ImpactAlpha, Sept. 1 – Climate, Covid and political uncertainty have had impact investors hiding out in developed markets. Perceptions of risk and volatility are changing, according to the Global Impact Investing Network. Over the next five, many impact investors plan to boost their allocations to emerging markets.

Risk, adjusted

Asset allocations over the last five years grew fastest in the U.S. and Canada at a compound annual growth rate of 53%.

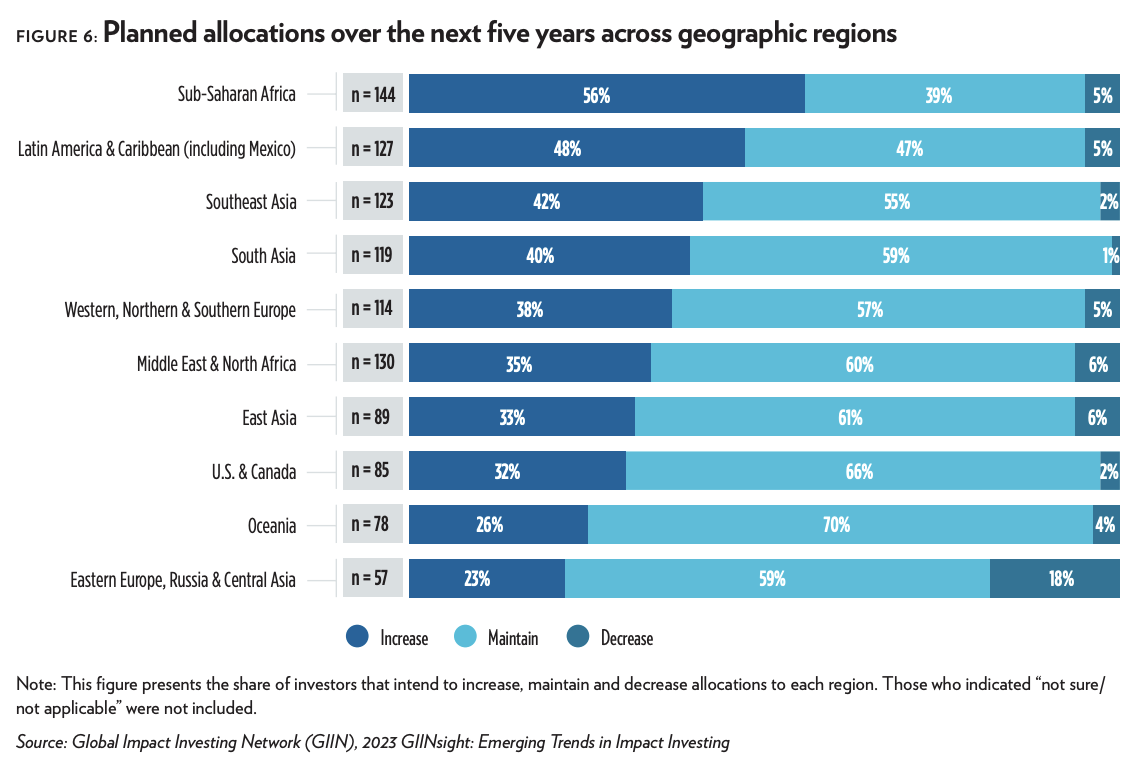

Going forward, investors surveyed by the GIIN are eyeing increases in sub-Saharan Africa (56%), followed by Latin America and the Caribbean (48%) and Southeast Asia (42%). At least part of the capital may come at the expense of Eastern Europe, Russia and Central Asia – 18% of investors say they plan to decrease their allocations to those markets.

Impact investing assets under management surpassed $1 trillion in 2022.