks an analyst in New York… BlueHub Capital (formerly Boston Community Capital) is hiring a chief strategy and implementation officer in Boston… Rethink Education is looking for an analyst in New York.

Thank you for reading.

–July 17, 2020