Greetings Agents of Impact! In today’s Brief:

- Climate + gender

- Ocean carbon capture

- Caribbean resilience fund

🔌 Last chance to RSVP: Training AI in Black and Brown history. In the next conversation in our Plugged In series on LinkedIn Live, Latimer.ai’s John Pasmore will join host Sherrell Dorsey to explore how thoughtful design and intentional strategies for training large language models can combat what OpenAI’s Sam Altman calls “shortcomings around bias.”

- Join the conversation, tomorrow, Jan. 31 at 8am PT / 11am ET / 4pm London. RSVP today.

Featured: Climate + Gender

Six questions to help investors level up their climate and gender strategies. Investors looking to deepen their impact are adding a gender lens to their climate investing. Climate + gender enables investors to touch nearly all of the Sustainable Development Goals. “Investing in climate and gender doesn’t have to be complicated or intimidating,” says Natalie Shriber, who leads investments for Heading for Change, the legacy endowment of the late Suzanne Biegel. In a guest post for ImpactAlpha, Shriber suggests six questions investors can ask when adding and diligencing a climate + gender focus. Her advice: Build from frameworks you have in place to assess opportunities and risks as well as teams, strategies and track records. “Many of the questions we ask as part of our due diligence are not materially different from anything you would do in a traditional finance deal,” she writes. Data collection and impact management are key. “What gets measured gets managed,” says Shriber. “Businesses and funds that collect data on gender diversity are more likely to prioritize it.”

- Finding climate + gender funds. ImpactAlpha’s searchable database of more than three dozen funds investing at the nexus of climate and gender helps investors find promising managers and practical examples. Compiled in partnership with Heading for Change, the list includes women-led EcoEnterprises Fund, among the first active climate + gender lens investors supporting sustainable and regenerative agriculture in Latin America. Elemental Excelerator in the US focuses on climate technologies that serve under-resourced and disadvantaged communities. Akiptan is an Indigenous-led lender that supports agricultural businesses on tribal lands in the US. Women-led Blume Equity invests in early-stage climate tech in Europe and links its remuneration to its portfolio’s climate impacts. SunFunder’s lending activities in Africa support access to clean energy, particularly for women in low-income communities.

- Due diligence. When screening new investments, examine whether potential investees already approach the intersection of climate and gender with intention. “That might look like a strategy that specifically addresses the adverse impacts of climate change on women,” explains Shriber, “or investing in industries where women make up a significant proportion of employees and the supply chain.” Investigate how the fund managers identify gender-related opportunities and risks. Are they helping remove barriers for women in traditionally male-dominated sectors? Are they in a position to support capacity building? Does their business or investment thesis consider the importance of a just economic and climate transition?

- Take action. A “catalyst at large,” Biegel founded GenderSmart, now 2X Global. On an Agents of Impact Call two years ago, Biegel called on the finance community to “be really bold” in championing climate + gender strategies. “Anyone coming into this now, in this moment, gets to benefit from all the examples, all of the fund managers, intermediaries and advisors not only creating what we can invest in, but how,” Biegel said. She died last September. This week, the Heading for Change team is paying tribute to Biegel’s legacy and encouraging other Catalysts at Large to gather, plot and take action. As Biegel said: “It’s early days, but this is the moment, and this whole community can make it happen.”

- Keep reading, “Six questions to level up your climate and gender strategies,” by Heading for Change’s Natalie Shriber on ImpactAlpha.

- Dive into our database of Climate + Gender funds. Heading for Change is a sponsor of ImpactAlpha’s coverage of Climate + Gender.

Dealflow: Low-Carbon Transition

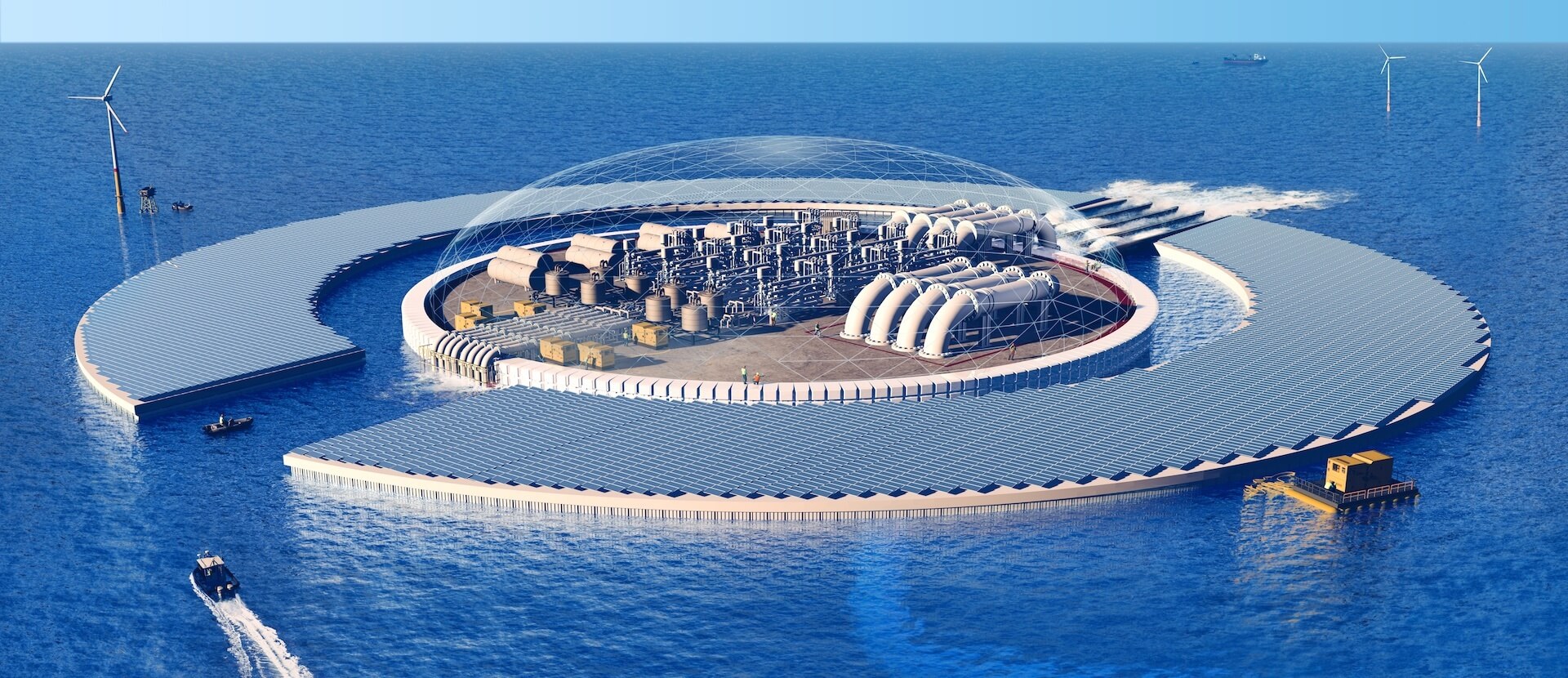

Captura scores $33.5 million to capture carbon from the oceans. The Pasadena, Calif.-based company extracts carbon from the ocean’s upper layers using seawater and renewable electricity. Captura says the process increases the oceans’ capacity to absorb additional CO2 from the atmosphere (see, “Ocean-based startups ride a wave of funds seeking opportunities in the blue economy”). “It’s becoming increasingly important to include carbon removal technologies as a part of a net-zero strategy,” said Luis Manuel of EDP Ventures, an existing Captura investor that reupped in the Series A round, alongside Saudi oil giant Aramco, and Equinor Ventures. Equinor is installing Captura’s technology at a plant in Norway that is expected to have nearly 1,000 metric tons of carbon capture capacity. The captured emissions are permanently stored or upcycled as clean fuel.

- European carbon markets. In Switzerland, CarbonPool raised 10.5 million Swiss francs ($12 million) in seed funding to insure carbon credit buyers if credits fail to deliver expected environmental gains. Wildfires and unmet promises have slowed the carbon offset market. Separately, Germany’s CEEZER clinched €10.3 million ($11.2 million) to use AI to screen, purchase and manage carbon offsets for corporate buyers. Ireland’s Concrete4Change, which is developing technology to capture and mineralize carbon emissions in concrete, snagged £2.5 million ($3.2 million) in seed funding.

- Check it out.

CARICOM Development Fund anchors Caribbean climate resilience fund. With storms, flooding and erosion, Caribbean islands are highly vulnerable in a warming world. The region’s climate adaptation annual financing gap tops $100 billion, says the International Monetary Fund. CARICOM, a development finance institution focused on the Caribbean, launched the CARICOM Resilience Fund to catalyze capital for climate adaptation and resilience in the region. The DFI provided $15 million in first-loss capital to anchor the blended-finance fund, which has a $100 million target. USAID provided technical assistance. “The Resilience Fund will contribute to preparing Caribbean countries to mitigate and adapt to adverse economic shocks, in particular those related to climate,” said Roger Nyhus, US ambassador to Barbados, where the fund was launched.

- Catalytic capital. The fund will make debt and equity investments in small and medium enterprises and infrastructure projects in renewables, clean transport, the blue economy, sustainable agriculture, information and communications technology, and financial services. CARICOM selected Sygnus Capital, a Jamaica-based alternative investment firm, to manage the fund. CrossBoundary helped structure the fund.

- Share this post.

Sweden’s H2 Green Steel hauls in more than $5 billion for green steel plant. The massive raise included $4.6 billion in debt funding from global banks and $325 million in equity from investors including Microsoft Climate Innovation Fund. The Swedish National Debt Office and insurance company Allianz Trade provided credit guarantees. H2 Green Steel, which uses green hydrogen in place of traditional coke firing to reduce emissions, also secured a $270 million grant from the EU’s Innovation Fund. That follows a $1.6 billion raise in September (see, “H2 Green Steel’s $1.6 billion raise signals investor and customer demand for low-carbon steel”).

- Off-takers. H2 Green Steel is building one of the first large-scale green steel plants, in Boden, Sweden. It hopes to produce 5 million tons of green steel annually by 2030. The company has already inked advance purchase agreements with auto industry players including Porsche, Volvo and Kirchoff Automotive.

- Share.

Dealflow overflow. Investment news crossing our screens:

- Foresight Group’s SME Impact Fund secured a €25 million ($27 million) commitment from Ireland Strategic Investment Fund to support Irish small and mid-sized enterprises in their sustainable transition. (Bdaily News)

- Switzerland-based Transmutex snagged $20 million Swiss francs ($23 million) in Series A funding to commercialize a process that burns and recycles nuclear waste for clean energy. (Transmutex)

- MoveInSync, which provides affordable green commuting services via employers in India, raised $15 million in Series C financing. “With more women joining the workforce, the need for [a] safe and secure commute cannot be compromised,” said MoveInSync’s Deepesh Agarwal. (YourStory)

- Woman-led Ecofy scored $10.8 million from FMO to expand green financing for electric vehicles, rooftop solar and climate-focused SMEs in India. (Ecofy)

Agents of Impact: Follow the Talent

Veris Wealth Partners names Eric Hsueh, formerly of Bivium Capital Partners, as director of investments… Ava Community Energy (formerly East Bay Community Energy) promotes Annie Henderson to chief customer officer… Edge Growth Ventures hires Janice Johnston, who previously worked on South Africa’s Just Energy Transition Investment Plan, as CEO… Future Fund, Australia’s sovereign wealth fund taps Greg Combet, the country’s former climate change minister, as chair.

Blue like an Orange Sustainable Capital has an opening for an intern in its legal department in Luxembourg… Black Farmer Fund seeks a development and investor relations director in New York… UnLtd is hiring a UK-based portfolio manager… Tesla is looking for a manager of environmental affairs in Austin, Texas… BlocPower is on the hunt for a full-time intern in Brooklyn.

Join Smitha Das of WES and Santhosh Ramdoss of Gary Community Ventures tomorrow for “Closing the racial wealth gap by shifting ownership,” based on their article on ImpactAlpha and presented by Transform Finance.

👉 View (or post) impact investing jobs on ImpactAlpha’s new Career Hub.

Thank you for your impact!

– Jan. 30, 2024