Greetings, Agents of Impact!

👋 Last chance to RSVP for tomorrow’s Call, “Optimizing muni bonds for racial equity,” Wednesday, Nov. 16 at 10am PT / 1pm ET / 6pm London. Join us.

Featured: Climate Finance

New narrative of climate action: Unstoppable progress and immense opportunity. It has become fashionable to dismiss global climate confabs like COP27 as so much “blah blah blah.” But for all the hot air, half-measures, backsliding and outright denialism, global climate action and falling costs have flattened the curve of global warming by a full degree Celsius from 2015 projections. To be sure, the new trajectory still points to a disastrous rise of 2.5 degrees Celsius in average temperatures over historical levels by the end of the century. The real takeaway: Global climate progress is not only possible, it’s happening. The S-curve of technology adoption makes the transition not slow, hard and forced, the think tank RMI says, but “fast, beneficial and inevitable.” So-called energy “experts” have consistently underestimated solar deployments and overestimated coal usage. The costs of new energy technologies, including solar, batteries and onshore and offshore wind have fallen by 60% to 90% in the last decade. “We’re not selling doom and gloom here,” says Rachel Kyte of the Fletcher School at Tufts University. “We’re selling what people want.”

History will see Russia’s invasion of Ukraine as the tipping point that pushed Europe and much of the world to clean energy, according to the International Energy Agency. “The energy world is shifting dramatically before our eyes,” said the IEA’s Fatih Birol. European countries like Denmark that have moved faster to wean themselves off of fossil fuels are faring better than countries like Germany that are still highly dependent on Russian oil and gas. In the U.S., the Inflation Reduction Act will “unleash a new era of clean energy-powered economic growth,” President Joe Biden said in his COP27 speech last week. Another potential winner: Africa, which has 60% of the world’s solar resources, but only 1% of solar generation capacity. New models, such as the Just Energy Transition Partnerships detailed for South Africa and Indonesia, offer ways to finance countries’ energy transitions and avoid the “lock-in” of fossil fuels for decades to come. Flattening the global warming curve by one degree Celsius is only the beginning of what’s required. “Rather than trudging in the fossil-fuel footsteps of those who went before,” Kenya’s President William Ruto writes, “we can leapfrog this dirty energy and embrace the benefits of clean power.”

Keep reading, “New narrative of climate action: Unstoppable progress and immense opportunity,” by Amy Cortese on ImpactAlpha.

Dealflow: Returns on Inclusion

Dearfield Fund secures $7.5 million to help Black first-time homeowners make down payments. Making a down payment is one the biggest challenges for first-time homebuyers in the U.S., particularly for Black and Latino buyers. Denver-based Dearfield Fund for Black Wealth has provided $3.8 million in interest-free down payment assistance loans to more than 100 local Black families to help them purchase their first homes. The impact fund also offers a homeownership support program to help borrowers keep their homes until they sell or refinance. “We’re not trying to just put capital on the street,” Dearfield’s Aisha Weeks told ImpactAlpha. “We’re partnering with homeowners throughout their homeownership journey for wealth creation.” Weeks said the fund has helped borrowers build $10,000 in wealth on average over the past year through home value appreciation. The average cost of Dearfield’s borrowers’ homes is $354,000.

- Place-based investing. Dearfield, which is looking to raise up to $30 million, aims to help more than 500 Black families in Denver purchase their first home. Commitments to its first close came from the Robert Wood Johnson Foundation, Gary Community Ventures, Gates Family Foundation, Denver Foundation and The Colorado Trust. “We want to see this model replicated nationally in partnership with cities, governments and other entities interested in launching a fund for Black homeownership in their cities,” said Weeks.

- Dive in.

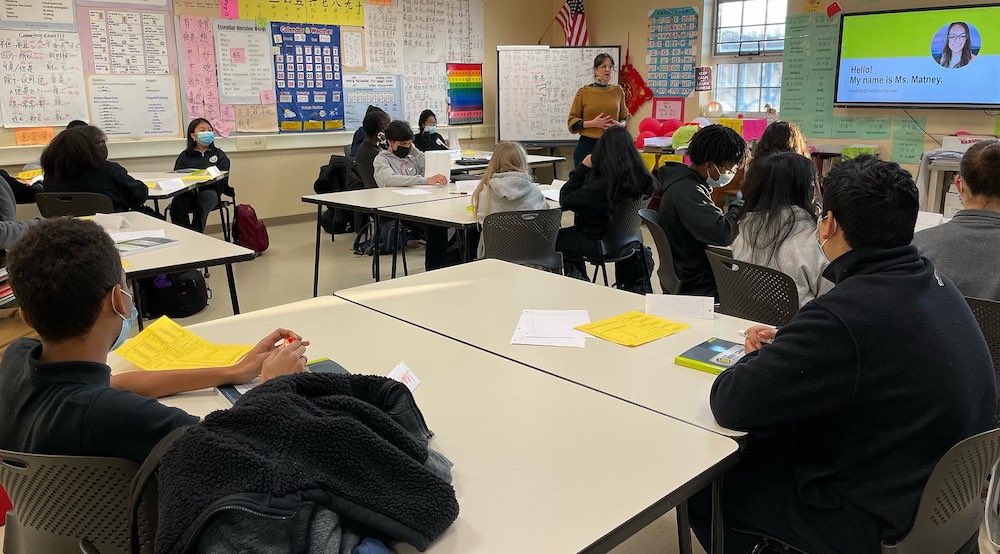

Achieve Partners acquires MasteryPrep to improve college readiness for underserved students. Baton Rouge, La.-based MasteryPrep has worked with more than 500 U.S.-based school districts on college readiness for over 400,000 low-income and underserved high school students. The edtech company provides low-cost, research-based tools for teachers to help students prepare for standardized tests, including college admissions exams. “At a time when end-of-course exams are becoming table stakes for high school graduation and accountability, too many students – especially those in under-resourced communities – are still struggling with the severe learning loss caused by the pandemic,” said MasteryPrep’s Craig Gehring. “MasteryPrep does a great job of getting these students back on track,” Achieve Partners’ Troy Williams told ImpactAlpha.

- Education equity. For high school seniors, preparing for standardized tests such as the SAT and ACT can be stressful. Scores determine academic scholarships, college acceptance and other higher education opportunities. A study last year found that students with family income of $100,000 or more, as well as white students, are more likely to score higher on the SAT than students with family incomes under $50,000, and Black and Latino students.

- More.

KKR bets $400 million on Serentica Renewable for clean energy in India. The Delhi-based company provides low-carbon clean power for energy-intensive, hard-to-abate industrial customers in India. India’s government has set goals to generate half of the country’s power from non-fossil fuel sources by 2030 and reduce carbon emissions by one billion tons. Serentica signs long-term power purchase agreements to supply customers with clean energy. The company is developing 1.5 gigawatts of solar and wind power under long-term power purchase agreements in Karnataka, Rajasthan, Maharashtra and other states. “Energy-intensive, heavy-industry companies play an important role in society but have traditionally faced more challenges in meeting energy needs sustainably,” said KKR’s Hardik Shah.

- Low-carbon power. Serentica is looking to install five gigawatts of carbon-free generation capacity and storage, removing 22 million metric tons of CO2 emissions from customers’ energy use. “The world is undergoing a clean energy transition, and India is at the forefront of this effort with its ambitious target of 450 gigawatts by the year 2030,” said Serentica’s Pratik Agarwal. KKR made the investment through its $3.9 billion Asia Pacific Infrastructure fund.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- Alcazar Energy raised $336.6 million in a first close for its second fund to invest in utility-scale clean energy projects in emerging markets.

- DIF Capital Partners will invest €150 million ($155 million) to acquire a majority stake in Stockholm-based Alight, a developer of subsidy-free solar projects in the Nordics.

- Singapore-based Wavemaker Impact raised $13 million in a first close to invest in low-carbon transition companies.

- Bangalore-based green mobility company Yulu Bikes secured a $9 million loan from the DFC.

Signals: Gender Alpha

Women-led agribusinesses notch greater profits, faster growth and less risk. Financing smallholder farmers is difficult work. New data from Root Capital suggests that investing in women delivers the trifecta: greater profits, faster growth and less risk. “Loans to enterprises with greater women’s leadership and participation yielded dramatically higher profits to Root Capital,” the nonprofit agri-lender reports. Root analyzed its $1 billion in investments to more than 550 agri-businesses supporting emerging market smallholder farmers over the past decade. Against an average of $6,000 in profits per loan, women-led enterprises notched $17,850 more in profits than non-women-led enterprises. Women make up 45% of emerging markets’ agricultural labor force but receive just 7% of capital provided to businesses in the sector. “Investors should look to women in agriculture not only because they are key to fighting global poverty, food insecurity, and climate change; they also generate a higher return on investment,” says Root Capital’s Willy Foote.

- Growth and risk. Root Capital provides loans of up to $2 million for agri-businesses to purchase materials, buy equipment or secure inputs for farmers. The 130 women-led enterprises in Root’s portfolio fared particularly well, achieving an average annual growth rate of 25.7% compared to 24% across the whole portfolio. Women are also better at servicing their debt. “Not only are enterprises with greater participation and leadership of women less likely to default, when they do default, Root Capital writes off less of their loan, on average,” the lender says.

- Catalytic capital. Lending to small agri-businesses has more than doubled in the last decade, reaching $756 million in 2021. The gap, however, is more than $100 billion annually in Africa and Asia alone. “First mover” lenders in gender-inclusive enterprises are powerfully catalytic, Root’s Alexandra Tuinstra tells ImpactAlpha. Gender-inclusive businesses in Root’s portfolio were 20% more likely to secure additional funding once Root had invested. “Investors should be seeking out and financing these enterprises at a much higher rate—it’s healthy for their own portfolios and the impact is undeniable,” she says.

- Learn more.

Six Short Signals: What We’re Reading

👩🏽🦱🧑🏼🦱👨🏾🦲👩🏻🦰 Returns on inclusion. Illumen Capital: Bias reduction to unlock impact and returns. (Stanford GSB case study)

💼 Golden opportunity. The state of boomer-owned small business. (Small Business Trends)

📈 Impact data. Al Gore helped launch a global emissions tracker that keeps big polluters honest. (NPR)

⚡ Policy corner. France to require all large parking lots to be covered by solar panels. (Electrek)

👷🏾♀️ Climate workforce. “If you’re transparent about impacts of climate change, more people would care about them,” Taj Eldridge of Include Ventures and JFFLabs says in a video. (Jobs for the Future)

📚 Recommended reads. Five climate books to read for COP27. (Carnegie Endowment)

Agents of Impact: Follow the Talent

Ben Jealous, ex- of NAACP and Kapor Capital, becomes executive director of Sierra Club… Women’s World Banking is hiring a principal in Boston… ECMC is looking for a senior brand strategist in Minneapolis… Bitgreen seeks a project finance director in New York… IREX is looking for a director of strategic partnerships in Washington, D.C… U.S. Bank is recruiting a remote ESG risk professional… Paxos seeks a remote global investigations compliance associate… LISC is hiring a remote lending asset manager.

Common Future’s Rodney Foxworth, Lafayette Square’s Damien Dwin, Builders Initiative’s Bruce McNamer, and Cecilia Muñoz of the Kresge and MacArthur Foundations will join Janis Bowdler of the U.S. Department of Treasury, and Securities and Exchange Commission chair Gary Gensler at the Mission Investors Exchange national conference, Dec. 5-7 in Baltimore. MIE members can register here.

Thank you for your impact!

– Nov. 15, 2022