Greetings, Agents of Impact!

👋 Agents of Impact Call No. 45: Creative capital for gender-smart investments. Women-led funds in emerging markets are finding innovative ways to raise and deploy high-impact capital. To learn how they’re doing it, join the conversation with Anna Raptis of Amplifica Capital in Mexico City, Lelemba Phiri of Africa Trust Group in Cape Town, Suzanne Biegel of GenderSmart, and other Agents of Impact in a special subscribers-only Call with ImpactAlpha’s Jessica Pothering and David Bank, Wednesday, Sept. 28 at 9am PT / 12pm ET / 6pm Cape Town. Mark your calendars.

Featured: Green Growth

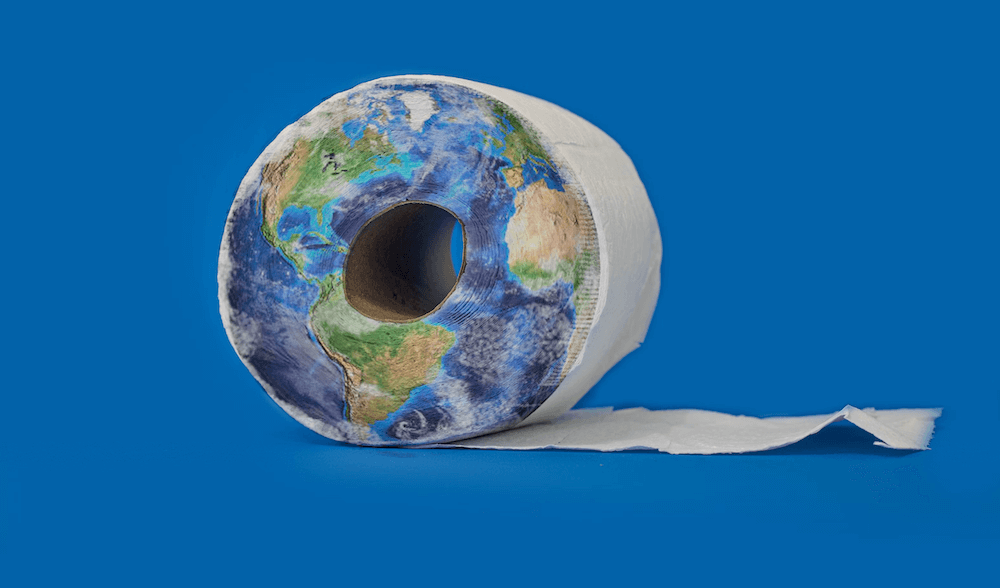

How The Good Roll and Wangara Green Ventures are saving trees and creating green jobs in Ghana. A startup in the Netherlands is teaming up with a fund manager in Ghana to demonstrate the green, resilient, local economic impact of… toilet paper. The Good Roll, based near Amsterdam, is on a mission to make the humble toilet paper roll a sustainable product that no longer depends on chewing up 27,000 trees a day (for context, see, “After light bulbs and plastic straws…toilet paper“). “We want to disrupt the whole chain of a product that almost everyone uses and which hasn’t been innovated in probably 100 years,” The Good Roll’s Sander de Klerk tells ImpactAlpha. Sourcing raw materials – recycled paper from Germany and bamboo from China – came with a host of challenges. Rebuilding its supply chain from scratch, the company is partnering with farmers in Ghana to plant, harvest and buy bamboo. “Making toilet rolls with farmers—nobody does that,” says de Klerk. For deeper impact, The Good Roll leveraged Ghanaian manufacturing incentives to open a local factory that has created more than 100 rural jobs. Carbon credits may soon feed a farmer pension plan.

Even with The Good Roll’s solid sales growth and environmental and social impact credentials, financing was tough to secure. Mainstream investors didn’t like that the company donates 50% of profits to its foundation, which builds clean toilets in rural Africa. Others were interested in tech, not products. “They needed a local investor to help them push it along,” says Yvonne Ofosu-Appiah of Accra-based Wangara Green Ventures, which kicked in a $200,000 convertible note from its early-stage, climate-focused fund to help The Good Roll complete its factory. The company’s deep thinking around climate and social impact is starting to percolate across Ghana’s entrepreneurial ecosystem. “The companies we see are innovating in a way that is sustainable and profitable,” says Wangara’s Ebenezer Arthur. “They’re innovating not just with climate in mind, but to reduce costs, improve upside and address real job creation.”

- Keep reading, “How The Good Roll and Wangara Green Ventures are creating green jobs and saving trees in Ghana,” by Jessica Pothering on ImpactAlpha.

Dealflow: Impact M&A

Common Future acquires Community Credit Lab for combined community wealth-building. Oakland-based Common Future earlier this year merged with nonprofit impact accelerator Uncharted. Now, the organization led by Rodney Foxworth is acquiring Seattle-based nonprofit lender Community Credit Lab, which since 2019 has raised $6 million in promissory notes and recoverable grants for affordable lending programs for underserved small businesses (CCL’s returnable grants vehicle was featured on The LIIST this month). “There are very few organizations that work directly with community partners to facilitate capital on behalf of those most excluded from our economic and financial systems,” said Foxworth.

- Common goals. Common Future and Community Credit Lab have worked together on projects, including character-based lending in BIPOC communities. Common Future raised $800,000 for the project; CCL was the facilitating partner. CCL’s executive leadership and staff members will join Common Future, which will retain the nonprofit as an affiliated entity.

- Community-led. CCL will bring its loan design, loan management, loan servicing and capital facilitation to Common Future, which has helped shift $280 million toward community investment via a network of more than 200 local institutions. “We view our role as a facilitator, from following the guidance of the community in building lending programs, to raising impact-first capital needed to pilot these programs,” said CCL’s Sandyha Nakhasi. “Common Future has the history, relationships, know-how and, most importantly, trust required to truly meet the moment.”

- Check it out.

KKR leads India-based Hero Future Energies’ $450 million raise to expand into battery storage and green hydrogen. Delhi-based independent power producer Hero Future Energies was launched a decade ago by industrial equipment giant Hero Group. It has built a portfolio of 1.6 gigawatts of solar and wind power in India, Bangladesh, Vietnam, Singapore, Ukraine and the U.K. The investment from KKR, alongside Hero Group, will help the company expand into battery storage and green hydrogen and enter new markets. KKR invested through its $3.9 billion Asia Pacific Infrastructure Fund. The investment brings Hero Future Energies valuation to $1 billion.

- Climate finance in India. Hero Future Energies is supporting the Indian government’s 2030 goals of generating half of the country’s power from non-fossil fuel sources and reducing carbon emissions by one billion tons. Climate finance in India reached $20 billion last year, mostly for renewable energy generation. India’s government is trying to make it easier for global private investors like KKR to enter the market.

- Share this post.

VC Include to accelerate investment into a dozen diverse first-time fund managers. First-time fund managers tend to outperform their more experienced peers but face structural barriers and biases in raising capital. The issues are more acute for funds led by women and/or people of color. Investing in first-time fund managers is an opportunity for impact alpha, particularly when they’re focused on climate, health and economic inclusion. That’s the thesis of VC Include, which selected a dozen diverse-led, impact-oriented venture capital and private equity funds for its second fellowship cohort. “VC Include is serious about backing the future of private equity and venture capital, and making sure people of color have a seat at the table,” said La Keisha Landrum Pierre of L.A.-based Emmeline Ventures, one of the funds selected, which backs female founders building businesses that help women.

- Inclusion alpha. The cohort includes Eunice Ajim’s Ajim Capital in Austin, Himalaya Rao’s BFM Fund in Portland, and Toussaint Bailey’s Uplifting Capital in San Rafael, Calif. Last year’s cohort included Apis & Heritage, which went on to a first close of $30 million, and Supply Change Capital, which has secured investments from Bank of America and General Mills. VC Include is supported by Blue Haven Initiative and the Visa, Skoll, MacArthur and Nasdaq foundations.

- Share this post.

Dealflow overflow. Other investment news crossing our desks:

- Yulu raised $82 million to expand its rental fleet of electric two-wheelers and battery swapping network in India.

- Houston-based PearlX raised $70 million to rent and install solar systems for multifamily renters and single-family homeowners in the U.S.

- Remedial Health scored $4.4 million to digitize pharmacies in Nigeria and other parts of West and East Africa in order to reduce fake and expired drug supplies.

- Paris-based Innovafeed raked in $250 million from ABC Impact, Temasek and other global investors to farm insects for animal and plant nutrition.

Agents of Impact: Follow the Talent

Emma Kulow, a former ImpactAlpha fellow and ex- of CapShift, joins ACCELR8 as an associate… Social Finance seeks a vice president of impact investments in Boston… Affirm is looking for a capital markets senior manager… In New York, Anheuser-Busch is hiring a director of community impact, and BlackRock Investment Stewardship seeks an analyst… 17 Communications is looking for a part-time remote research assistant.

GreenBiz Group is recruiting an ESG analyst… Realize Impact will host a DAF Salon, Thursday, Sept. 22… Convergence will launch the sixth edition of its “State of Blended Finance” report, Wednesday, Oct. 26… This year’s annual L’ATTITUDE Conference, highlighting U.S. Latinos in the new economy, will take place Sept. 22-25 in San Diego.

Thank you for your impact!

– Sept. 21, 2022