Greetings, Agents of Impact!

Featured: Policy Corner

Pro-ESG forces rally to confront backlash against corporate accountability, workers rights and risk management. It took awhile, but advocates for the integration of environmental, social and governance factors in investment decisions are mobilizing their allies and their arguments to counter the well-coordinated campaign to demonize ESG. The attorneys general of 16 states and the District of Columbia wrote to congressional leaders last month rebutting the anti-ESG arguments made by 19 other attorneys general in an August letter to BlackRock CEO Larry Fink. Coalitions of climate, labor and “stakeholder capitalism” organizations are coordinating their messaging, social media and state-level organizing to quickly respond to rhetorical attacks and legislative proposals to roll back ESG policies and practices at state agencies and pension funds. “Most people are on our side when you describe what ESG is about in plain English,” said Chris Jurgens of Omidyar Network. “It’s about companies disclosing and managing their positive and negative impacts on workers, people, planet and communities.”

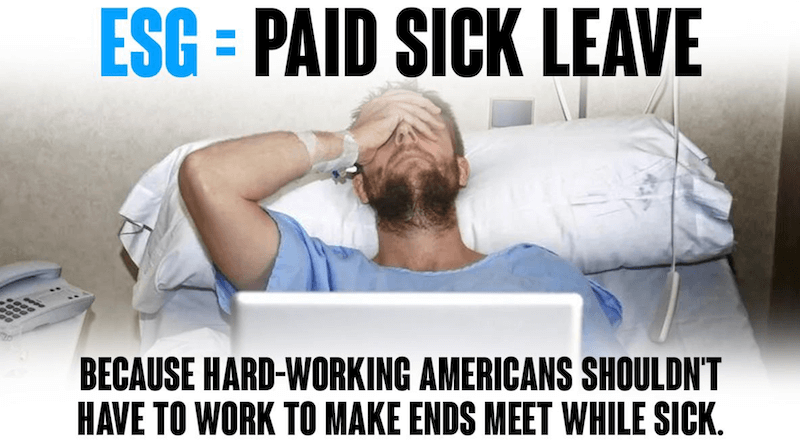

- Shifting the narrative. A July poll commissioned by Omidyar found bipartisan majorities in favor of companies measuring their impacts on workers, communities and the environment. Effective messaging: Disclosure and transparency “allow people to work, shop and invest based on their own values and beliefs” and to “advocate for workers and protect their pay and treatment.” Investors should highlight the “need for ESG data to pick companies with good long-term prospects.” Shareholder advocacy group As You Sow has organized the coalition ESG Amplify to share social media content (such as the example above), to drive a pro-ESG narrative. The goal, says ManifestSocial’s Ryon Harms, who is coordinating the effort, is to “overwhelm the regressive anti-ESG sentiment with an avalanche of positive messages.”

- Reclaiming ESG. The new confidence will be on display at this week’s Mission Investors Exchange conference in Baltimore, where ImpactAlpha’s David Bank will moderate the session, “Reclaiming ESG,” with Ford Foundation’s Roy Swan, Sorenson Impact’s Jim Sorenson, Capricorn Investment’s Kunle Apampa, and Lisa Woll of US SIF.

- Europe’s ESG edge. In Europe, asset owners are pushing ahead to implement ESG across the venture capital and tech ecosystem. Germany’s KfW Capital has invested €1.3 billion ($1.4 billion) in over 70 European VC funds. “Before we invest in VC funds, we assess the ESG management and integration of the fund managers,” KfW’s Theresa Bardubitzki said at the SuperVenture conference. European regulators and industry groups such as VentureESG or ESG_VC are driving ESG adoption in VC, “giving Europe an edge over Silicon Valley,” VentureESG’s Johannes Lenhard, Oxford Smith School’s David Kampmann, and Houlihan Lokey’s Moriam Masha write in a guest post, citing the blowups of FTX, Deliveroo and WeWork as examples of venture capital’s “ESG blindspot.”

- Keep reading, “Pro-ESG forces rally to confront backlash against corporate accountability, workers rights and risk management,” by David Bank on ImpactAlpha.

Sponsored by Mission Investors Exchange

‘We can make do, or we can make noise.’ In the pandemic lockdowns of spring 2020, many Black and Brown businesses owners in Forrest City, Ark. found themselves shut out of federal and state relief programs. “That familiar ‘here we go again’ feeling rose up in me,” Sherece West Scantlebury of the Winthrop Rockefeller Foundation writes as part of ImpactAlpha’s series with Mission Investors Exchange. The foundation worked with nonprofit leaders in the majority-Black region to launch and seed the Delta Owned loan fund. WRF and other funders have invested $1.3 million in the fund and facilitated a partnership with the Arkansas Small Business Administration to connect Delta businesses to SBA loans and resources. “This is what pursuing economic equity and systems disruption looks like for us,” says West Scantlebury. “As investors for impact and change, we have a choice. We can make do, or we can make noise.”

- Keep reading, “Investors must make noise so BIPOC entrepreneurs don’t have to make do,” by Sherece West Scantlebury of the Winthrop Rockefeller Foundation.

- Join the conversation. West Scantlebury will join Ford Foundation’s Darren Walker, the Annie E. Casey Foundation’s Lisa Hamilton and others at today’s opening plenary, “All in for Equity: Activating the Entire Foundation,” at Mission Investors Exchange’s national conference in Baltimore.

Dealflow: Inclusive Fintech

Creation Investments closes $270 million fund for financial inclusion in emerging markets. With its fifth fund, Creation will invest in eight to 10 companies in basic banking, insurance services and fintech-enabled affordable housing, education and supply chain finance, mostly in Mexico and India. Since 2007, Chicago-based Creation Investments has focused on deploying private credit and equity to microfinance institutions, small and medium enterprise lenders, banks and other financial services providers in emerging markets. The goal: expand access to financial capital and services for the 1.4 billion unbanked adults in emerging markets, primarily women, Creation’s Patrick Fisher told ImpactAlpha. Creation has local teams in Bangalore and Mexico City.

- Inclusive finance. Creation has invested over half the fund in five portfolio companies, including AVLA, a Chilean company that offers insurance and affordable loans to Latin American consumers and small businesses; India’s ReshaMandi, which runs a B2B online marketplace for local silk farmers, retailers and fashion small businesses; and DD360, a Mexican housing fintech company that provides mortgage loans to consumers and construction loans for developers.

- Share this post.

Nigeria’s Aruwa Capital raises more than $20 million for gender-lens investments. The Lagos-based firm raised 30% of the capital from local investors “who have a first-hand understanding of the operating terrain,” said Aruwa’s Adesuwa Okunbo Rhodes, “a trend we hope to see continue.” (See, “Agent of Impact: Adesuwa Okunbo Rhodes”). Aruwa launched in 2019 to cut checks of $500,000 to $2.5 million to Nigeria’s small and mid-sized companies and help them be more inclusive of female managers, workers and customers. Aruwa surpassed its fundraising target with backing from Visa Foundation, Mastercard Foundation, Nyala Venturesand others.

- First investments. Aruwa was the first investment of both Mastercard Foundation’s $200 million Africa Growth Fund and Nyala Ventures, a fund seeded by FSDAi to invest in first-time emerging market fund managers (see, “Nyala Venture aims to catalyze local fund managers to unlock capital for small businesses in Africa.”) Aruwa has invested 45% of its capital in six companies. Wemy Industries makes personal hygiene companies. Koolbooks makes renewably-powered refrigerators to support farmers and cut food waste. Women-led fintech venture Pngme uses mobile phone data to improve lending in Africa.

- Check it out.

Aqua-Spark secures €15 million from Silverstrand Capital for sustainable aquaculture. The allocation from the Singapore-based family office Silverstrand follows its 2020 investment of €10 million ($10.5 million). Silverstrand’s Kevin Chiu will join Aqua-Spark’s advisory board and Patti Chiu will sit on its investment committee. Utrecht-based Aqua-Spark manages €450 million in sustainable aquaculture investments for more than 300 investors in over 25 countries. Recent investments include African tilapia farm operator Lake Harvestand Portuguese sustainable seafood company Oceano Fresco.

- Financing fish. Husband-and-wife impact investors Amy Novogratz and Mike Velings launched Aqua-Spark in 2013 to meet the world’s growing demand for protein. “Fish supply 17% of the world’s protein, and by 2030 the planet is expected to eat nearly 20% more fish,” said Novogratz and Velings. “With our ocean approaching the brink of species collapse, this increase must come from sustainable sources: namely aquaculture.”

- Check it out.

Dealflow overflow. Other investment news crossing our desks:

- MooFarm scored $13 million in Series A funding, led by Aavishkaar, to provide India’s dairy farmers with access to credit, insurance and livestock management tools.

- Aye Finance raised $10 million from responsAbility to provide business loans to micro and small enterprises in India.

- Austin Community Foundation provided nearly $2.9 million in low-interest loans to SGI Ventures to build permanent supportive housing and services for the homeless.

- Sunwealth’s Solar Impact Fund secured $2.5 million from Connecticut-based Liberty Bank for community-based solar projects in diverse communities.

Impact Voices: Impact Management

For comparability’s sake, let’s really move impact measurement from outputs to outcomes. Designing impact investment performance instruments that actually measure outcomes was never going to be easy. But it is not impossible. “Commonly used measurement tools are doing a reasonable job of measuring outputs,” such as the number of people reached, says Tom Adams of 60 Decibels. Data remains scarce on the depth of impact on individual and household, or ‘outcome’ metrics. “It’s high time this changed,” Adams writes in a guest post.

- Comparing performance. The well-recognized need for comparable impact data spurred the Global Impact Investing Network to establish IRIS+ to provide a common taxonomy of indicators. However, “It is easier to define ‘what’ to measure than it is to solve for the ‘how’ of measurement itself,” Adams says.

- Listening to customers. 60 Decibels has pioneered cost-effective techniques for directly surveying customers. “Rather than consolidating whatever metrics are currently and easily available from the top-down, we instead have to do the hard work of building meaningful measures from the ground-up,” says Adams. “We need to first listen to the people who we hope to positively impact through the work we do, so that they can tell us what things change in their lives and, of these, which are most material to their wellbeing.”

- Keep reading, “For comparability’s sake, let’s really move impact measurement from outputs to outcomes,” by 60 Decibels’ Tom Adams.

Agents of Impact: Follow the Talent

Nonprofit Finance Fund namesBrenda Loya of Amalgamated Bank, Kris Putnam-Walkerly of Putnam Consulting Group, Gregory Robinson of Moody’s, and Joe Silver of Submittable to its board… Economist Sebastián Welisiejkojoins New Ventures as a partner… The MacArthur Foundation is recruiting a senior impact investments officer in Chicago… The Equality Fundseeks a vice president of its investment program in Ottawa, Ontario.

Maycomb Capital and the ZOMA Foundation’s Outcomes Finance Accelerator Fund invites social innovators to apply for loans… BSR, The Shift, SHARE, The Predistribution Initiative, Principles for Responsible Investment and Omidyar Network are co-hosting a webinar today on applying a human rights approach to real estate investing, today at 1pm ET/10am PT.

Thank you for your impact!

– Dec. 5, 2022